Why 4DS Memory's (ASX:4DS) CEO Pay Matters

The CEO of 4DS Memory Limited (ASX:4DS) is Guido Arnout, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

See our latest analysis for 4DS Memory

How Does Total Compensation For Guido Arnout Compare With Other Companies In The Industry?

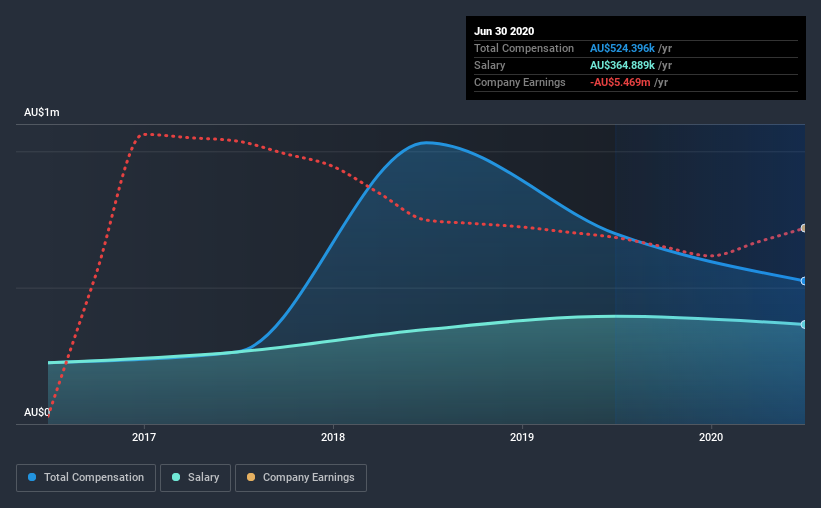

At the time of writing, our data shows that 4DS Memory Limited has a market capitalization of AU$85m, and reported total annual CEO compensation of AU$524k for the year to June 2020. That's a notable decrease of 25% on last year. Notably, the salary which is AU$364.9k, represents most of the total compensation being paid.

On comparing similar-sized companies in the industry with market capitalizations below AU$282m, we found that the median total CEO compensation was AU$524k. This suggests that 4DS Memory remunerates its CEO largely in line with the industry average. Furthermore, Guido Arnout directly owns AU$197k worth of shares in the company.

Component | 2020 | 2019 | Proportion (2020) |

Salary | AU$365k | AU$395k | 70% |

Other | AU$160k | AU$303k | 30% |

Total Compensation | AU$524k | AU$698k | 100% |

On an industry level, around 90% of total compensation represents salary and 9.8% is other remuneration. In 4DS Memory's case, non-salary compensation represents a greater slice of total remuneration, in comparison to the broader industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

4DS Memory Limited's Growth

Over the last three years, 4DS Memory Limited has shrunk its earnings per share by 10% per year. In the last year, its revenue is up 87%.

The decrease in EPS could be a concern for some investors. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has 4DS Memory Limited Been A Good Investment?

Boasting a total shareholder return of 124% over three years, 4DS Memory Limited has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

As previously discussed, Guido is compensated close to the median for companies of its size, and which belong to the same industry. The company has logged solid shareholder returns for the past three years. Revenues have also showed some positive momentum, recently. However, on a concerning note, EPS is not growing. Considering overall performance, it's fair to say Guido is paid reasonably.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 4 warning signs for 4DS Memory (1 is a bit concerning!) that you should be aware of before investing here.

Important note: 4DS Memory is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.