Russia’s Seaborne Crude Flows Edge Lower Before OPEC+ Meeting

(Bloomberg) -- Russia’s seaborne crude shipments eased slightly ahead of a meeting of OPEC+ oil minsters later this month, bringing flows back below the level pledged by Moscow. The move comes after exports surged in October.

Most Read from Bloomberg

S&P 500 Up 2% as Bets ‘Fed Is Done’ Sink US Yields: Markets Wrap

Israel Latest: Troops Reported Inside of Gaza Hospital Compound

Trump Insists on ‘Disclaimer’ Defense Already Tossed in NY Fraud Trial

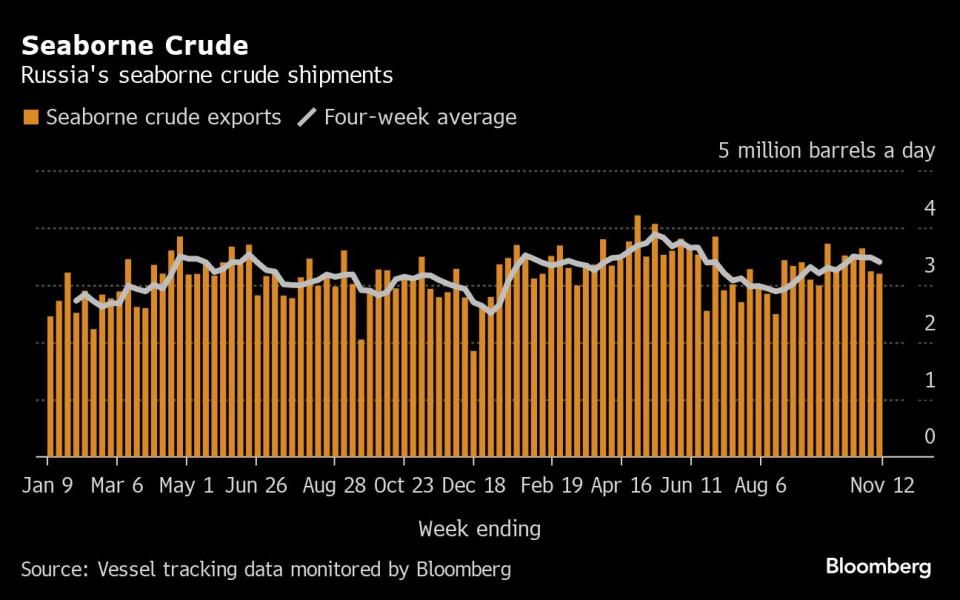

About 3.2 million barrels a day of crude was shipped from Russian ports in the week to Nov. 12, tanker-tracking data monitored by Bloomberg show. That was down by 40,000 barrels a day from the period to Nov. 5, but still 700,000 barrels a day above the levels seen in August.

Moscow said in early August that it would prolong export restrictions at a reduced rate of 300,000 barrels a day below their May-June average level until the end of the year, a policy confirmed earlier this month. That would imply seaborne shipments of 3.28 million barrels a day if the burden falls entirely on crude. But the reduction is spread across both crude and refined products, Deputy Prime Minister Alexander Novak told Interfax last month after the government imposed a fuel export ban.The OPEC+ group of oil producers, jointly led by Russia and Saudi Arabia, meet in Vienna on Nov. 26 when they will consider how to respond to a weakening oil market outlook. Analysts from the smaller OPEC group argue that negative sentiment is “overblown.”

The less volatile four-week average flow fell to 3.4 million barrels a day, down by about 80,000 barrels a day from the period to Nov. 5. That was the lowest in four weeks, but still more than 500,000 barrels a day above shipments in the period to Aug. 20, when Moscow’s crude export cuts were at their deepest.

Russia’s elevated crude exports, combined with rising demand from domestic refineries, has drained oil inventories to their lowest since February. The country’s refinery operations are rebounding as the industry is completing seasonal maintenance, with more primary and secondary capacity scheduled to return this week.

Meanwhile, the US Treasury Department has sent notices to ship management companies about more than 100 vessels it suspects may have violated the price cap on Russian oil imposed after the invasion of Ukraine.

With all of last week’s shipments attracting the higher export duty rate for November, the Kremlin’s weekly revenues from oil export duties rose, despite the small drop in flows. Meanwhile, the four-week average edged lower, falling for the first time in 16 weeks.

Moscow’s overall oil and gas revenue soared in October to the highest since April 2022 due to high oil prices and a pause in government subsidies to refiners. Levies on crude and petroleum products — which accounted for almost 91% of total hydrocarbon revenues last month — more than doubled. Oil revenue includes mineral extraction tax on gas condensate and export duty on petroleum products, as well as subsidies payments for refiners for domestic supplies of fuel, tax reimbursements and payments for refinery modernization.

From January, Russia’s oil producers are set to pay a higher output tax to fund increased downstream subsidies, which were reinstated in October after being halved the previous month.

Flows by Destination

Russia’s seaborne crude flows in the four weeks to Nov. 12, slipped to 3.4 million barrels a day. That was down from 3.48 million barrels a day in the period to Nov. 5. Shipments remain about 180,000 barrels a day below the average seen during the surge in volumes between April and June.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and the Baltic port of Ust-Luga and are not subject to European Union sanctions or a price cap.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

Asia

Most Read from Bloomberg

Observed shipments to Russia’s Asian customers, including those showing no final destination, edged lower to 2.91 million barrels a day in the four weeks to Nov. 12, down from 2.93 million barrels a day in the period to Nov. 5. That’s well below a peak of about 3.6 million barrels a day seen in May.

About 1.21 million barrels a day of crude was shipped to China in the four weeks to Nov. 12, but that figure may rise once the destinations become apparent for more than 21 million barrels of crude on tankers that have yet to signal their final port of call. Shipments to China are similar to the volume on ships heading to India, but China’s seaborne imports are supplemented by about 800,000 barrels a day of crude delivered directly from Russia by pipeline.

Flows on ships signaling destinations in India are falling, averaging 970,000 barrels a day in the four weeks to Nov. 12.

However, the equivalent of about 630,000 barrels a day was on vessels signaling Port Said or Suez in Egypt, or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India or China and show up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at about 100,000 barrels a day in the four weeks to Nov. 12, are those on tankers showing no clear destination. Most of those cargoes originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others could be moved from one vessel to another, with most such transfers now taking place in the Mediterranean, off the coast of Greece.

Europe and Turkey

Most Read from Bloomberg

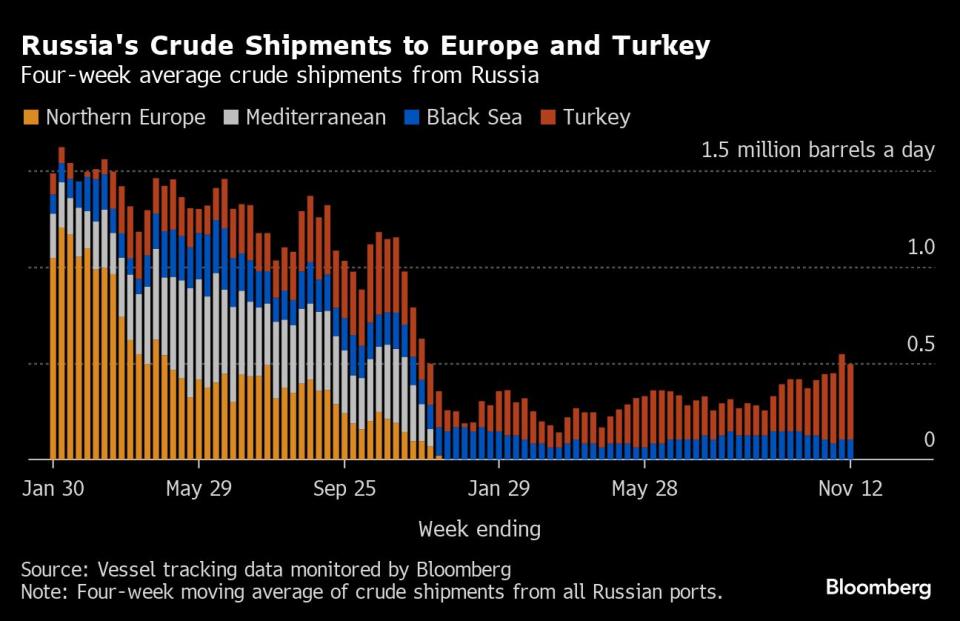

Russia’s seaborne crude exports to European countries have collapsed since Moscow’s troops invaded Ukraine in February 2022. A market that consumed about 1.5 million barrels a day of short-haul seaborne crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve. These figures do not include shipments to Turkey.

No Russian crude was shipped to northern European countries, or those in the Mediterranean in the four weeks to Nov. 12.

Flows to Bulgaria, now Russia’s only European market for crude, were unchanged at about 104,000 barrels a day in the most recent four-week period.

Exports to Turkey edged lower to about 390,000 barrels a day in the four weeks to Nov. 12, but remain more than twice as high as they were in July and August. The recent increase comes after Lukoil resumed deliveries to the Azerbaijani-owned Star refinery at Aliaga. Supplies to the plant are expected at about 100,000 barrels a day, equivalent to half of the refinery’s capacity.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty increased to $79.6 million in the seven days to Nov. 12, while four-week average income edged lower to $80.4 million. The higher November duty rate helped to boost the Kremlin’s oil revenue in the week to Nov. 12, despite the small drop in exports.

The export duty rate for December is likely to be lower than this month’s, with oil’s retreat sending the value of Russia’s flagship Urals crude grade back into the $60 range.

The duty rate for November has been set at $3.57 a barrel, based on an average Urals price of $83.35 during the calculation period between Sept. 15 and Oct. 14. That was about $7.70 a barrel below Brent over the same period. November’s duty rate sets another new high for the year.

Origin-to-Location Flows

The following table shows the number of ships leaving each export terminal.

A total of 29 tankers loaded 22.4 million barrels of Russian crude in the week to Nov. 12, vessel-tracking data and port agent reports show. That’s down by about 300,000 barrels from the previous week.

There was one fewer shipment from Ust-Luga and from Kozmino compared with the previous week, while the number of vessels leaving all of Russia’s other oil terminals was unchanged.

Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress. All figures exclude cargoes identified as Kazakhstan’s KEBCO grade.

In addition, one cargo of KEBCO was loaded at Novorossiysk and one from Ust-Luga during the week.

NOTES

Note: This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government. Weeks run from Monday to Sunday. The next update will be on Tuesday, Nov. 21.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

If you are reading this story on the Bloomberg terminal, click here for a link to a PDF file of four-week average flows from Russia to key destinations.

--With assistance from Sherry Su.

Most Read from Bloomberg Businessweek

Everything Biden and Xi Need From Their Summit—Starting With Each Other

US Veterans Got a Mortgage Break. Now They’re Losing Their Homes

©2023 Bloomberg L.P.