Bank of France Urges Budget Clarity as Elections Shake Markets

(Bloomberg) -- France’s next government must quickly clarify its economic policy as investors rattled by snap elections dump the country’s debt and drive up borrowing costs, Bank of France Governor Francois Villeroy de Galhau said.

Most Read from Bloomberg

Hunter Biden Was Convicted. His Dad’s Reaction Was Remarkable.

US Inflation Broadly Cools in Encouraging Sign for Fed Officials

Fed Officials Dial Back Rate Forecasts, Signal Just One ‘24 Cut

Stock Bull Run Breaks Record on Fed Decision Day: Markets Wrap

Blinken Casts Doubt on Cease-Fire Hopes After Hamas Responds

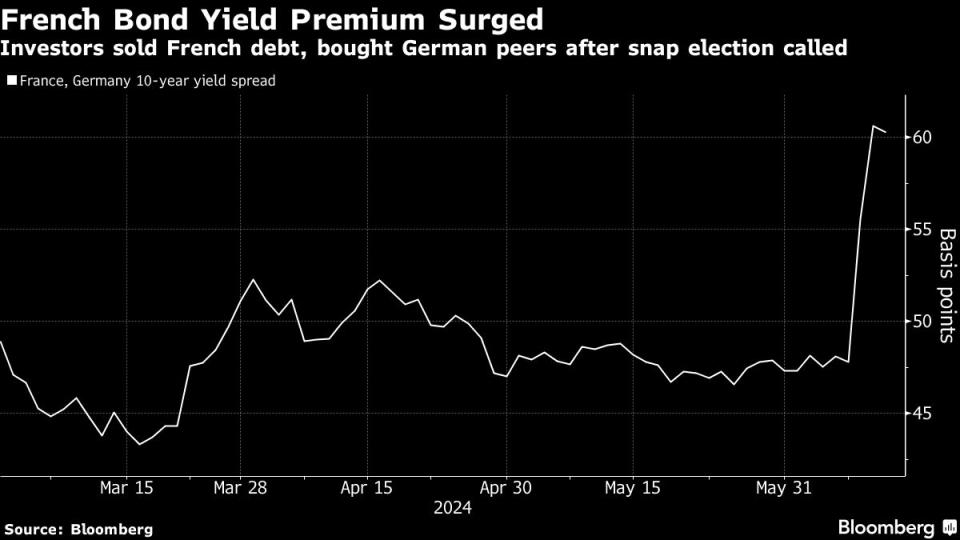

The country’s debt sold off sharply at the start of the week after President Emmanuel Macron called legislative elections when his party was trounced by Marine Le Pen’s National Rally in a vote for the European Parliament.

The president’s gamble has spooked markets as it opens the door to a far-right government, or at least a fractious parliament that could struggle to pass economic and fiscal legislation. The current government already slipped from its plans to cut the budget deficit earlier this year.

“French interest rates have indeed risen over the last two days. Why? Because investors don’t like uncertainty and an election period always has uncertainty, that’s the game of democracy,” the Bank of France chief said on Radio Classique. “But it will be important that whatever happens in the vote, France must be able to quickly clarify its economic strategy and in particular its fiscal policy.”

The yield on 10-year French bonds jumped as much as 10 basis points on Tuesday, briefly lifting the spread over equivalent German bonds to 66 basis points, the highest level since March 2020. The French yield premium was steady at around 60 basis points on Wednesday.

A lasting reconfiguration of bond markets would be a tectonic shift in Europe as France had long been considered one of the continent’s safe havens. Bond markets had remained relatively sanguine in the last two years, even as Macron faced difficulties legislating without an absolute majority since 2022 and as ratings firms downgraded the country.

Finance Minister Bruno Le Maire raised the stakes of the election on Tuesday, saying that France would be plunged into a debt crisis if the National Rally were to implement their economic program.

“There are lies that are sold to people, there are illusions that are spread in TV debates, and then there is the economic and financial reality,” Le Maire said. “It was stable, it will become unstable; it was certain, it will become uncertain.”

The National Rally has not yet detailed economic measures it would take if in power. Le Maire said past proposals such as cutting sales taxes, reducing the retirement age or nationalizing toll roads could amount to hundreds of billions of euros in new spending.

Speaking late Tuesday on France 2 television, the head of Le Pen’s party, Jordan Bardella, said the first step of a National Rally government would be to conduct a financial audit of public accounts.

“Macron is characterized by budgetary folly — today, we’re obliged to repair a country that faces a wall of debt, a wall of trade deficit and a wall of public deficit,” Bardella said.

Macron’s government has faced difficulties tackling the debt burden from the Covid pandemic and the energy crisis as soft economic growth undermined tax receipts. It’s pledged €20 billion of additional savings this year, although even that was insufficient to avoid revising longer term deficit forecasts.

In his interview on French radio on Wednesday, Villeroy said that while public finances can seem abstract, higher debt will have a concrete impact on people’s lives.

“The practical result is that if debt is more and more expensive, we and our children will gradually lose our freedom of choice and sovereignty,” Villeroy said.

Still, the Bank of France governor said the country isn’t about to fall into a full blown crisis. “France isn’t bankrupt — we are the seventh economy in the world, we have strong companies, and we have a certain number of assets.”

--With assistance from James Hirai and James Regan.

(Updates with further comments from Villeroy, finance minister and National Rally leader)

Most Read from Bloomberg Businessweek

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Food Companies Hope You Won’t Notice Shortages Are Raising Prices

©2024 Bloomberg L.P.