Rent relief urgently needed as pandemic shock overwhelms St. John's small businesses

Kristian Alexander spent the last six years building up clientele in his 24-hour private fitness centre in St. John's, and then stood by helpless as the COVID-19 pandemic shut it all down.

Now Alexander doesn't know if he will be able to keep paying rent on Inshape Fitness's space on O'Leary Avenue

"We really don't know where the money is supposed to come from, because we don't have any coming in," he said.

Like many small business operators trying to make it through the pandemic, Alexander is looking for the government to help out. Without some form of rent relief he doesn't know how businesses such as his will be able to open their doors again when the COVID cloud finally lifts.

"I've got a mortgage, I've got a child, I've got a family to support," he said.

While there is emergency aid he can apply for to make sure his family has food on the table, the rent bill is still due at the beginning of each month.

Alexander said loans for small businesses won't cut it either. "Either way that is money you still got to pay back, which is going to be difficult if not impossible for most businesses to do," he said.

Alexander wants a rent and mortgage pause which he believes is the only way to prevent thousands of businesses across the country from declaring bankruptcy.

"The only thing that they can really do is to put a total freeze on it which takes the stress off the landlords, which takes the stress off the tenants," he said. "And everyone can relax and focus on staying healthy and social distancing and wait until this is all over."

Federal bailout in order to survive

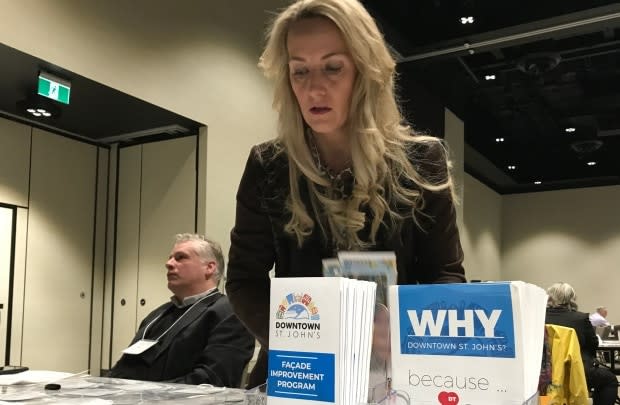

Gaylynne Gulliver with Downtown St. John's says her association's members are saying the same sorts of things, because rent is not cheap.

"As resilient as downtown businesses are and as much as they're trying to change their business operations to survive all this," said Gulliver. "We need to see something for rent. That's not going away."

In Gulliver's opinion, the only answer is a federal bailout.

Byron Murphy, owner of Byron's Clothing for Men on Water Street, is also calling for some sort of federal action.

Murphy, a veteran of the downtown retail scene for decades, has survived numerous ups and downs. However, he has not seen anything like what is unfolding now, which comes on the heels of a blizzard in January that triggered a week-long state of emergency.

Byron said while the banks are giving a pretty good break with interest-only payments on mortgages, more needs to be done.

"The bottom line is as we run out of the little stash that we have and it comes down to an interest payment on our mortgages or keeping the business insurance on the building and gas and groceries and everything else, the decision has to be made," he said.

"Certainly the interest payment is probably not going to get paid either."

Murphy said the federal government and the banking industry need to come up with a plan -- preferably one that allows interest payments to be paid later.

Win-wins can still be achieved: trade board

The St. John's Board of Trade is well aware of the issues for renters as well as building owners and it's trying to help plow a way forward. Part of that involves some give and take that ultimately can be of some benefit to both sides.

Acting chief executive officer Rhonda Tulk-Lane cites an example of a situation recently where the landlord extended a lease agreement by five years and then gave their tenant a rent break for a couple of months in return.

"So it was actually a win-win," said Tulk-Lane.

The board is also trying to communicate the needs of its members to the various levels of government.

Chair Andrew Wadden sent a letter to Premier Dwight Ball this week that was also copied to federal Finance Minister Bill Morneau, which among other things suggested a temporary moratorium on evictions of commercial tenants and putting a freeze on lease terminations.

In an interview with CBC News, Wadden laid out what he called a nightmare scenario where tenants shut down because they can't pay rent, landlords end up being unable to pay their mortgages, banks foreclose and numerous properties end up being empty — something he says nobody wants.

"Right now we got a problem, and without further work in this area it's not going to be solved any time soon," he said.

'Nothing is off the table'

Wadden said there are a lot of moving parts and input is needed from everyone involved. But, he said, there is a crucial role for the banks in all of this.

"It all goes back to the question, what can the bank do for the landlord to assist them on their mortgage while that landlord is having trouble getting money from the tenant, who — quite frankly — can't pay."

And even if that happens, Wadden says other measures should be considered. He listed the restaurant industry as an example, saying operators may need some sort of grant in order to make up their losses once they open again.

In another effort to deliver the message to Ottawa, the board is hosting a virtual town hall on Wednesday with federal Economic Development Minister Mélanie Joly. The event is billed as a conversation with the minister "regarding supports during these challenging times."

When asked for comment, St. John's South-Mount Pearl MP Seamus O'Regan agreed in a statement that "this is an extremely difficult time for businesses in our community. People are worried."

O'Regan's statement ran through a list of recent government action including a 75 per cent wage subsidy, deferred payments of HST, income tax relief and interest-free lans.

He said has received plenty of suggestions on other options.

"Nothing is off the table," he said.

Read more from CBC Newfoundland and Labrador