UK Unemployment Hits Surprise 2.5-Year High After Rate Increases

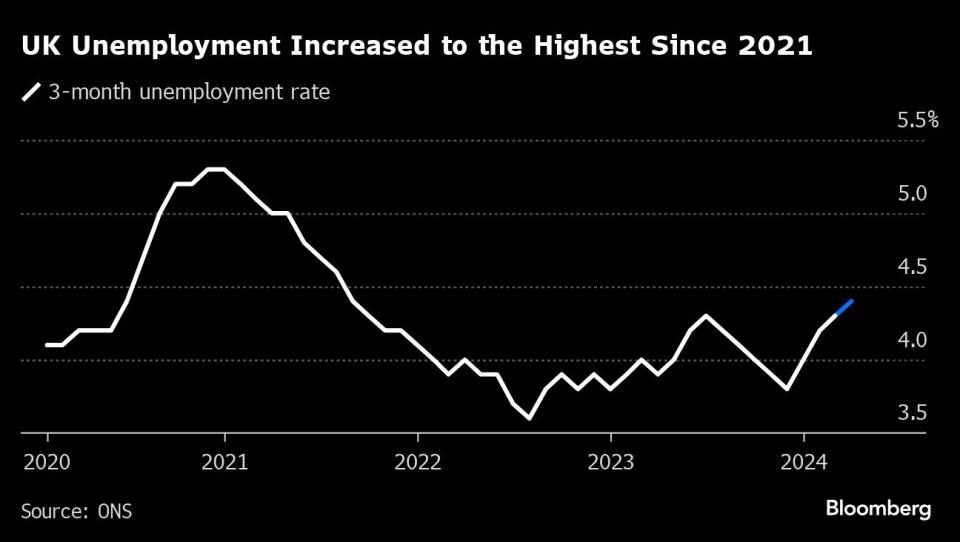

(Bloomberg) -- UK unemployment unexpectedly rose to the highest in more than 2 1/2 years, and pay pressures eased, keeping the Bank of England on track to cut interest rates later this year.

Most Read from Bloomberg

Dozens of CVS Generic Drug Recalls Expose Link to Tainted Factories

Stocks Rise as Solid Treasury Sale Spurs CPI Bets: Markets Wrap

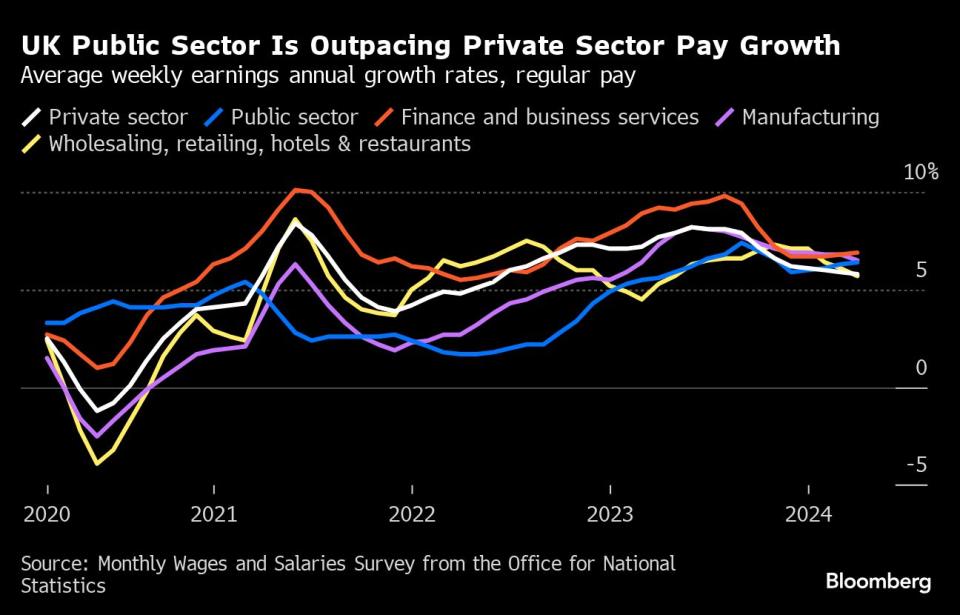

The jobless rate climbed to 4.4% in the three months through April, a level not seen since the middle of 2021, the Office for National Statistics said Tuesday. Average weekly earnings in the private sector, which the central bank is keeping a close eye on, increased by 5.8% — the slowest pace in two years even though the minimum wage increased by almost 10%.

The figures add to hopes that underlying inflationary pressures are abating, allowing the central bank to reduce the highest borrowing costs in 16 years. The pound edged lower after the data as money markets added to wagers on interest-rate cuts.

“The UK’s labor market is slowly weakening,” said Tomasz Wieladek, chief European economist at T. Rowe Price. “A rapidly weakening labor market is a strong signal to cut Bank Rate.”

Traders are fully pricing in the first quarter-point reduction by November and see around a 40% chance of a second decrease by year end — up from 20% on Monday.

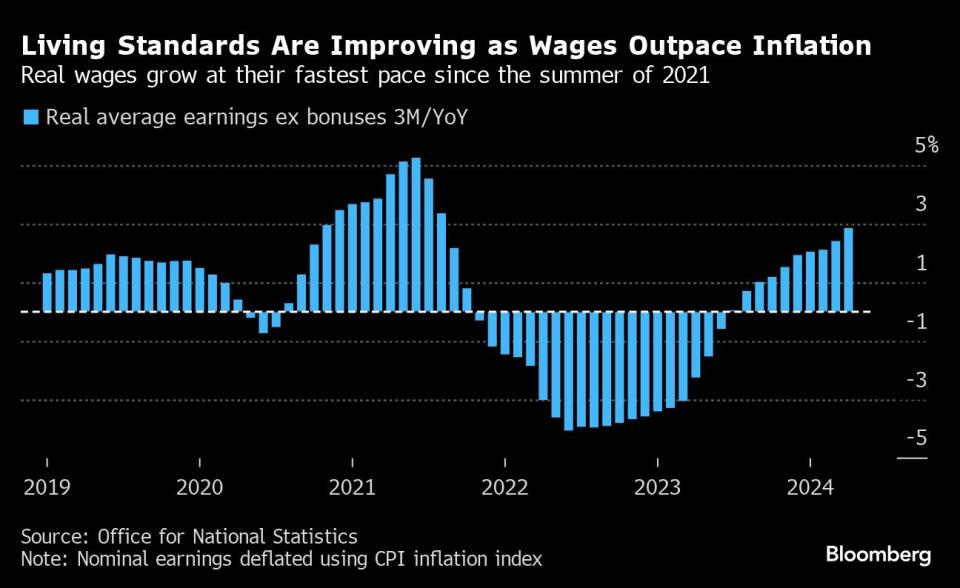

The figures also gave Rishi Sunak a political boost as he prepares to launch the Conservative manifesto Tuesday. Living standards continued to improve as real wages grew 2.9%, the highest since the summer of 2021 and the tenth month running of above inflation pay growth.

The Tories trail Labour in the polls and are hoping the promise of tax cuts and the prospect of rate cuts will give people the “feel-good factor” that will lift the party’s chances in the general election on July 4.

The report also showed:

Job vacancies dropped by 12,000 in the quarter to 904,000, the 23rd consecutive fall. That’s still above levels before the Covid-19 pandemic hit

The number of employees on company payrolls fell 3,000 in May to 30.3 million. Total employment in the quarter through April dropped 139,000, more than expected

Total earnings growth held at 5.9%, and the figure excluding bonuses remained 6%. The regular wages figure was a touch softer than economists’ forecasts for an increase to 6.1%

Household finances continued to be bolstered by pay increases outstripping inflation with real wage growth of 2.9%, the highest since the summer of 2021

“Average earnings are rising in real terms as inflation falls, but are a staggering £12,000 per year below what they’d be on pre-financial crisis trends,” said Stephen Evans, chief executive at Learning and Work Institute. “This shows the scale of catch-up needed in the years ahead.”

While the figures showed the labor market cooling, it is unlikely to be enough to persuade the BOE to begin cutting interest rates at next week’s meeting.

Sterling is the best performing currency in the Group-of-10 this year on expectations interest rates will stay high for longer than in other large economies. The European Central Bank delivered its first quarter-point reduction last week and is expected to reduce rates at least once more by the end of the year.

The central bank’s nine-member Monetary Policy Committee had started to lay the groundwork for a reduction in borrowing costs over the summer. However, the odds of a move this month dropped when inflation exceeded forecasts in the UK, particularly in services prices, and Sunak called a surprise election for July 4.

What Bloomberg Economics Says ...

“The surprise slowdown in private sector pay growth is likely to give the Bank of England a little more confidence that inflation is on a durable path to 2%, though it won’t be enough for the central bank to sound the all-clear.”

—Ana Andrade and Dan Hanson, Bloomberg Economics. Click for the REACT.

BOE rate-setters have cancelled all public appearances and speeches for the election campaign. The blackout means investors are getting little guidance about how policymakers are interpreting key data before their next decision on June 20.

Officials previously have said wage data — especially in the private sector — and services sector inflation are key indicators about the strength of upward pressure on pay and prices.

Detail in the report showed more signs of loosening in the labor market, which had been feeding upward pressures on pay and prices.

The employment rate dropped to 74.3%, a level last seen in December 2016 outside the pandemic, as both unemployment and inactivity picked up

Another 132,000 people dropped out of the workforce in the three months through April, leaving the number of people classed as inactive at 9.43 million. Within that, long-term sickness increased once again to a new record of 2.83 million

The overall inactivity rate climbed to 22.3% of the working-age population, the highest since 2015

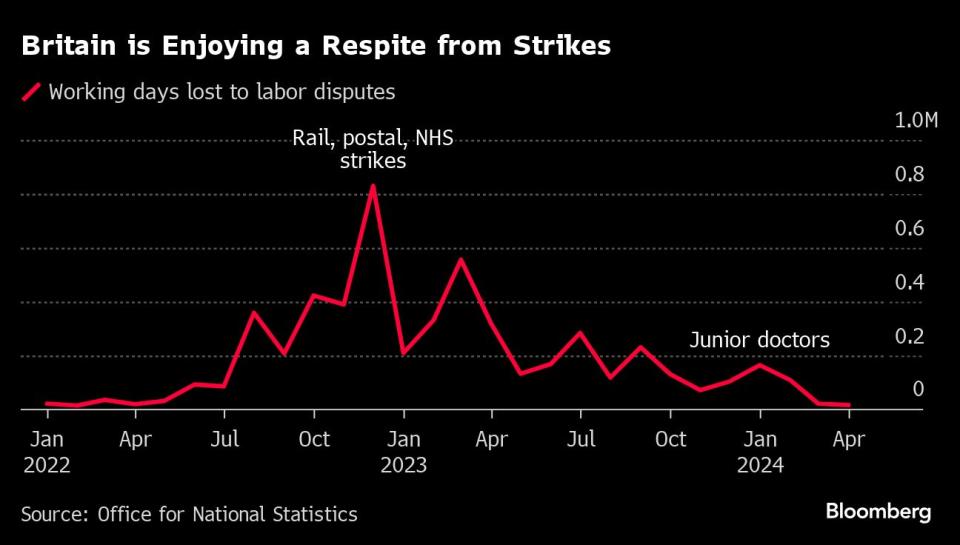

The number of working days lost to industrial action fell to 17,000 in April, the lowest since February 2022

“Grasping the challenge of high levels of economic inactivity – and how it impacts the exchequer, the welfare system and the health of the nation – will be one of the most pressing tasks facing the next Government,” said Rebecca Florisson, principal analyst at the Work Foundation at Lancaster University.

April was a crucial month, since an increase in the National Living Wage came into force then and many workers receive their annual increase to their salaries.

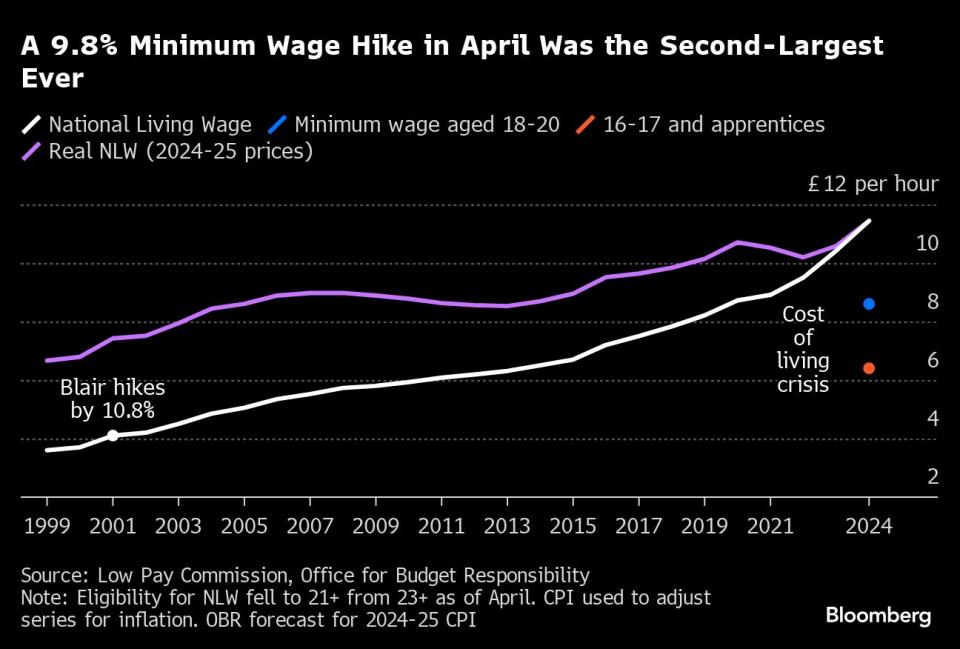

The NLW increased by 9.8% this April, the second-largest rise since Britain adopted a minimum wage in 1999. Economists have also been concerned about whether the latest rise will boost pay further up the income scale.

“Today’s data are unlikely to warrant an immediate shift in policy from the Bank of England,” said Yael Selfin, chief economist at KPMG UK. “We expect the MPC to stay put at its June meeting and reassess the incoming data flow over the summer.”

--With assistance from Andrew Atkinson, Irina Anghel and Constantine Courcoulas.

(Updates to move up market reaction, adds reference to strikes.)

Most Read from Bloomberg Businessweek

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Food Companies Hope You Won’t Notice Shortages Are Raising Prices

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

Legacy Airlines Are Thriving With Ultracheap Fares, Crushing Budget Carriers

©2024 Bloomberg L.P.