Condo vacancies rise, rents fall as pandemic crushes GTA's short-term rental market

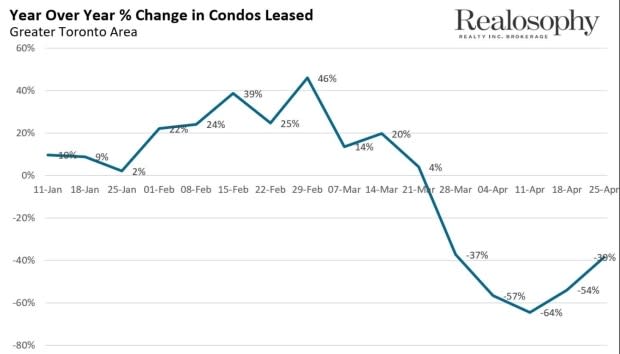

The GTA's condo rental market has dramatically reversed directions in the course of a single month with a surge in listings since the pandemic hit, real estate watchers say.

And they believe a big drop in Airbnb rentals may be playing a role in this trend.

"We're seeing renters pull out of the market," said John Pasalis, president of Realosophy Realty Inc. And he says while prospective renters are getting scarce, there has been a spike in the numbers of units for rent.

"Especially condominiums, which are high-priced rentals ... over $2,000 a month for a one bedroom," Pasalis told CBC Toronto.

"So those people are kind of pulling back given the economic uncertainty and the impact on their incomes. And on the flip side, we're seeing landlords — who need to pay the mortgages and property taxes — scramble to put their units on the market."

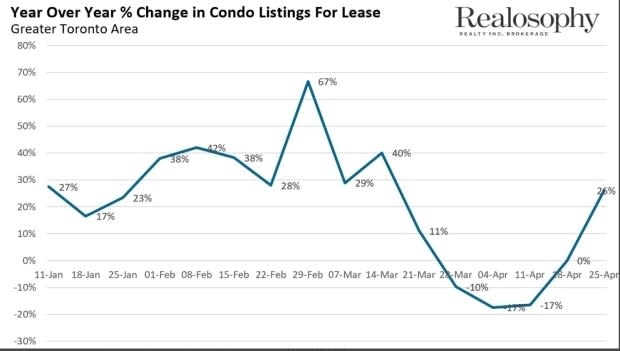

Pasalis says there's been a 25 per cent increase in listings and he thinks that former Airbnb hosts are scrambling to lease out their units.

He says investors who bought multiple units to list as short-term vacation rentals are now pivoting to leasing longer term after the Airbnb market collapsed due to the COVID-19 pandemic.

And he says a surge in listings has pushed the condo rental inventory from one-and-a-half months of inventory (MOI) at the end of March to nearly 4 MOI at the end of April.

All that new competition for renters has meant a 3.5 per cent drop in average rents for the month of April. Pasalis says he doesn't expect things to return to normal quickly and that may mean a soft rental market for some time.

"If immigration starts to decline, which typically happens during a recession, this is also going to weigh on rental demand in the short term," he said.

"We might see some condo investors take their chips off the table and sell their units."

Jaco Joubert has studied the effects of Airbnb on condo rental vacancies. He photographed 15 downtown condo towers at night over the course of a year to monitor when the lights were on to determine whether or not they were occupied.

At that time, he calculated that 5.6 per cent were vacant. He thinks that may have more than doubled in some buildings to as high as 13 per cent.

And he says he's noticed rents have declined by a few hundred dollars.

"There are some rentals that are listing for quite a bit lower than it would have maybe a year ago," said Joubert, adding that price expectations are likely moving lower.

For example, he says he found a studio condominium listed in the downtown area that probably would have gone for around $2,000. It's now listed as low as $1,850 a month.

"People are getting more desperate to get somebody[to rent their units]. There's quite a few listings in the city overall, and not a lot of people want to move right now."

But the Advocacy Centre for Tenants Ontario (ACTO) says it may be premature to say whether the rental market is expected to slow down in the post-COVID-19 period.

And the Canada Mortgage and Housing Corporation, which calculates vacancy rates across the country, has not yet released a report.