Sysco's (SYY) Q4 Loss Narrower Than Expected, Sales Down Y/Y

Sysco Corporation SYY reported fourth-quarter fiscal 2020 results, wherein the top and bottom lines deteriorated year over year but came ahead of the Zacks Consensus Estimate. Results were largely affected by coronavirus-related headwinds.

The company is making robust efforts to manage its business amid the pandemic. To this end, it is utilizing its sales team to boost additional businesses and prepare for the return of demand in the food-away-from-home channel. The company is also helping its restaurant partners to reshape business, as per the current environment, by offering solutions related to meal kits, contactless menus, curbside/takeout, along with safety and sanitation.

Quarter in Detail

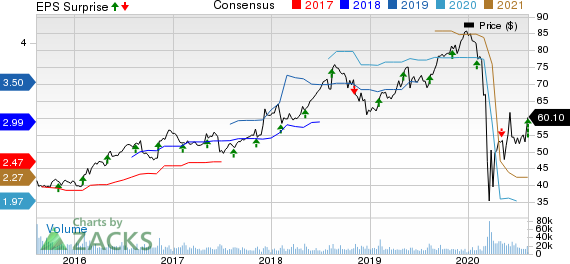

The company posted an adjusted loss of 29 cents per share, which was narrower than the Zacks Consensus Estimate of a loss of 39 cents. However, the bottom line fell significantly from the year-ago period’s adjusted earnings of $1.10 per share. The year-over-year deterioration can be attributed to reduced sales and margins.

Sysco Corporation Price, Consensus and EPS Surprise

Sysco Corporation price-consensus-eps-surprise-chart | Sysco Corporation Quote

This global food products maker and distributor reported sales of $8,866.6 million, which slumped 42.7% year over year, thanks to the coronavirus outbreak. Nevertheless, the figure surpassed the Zacks Consensus Estimate of $8,188.2 million. Foreign currency headwinds had an adverse impact of about 0.3% on the top line.

Gross profit in the quarter declined 47.4% to $1,565.7 million and the gross margin contracted 159 basis points (bps) to 17.66%. Foreign currency headwinds had an adverse impact of about 0.3% on the gross profit.

Adjusted operating loss was $33.9 million against adjusted operating income of roughly $818 million in the year-ago period.

Segment Details

U.S. Foodservice Operations: During the fourth quarter, segment sales declined 42.8% to $6,114.9 million. Local case volumes within U.S. Broadline operations fell 38.7% (including organic sales decline of 39.4%) and total case volumes dropped 41.5% (wherein organic sales declined 41.9%). Gross profit plunged 45.7% to $1,165.6 million, while gross margin contracted 102 bps to 19.06%. Food-cost inflation was almost flat in U.S. Broadline, as inflation in meat was countered by deflationary trends in frozen and poultry categories.

International Foodservice Operations: Segment sales declined 53.4% to $1,361.1 million in the fourth quarter. Foreign exchange fluctuations hurt segment sales by 1.5% during the quarter. On a constant-currency (cc) basis, sales fell 51.9% to $1,405.6 million. At cc, gross profit declined 56.4% to $270.9 million and gross margin fell 199 bps to 19.27%. Currency headwinds affected the segment’s gross profit by 1.3%.

SYGMA sales dropped 16.8% to $1,288.9 million.

Other segment sales tumbled 66.8% to $101.6 million.

Other Updates

Sysco ended the quarter with cash and cash equivalents of $6,059.4 million, long-term debt of $12,902.5 million and total shareholders’ equity of $1,158.6 million.

During fiscal 2020, the company generated cash flow from operations of $1,618.7 million and free cash flow amounted to $927 million.

This Zacks Rank #5 (Strong Sell) stock has lost 22.4% in the past six months compared with the industry’s decline of 1.7%.

Looking for Solid Food Stocks? Check These

Medifast MED, which currently carries a Zacks Rank #1 (Strong Buy), has an impressive earnings surprise record. You can see the complete list of today’s Zacks #1 Rank stocks here.

Campbell Soup CPB, with a Zacks Rank #2 (Buy), has a long-term earnings growth rate of 8.3%.

B&G Foods BGS, with a Zacks Rank #2, has a robust earnings surprise record.

Zacks’ Single Best Pick to Double

From thousands of stocks, 5 Zacks experts each picked their favorite to gain +100% or more in months to come. From those 5, Zacks Director of Research, Sheraz Mian hand-picks one to have the most explosive upside of all.

With users in 180 countries and soaring revenues, it’s set to thrive on remote working long after the pandemic ends. No wonder it recently offered a stunning $600 million stock buy-back plan.

The sky’s the limit for this emerging tech giant. And the earlier you get in, the greater your potential gain.

Click Here, See It Free >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Campbell Soup Company (CPB) : Free Stock Analysis Report

Sysco Corporation (SYY) : Free Stock Analysis Report

BG Foods, Inc. (BGS) : Free Stock Analysis Report

MEDIFAST INC (MED) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research