The Société de la Tour Eiffel (EPA:EIFF) Share Price Is Down 50% So Some Shareholders Are Wishing They Sold

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. We regret to report that long term Société de la Tour Eiffel (EPA:EIFF) shareholders have had that experience, with the share price dropping 50% in three years, versus a market decline of about 4.1%. The more recent news is of little comfort, with the share price down 29% in a year. The falls have accelerated recently, with the share price down 29% in the last three months. However, one could argue that the price has been influenced by the general market, which is down 26% in the same timeframe.

View our latest analysis for Société de la Tour Eiffel

We don't think that Société de la Tour Eiffel's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. It would be hard to believe in a more profitable future without growing revenues.

Over three years, Société de la Tour Eiffel grew revenue at 26% per year. That's well above most other pre-profit companies. The share price has moved in quite the opposite direction, down 21% over that time, a bad result. It seems likely that the market is worried about the continual losses. But a share price drop of that magnitude could well signal that the market is overly negative on the stock.

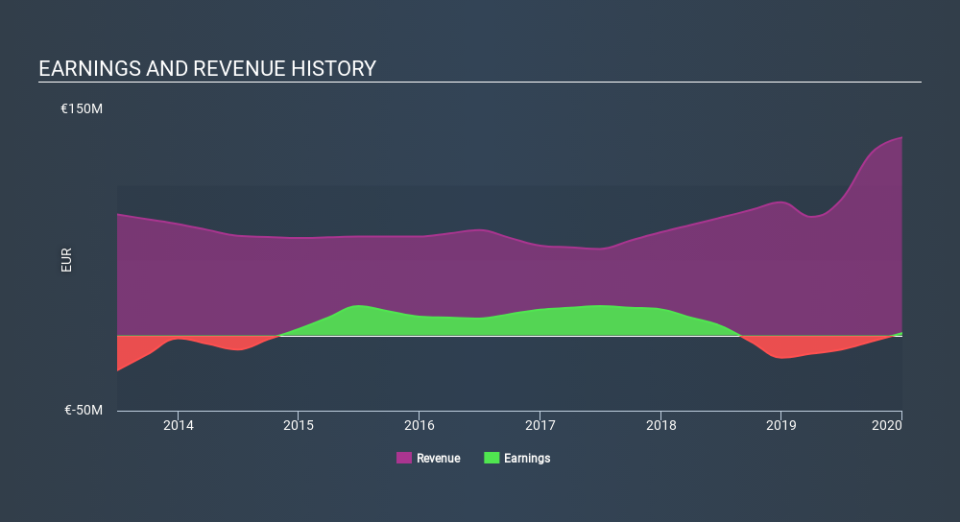

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. This free interactive report on Société de la Tour Eiffel's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Société de la Tour Eiffel's TSR for the last 3 years was -40%, which exceeds the share price return mentioned earlier. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market lost about 15% in the twelve months, Société de la Tour Eiffel shareholders did even worse, losing 23% (even including dividends) . Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7.0% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. It's always interesting to track share price performance over the longer term. But to understand Société de la Tour Eiffel better, we need to consider many other factors. For example, we've discovered 6 warning signs for Société de la Tour Eiffel (2 can't be ignored!) that you should be aware of before investing here.

We will like Société de la Tour Eiffel better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.