Thailand Keeps Key Rate as Divided Vote Boosts Dovish Bets

(Bloomberg) -- Thailand’s central bank resisted the government’s call for cheaper borrowing costs as policymakers stood pat on Wednesday, in a decision that showed the first signs of dissent in the rate panel in over a year.

Most Read from Bloomberg

Citadel Among Hedge Funds That Got Morgan Stanley’s Block-Trading Leaks

China Replaces Top Markets Regulator as Xi Tries to End Rout

Haley Loses Nevada Primary to ‘None of These Candidates’ Option

The Monetary Policy Committee voted 5-2 to maintain the one-day repurchase rate steady at a decade-high 2.50%, as predicted by all 24 economists in a Bloomberg survey. That was the first divided outcome in nine meetings, with two of the rate-setters favoring a quarter-point easing.

Prime Minister Srettha Thavisin, who had called for a cut to 2.25% to spur consumption and economic growth, told reporters separately on Wednesday that he disagrees with the Bank of Thailand’s decision but he can’t interfere with the outcome. The government wants “fiscal and monetary policies to be aligned amid negative inflation rate,” Srettha said.

The current policy settings remain consistent with sustaining growth, and fostering macro-financial stability, the BOT said in a statement, maintaining its stance that negative inflation readings were a product of state subsidies, and they do not reflect demand deficiency. Thailand’s rate is still among the lowest in the world, Assistant Governor Piti Disyatat told a briefing in Bangkok.

The BOT sees headline inflation stabilizing at levels close to 1% in 2024 — the lower end of its 1%-3% target range — before gradually picking up next year, it said. “We still haven’t seen a sharp drop in consumption. We expect inflation rate to rise in the future,” Piti said.

The central bank will remain data-dependent, and will weigh growth data before arriving at its next decision, Piti said, consistent with his remarks last month that policymakers are not wedded to a fixed stance. Still, the BOT maintained that rate cuts aren’t the answer to structural economic problems.

Piti acknowledged that last year’s expansion, especially in the fourth quarter was “much weaker” than the BOT expected, and that the trend points to a softer outlook for 2024. Expectations for gross domestic product growth this year was revised down to 2.5%-3%.

The government will report last year’s GDP on Feb. 19, with the finance ministry earlier saying annual growth likely slowed to 1.8%.

The 5-2 BOT decision “has started the countdown to an easing in rates like past cycles,” said Kobsidthi Silpachai, head of Capital Market Research at Kasikornbank Pcl. in Bangkok. “The debate over whether to cut or not to cut has become more political than about economics.”

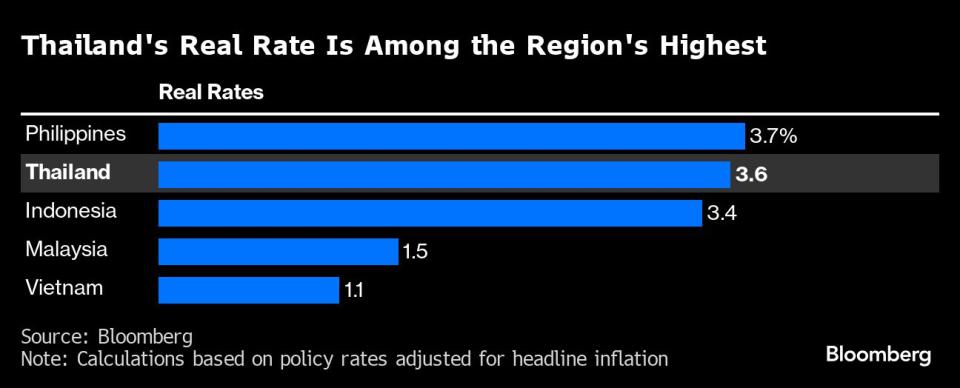

Although the central bank has delivered only 200 basis points of increases in its tightening cycle since 2022, Thailand’s inflation-adjusted real interest rate has risen to 3.61% — among the highest in Southeast Asia — amid declining consumer prices.

What Bloomberg Economics Says...

“A rate cut is starting to come into view. Two members of the policy committee preferred to cut instead of hold. Lower growth and inflation forecasts also point in that direction. Should household spending slump or tourism fail to revive ahead, the BOT is likely to cut rates this year.”

— Tamara Mast Henderson, economist

For the full note, click here

On the political pressure to cut the rate, Piti said the calls were made with “good intentions” and they help the central bank frame its policy better.

The baht was up 0.2% against the dollar at 4:45 p.m. local time, paring earlier gains. Five-year Thai overnight indexed swap fell 6 basis points to 2.23% following the decision, signaling rising dovish bets for the central bank.

“A clash between Thailand’s central bank that wants to keep rates elevated, and its government that wants lower rates, raises concerns for further volatility,” said Lee Young Hwa, an economist at Shinhan Bank in Seoul. “It won’t be realistic for the BOT to cut rates before” the Federal Reserve does given the risk of capital outflows.

--With assistance from Tomoko Sato, Janine Phakdeetham, Eduard Gismatullin, Cecilia Yap, Suttinee Yuvejwattana, Marcus Wong and Hooyeon Kim.

(Updates with details from central bank briefing and premier’s comment.)

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.