Skillsoft (NYSE:SKIL shareholders incur further losses as stock declines 16% this week, taking three-year losses to 90%

It's not possible to invest over long periods without making some bad investments. But really bad investments should be rare. So consider, for a moment, the misfortune of Skillsoft Corp. (NYSE:SKIL) investors who have held the stock for three years as it declined a whopping 90%. That would certainly shake our confidence in the decision to own the stock. And over the last year the share price fell 68%, so we doubt many shareholders are delighted. Shareholders have had an even rougher run lately, with the share price down 40% in the last 90 days. We note that the company has reported results fairly recently; and the market is hardly delighted. You can check out the latest numbers in our company report. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

With the stock having lost 16% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

See our latest analysis for Skillsoft

Because Skillsoft made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

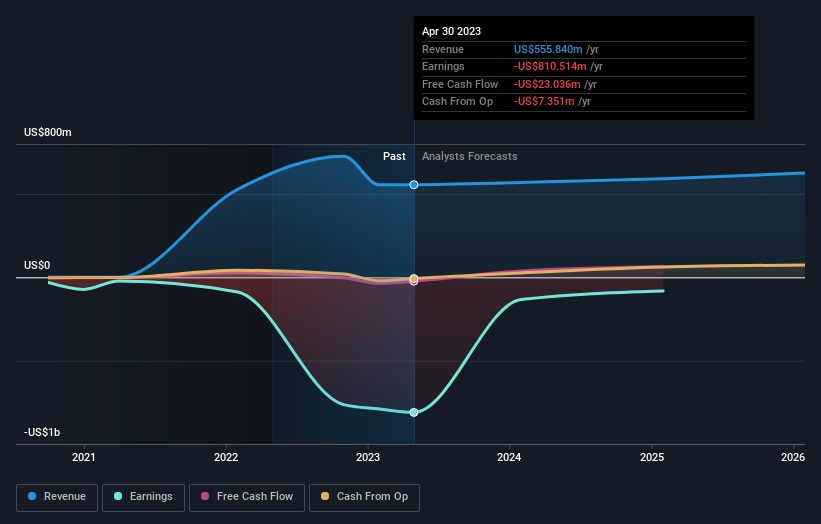

In the last three years, Skillsoft saw its revenue grow by 82% per year, compound. That's well above most other pre-profit companies. So why has the share priced crashed 24% per year, in the same time? You'd want to take a close look at the balance sheet, as well as the losses. Sometimes fast revenue growth doesn't lead to profits. If the company is low on cash, it may have to raise capital soon.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We consider it positive that insiders have made significant purchases in the last year. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling Skillsoft stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

Over the last year, Skillsoft shareholders took a loss of 68%. In contrast the market gained about 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 24% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. It's always interesting to track share price performance over the longer term. But to understand Skillsoft better, we need to consider many other factors. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Skillsoft you should know about.

Skillsoft is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Join A Paid User Research Session

You’ll receive a US$30 Amazon Gift card for 1 hour of your time while helping us build better investing tools for the individual investors like yourself. Sign up here