Srettha’s Standoff With Central Bank Risks Thailand’s Economic Turnaround

(Bloomberg) -- Six months into the job, Thailand’s first civilian leader in a decade is running into roadblocks as he tries to deliver on election promises to lift the economy out of its decade of sub 2% growth rates.

Most Read from Bloomberg

S&P 500 Set for Worst CPI Day Since September 2022: Markets Wrap

Retail Traders Are Losing Billions in India’s Booming Options Market

Having pledged free cash for 50 million citizens, the property tycoon-turned-premier Srettha Thavisin and his Pheu Thai Party have struggled to win over critics of the proposed 500-billion baht ($14 billion) digital wallet program. Meantime, his bid to persuade the central bank to lower borrowing costs has been snubbed.

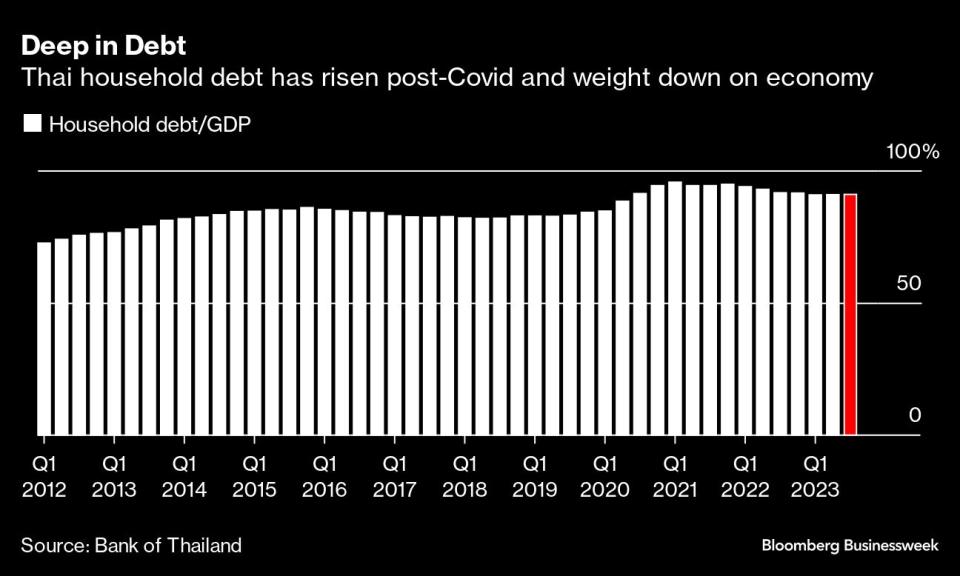

The impasse reveals fundamentally different views on what the $500 billion economy needs. Srettha and his administration are convinced a strong shot of stimulus would revive consumption; The Bank of Thailand is taking a more cautious line amid worries about elevated household debt levels.

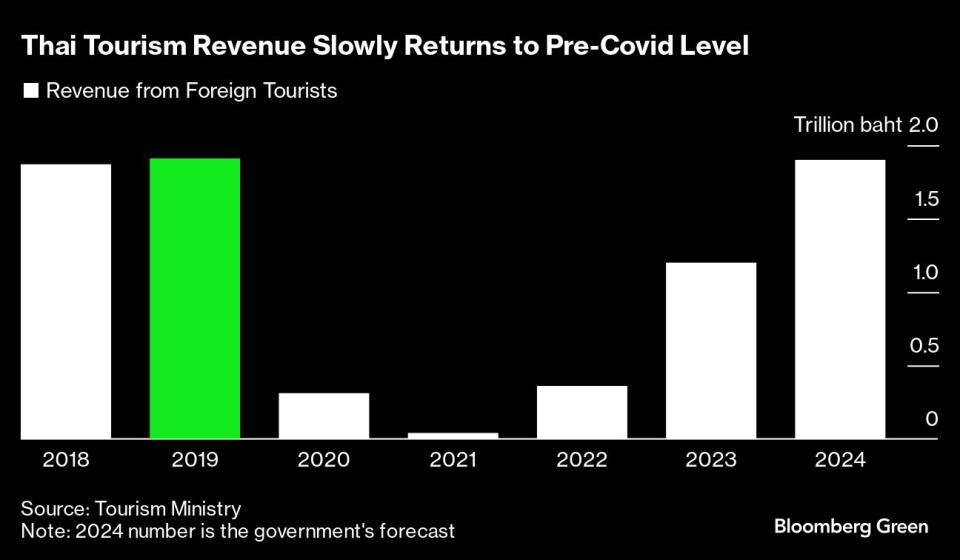

The resulting inertia appears to be taking a toll. Economists have scaled back growth projections for this year given the likely delay to the cash injection and a less than rosy outlook for tourist spending and exports.

Meantime, the nation’s main stock index has slumped to a three-year low and the local currency has gone from being the best performer in Asia in the final quarter of 2023 to the second-worst this year. Investors have continued to shun Thai debt more than its regional peers, pulling out almost $500 million from the nation’s bond market so far in 2024.

“The government remains focused on boosting consumption, while the BOT remains focused on assessing the best policy outcome based on the growth-inflation-financial stability mix,” said Lavanya Venkateswaran, a senior economist at Oversea-Chinese Banking Corp. in Singapore. “The risk is that these tensions obstruct policy making,” impacting real economic activities.

The Thai premier said Friday that he will keep trying to convince the BOT to cut rates, as doing so can immediately help people cope with rising expenses without the need for using the government budget.

“I will continue to do my administrative job by trying to convince the Bank of Thailand to sympathize with people who are suffering,” Srettha’s said in a post on X. “I won’t give up.”

While the BOT last week kept its benchmark interest-rate unchanged for a second straight time, a split 5-2 vote by the rate-setting panel signaled the readiness of some policymakers to start easing.

Assistant Governor Piti Disyatat separately said the central bank is willing to lower borrowing costs if it’s convinced that the weakness in the economy is persistent and not transitory.

Thailand is currently witnessing a spell of disinflation, with consumer prices printing negative for four months since October. Economic growth has slowed, while exports have struggled to recover.

A rate cut is “conditional on how the economy progresses going forward and how we disentangle the softness that we see — if it’s a temporary thing or something more persistent,” Piti said in an interview to Bloomberg Television Friday. Any easing as a result would be an act of recalibration rather than the start of an easing cycle, he added.

Also, Thailand’s high household debt ratio will make it difficult for the BOT to justify a rate cut at this juncture. Policymakers have argued that rates are meant to tackle near-term price pressures, and not structural issues such as debt levels.

Thailand’s household debt almost equals 90.9% of its GDP, or about $451 billion, and is seen as a ticking time-bomb by policymakers given its risks for wider financial system stability. Srettha’s government has announced a slew of debt moratorium for farmers, students and small businesses in addition to running mediation campaigns to restructure loans.

But borrowers are struggling to shake off the loan burden given lackluster economic activities that’s threatening to drive them deeper into debt. While higher household debt has a positive impact on consumption in the short term, it will have long term negative implications, according to Kasikorn Research Center.

“Government efforts to rein in high household debt will strengthen household resilience,” according to a S&P Global Ratings note by analysts including Ivan Tan. “That said, borrowing habits and debt cycles are hard to break, and these measures won’t reverse structural constraints overnight.”

Easier visa rules to promote tourism, a key engine of the economy, remains one of Srettha’s notable wins for now. He wants to lift the pace of economic growth to 5% during his term, a goal that requires the premier to be nimble in setting policy and even be prepared to rechart course.

Boosting exports needs particular attention. Factory output has shrunk for 15 months in a row as exports took a knock due to sluggish demand for automobiles, electronics and other products. There was also heavy draw-down of inventories that hurt manufacturing even as domestic consumption remained strong.

Even with a pickup in exports, the outlook for manufacturing doesn’t look bright as tighter auto loan norms hurt demand for new cars and demand shifts to high-end electronic gears and chips. If Thailand, once a regional manufacturing powerhouse wants to regain its importance, it needs to address structural issues and sharpen its competitiveness. That will require coordinated efforts from all policymakers, according to Somprawin Manprasert, chief economist at Siam Commercial Bank.

“There is room for policy coordination to promote long term policies,” said Pipat Luengnaruemitchai, chief economist at Kiatnakin Phatra Securities Pcl. “The tension between the government and the central bank is not productive and could lead to policy uncertainty.”

Most Read from Bloomberg Businessweek

OpenAI’s Secret Weapon Is Sam Altman’s 33-Year-Old Lieutenant

How Jack Dorsey’s Plan to Get Elon Musk to Save Twitter Went South

©2024 Bloomberg L.P.