No Fixed Address: Stuck in your housing situation in Toronto? New proof it's a 'vicious circle'

The first time Jessica Whitehead and Sean Kosonic lost a bidding war on a home in Toronto they felt a little let down.

But after countless other offers, they've reached a grim acceptance: they may never win.

"Depressed isn't the right word, but dejected," Kosonic says.

His partner echoes him quietly.

"Sometimes we're pretty discouraged."

Whitehead works as a teacher with the Toronto District School Board and Kosonic is a contractor. The couple, both 31, live in an older apartment building in the Junction neighbourhood. They have saved up as much as they can toward a down payment but say they keep getting outbid — in at least one bidding war by as much as $60,000.

"Even in the five months we've been looking, it's gone from possible to impossible," Kosonic said. In September 2016, the renters were first pre-approved for a mortgage of $550,000. But then the federal government tightened mortgage rules, and the new stress test pushed them out of the market. (That stress test requires buyers to prove they could still make their payments if the interest rate were to jump to 4.64 per cent for a five-year loan.)

"We dropped $100,000 within a month," said Whitehead. "When we started saving five years ago, $500,000 could probably get something and it would be fairly decent — not huge by any means. But now, we only see condos."

At the end of both 2015 and 2016, about 60 per cent of potential homebuyers identified as first-timers and said they were likely to purchase a home the following year, according to a survey conducted for the Toronto Real Estate Board (TREB) by Ipsos.

Listings way down

But TREB didn't follow up to see if those intentions ended up in home purchases or unrealized goals.

Proof of that limited supply can be found in the declining number of active listings in the Greater Toronto Area — 5,400 on the market in February, a nosedive of 50.5 per cent compared to this time last year, according to statistics published by the TREB.

"That's led to more competition between buyers and further upward pressure," said Jason Mercer, the board's director of market analysis.

Starter home becomes forever home

In a neighbourhood over in the nearby Junction Triangle, the Junkins blame families like theirs for keeping would-be first-time home buyers as renters.

Isaac Junkin and his wife, Julie, bought their three-bedroom house in 2012 when it was just the two of them. Now, they have two kids — and a third is on the way.

The Junkins say they need another bedroom and another bathroom to accommodate their growing family, but the spike in housing prices makes it impossible for them to upgrade to a more suitable home. To put that in perspective, a semi-detached home in Toronto is currently selling for an average of $1.08 million.

"I think there's a lack of movement and I think the people who are most impacted are the people who are trying to get into the market in the first place," Isaac Junkin said.

They purchased their home for $540,000. Because they can't afford something larger in their neighbourhood, what was once a starter house has become a forever home.

"Just having that ability to move into a larger space ... was something that Canadian families or families in Toronto probably took for granted," he said. "But I think it's something that isn't feasible to the majority of families at this point."

Instead, the couple has set aside $200,000 to $250,000 to either dig out the basement or build a third storey.

Renovation spending nearly doubles in Toronto

It's a trend the TREB dubs a "vicious circle" and is watching closely in its 2016 Market Year in Review.

The review contains a report by Ipsos that suggests 40 per cent of non-recent home buyers plan to spend $50,000 on home renovations, up from 23 per cent a year ago.

"Now, you're taking a home — that otherwise would have been listed — off the market, and you're changing that home forever when you renovate it," TREB director of market analysis Jason Mercer said. "What might have been an entry-level single or semi-detached home, now has had more value added to it, so it's in a different market segment."

The latest report from TREB shows that overall the number of home sales are up in the Greater Toronto Area from February 2017 to that time last year.

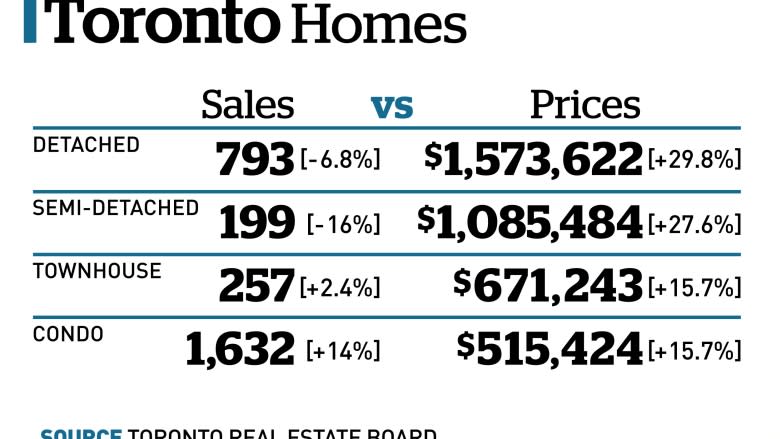

But the sales of detached and semi-detached homes in Toronto have dropped — by 6.8 per cent and 16 per cent, respectively. That's led to those types of properties seeing the largest price increases.

More than half of Torontonians aged 20-29 live with mom and dad

Data collected in the 2011 census show there's another factor limiting the housing supply: fewer baby boomers are downsizing. That's because they need the space to house their adult children.

Roughly 42.3 per cent of Canadians aged 20 to 29 either moved back in with mom and dad or never left in the first place Canada wide, according to the census data.

That's a jump of 10 percentage points in 20 years.

The phenomenon is more pronounced in Ontario than anywhere else in the country. In Toronto, 56.3 per cent of people in that age bracket live with their parents, more than any other metropolitan area in the province.

The census report suggested a number of reasons for this, including lack of housing affordability, compounded by a lack of supply as boomers stay in their original homes.