Serbia Cuts Rate Once More With Inflation in Target Range

(Bloomberg) -- Serbia’s central bank delivered its second interest-rate cut in as many months, following through with easing as inflation in the Balkan nation continues to ebb.

Most Read from Bloomberg

Biden Vows to Stay in 2024 Race Even as NATO Gaffes Risk His Campaign

Tesla Delays Robotaxi Event in Blow to Musk’s Autonomy Drive

Stock Rotation Hits Megacaps on Bets Fed Will Cut: Markets Wrap

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

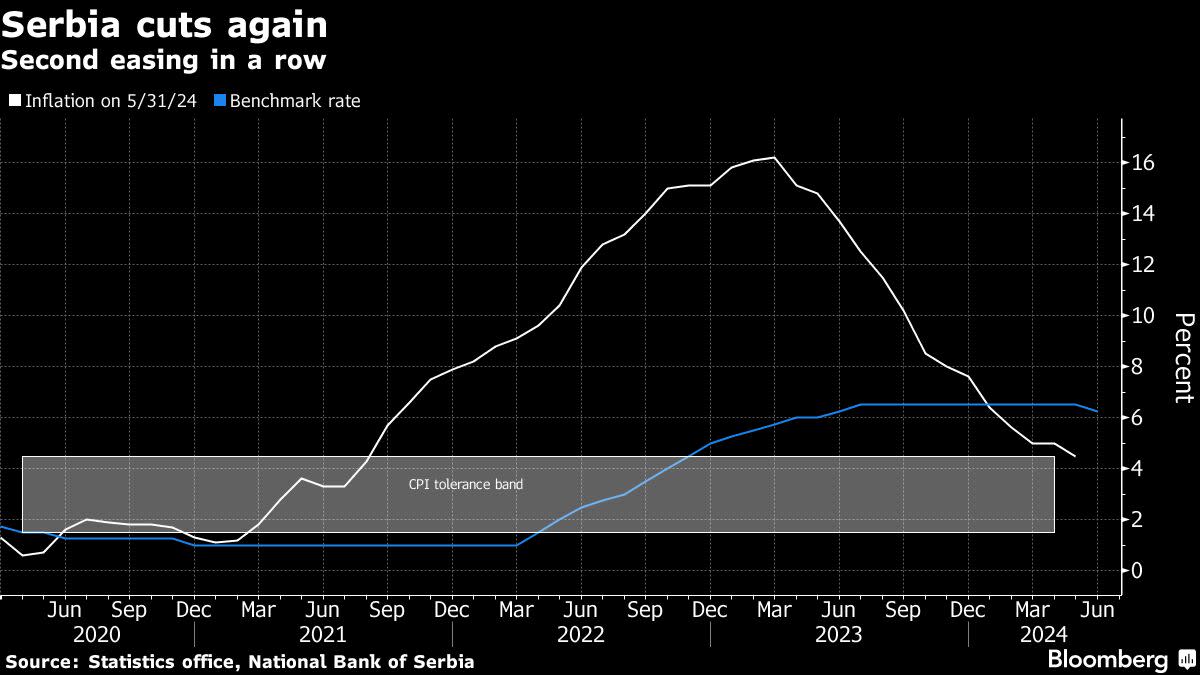

The National Bank of Serbia reduced the benchmark one-week repurchase rate by a quarter of a percentage point on Thursday to 6%. The move was predicted by six economists in a Bloomberg survey, while eight expected a hold on the rate.

The easing comes after a “months-long downward trajectory of domestic inflation and its return to the target range” in May, the central bank said in a statement as it announced the decision.

Policymakers in Belgrade cut the key rate in June after the European Central Bank began easing. Officials had deployed the steepest monetary tightening cycle on record to bring headline inflation to within the Balkan nation’s target range, though the core measure remains more elevated.

The consumer-price index returned to the high end of the central bank’s tolerance band of between 1.5% and 4.5% in May — and is seen slipping to 4.2% in June. Core inflation stood at 5% in May. The statistics office will release its inflation reading for last month on Friday.

Despite the monetary tightening campaign, the economy gained momentum in every quarter of 2023, while the 4.7% growth rate in the first three months of this year exceeded most forecasts. Finance Minister Sinisa Mali said on Wednesday that full-year growth may reach 4%.

The central bank concurred on Thursday, citing an “increased probability” that economic growth this year will exceed the 3.5% forecast in May. Domestic demand, higher real pensions and wages, and extensive capital expenditures by the government are seen as the top drivers, it said.

The benchmark will probably be brought down to 5.5% by the end of the year and to 4.5% in 2025, according to Mauro Giorgio Marrano, a senior economist UniCredit. The central bank also reduced rates on deposit and credit facilities by a quarter point to 4.75% and 7.25% respectively.

Serbian authorities have also dealt with appreciation pressures on the dinar. The central bank purchased a net €1.33 billion ($1.4 billion) in the first half, including €695 million last month alone, as it keeps the national currency in a narrow range against the euro in a so-called managed float.

--With assistance from Harumi Ichikura.

(Updates with central bank comment in third, seventh paragraphs)

Most Read from Bloomberg Businessweek

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

He’s Starting an Olympics Rival Where the Athletes Are on Steroids

©2024 Bloomberg L.P.