Falling loonie has some Canadian snowbirds selling their U.S. homes

Seated on a coffee shop patio in southern California, Saskatchewan snowbirds Irene Henderson and Randy Krauss explain to an American friend how things were during the good old days, when the loonie floated well above par.

About five years ago, they were getting between $1.06 and $1.10 US for every Canadian dollar.

Now, with the loonie sitting around 82 cents US and her savings hovering near a six-year low, Henderson has become a currency ostrich.

"I don't like to think about it," she says. "I just pretend it's the normal dollar....

"I'm in denial."

That's not not a helpful adaptation, Krauss counters.

"It's real. It's there. It's money on top of money that you got to pay."

With the Canadian dollar now well below par against its U.S. counterpart, many snowbirds are finding it increasingly hard on their finances.

"It bites every time you transfer money out of your Canadian to US," says Joe Schipper of Alberta. "Five thousand dollars doesn't go very far."

Leftover Tims

And here's a very Canadian measure of the economic wellbeing: the informal Tim Hortons index.

Every year, Palm Springs holds a Canadian festival and Tim Hortons coffee is ordered in just for the occasion.

And every year, organizer Bette King says, the coffee sells out, except this year. That happened even though she reduced her price "out of respect for the Canadian dollar being down."

The Palm Springs event promoter says the local economy practically runs on Canadian spending. When the loonie slides, the city slides with it.

"We love our Canadians here and we hope to get the spending back up to the standard because let me tell you, they have done so much for our economy here it's not funny," King says.

"If it weren't for the Canadians, we'd be on Noah's Ark."

The Palm Springs housing market is also adrift.

Real estate agent Jeff Miller keeps a loonie on his desk as a tribute to the folks who built his business. Eighty per cent of his clients are Canadian. A couple of years ago snowbirds were buying up the town.

"It was an opportunity," Miller says. "The loonie was high, the dollar cost of housing was low, and it was like getting a double sale at the time. I would have done it, too."

On hold

But new Canadian buyers have dried up.

"Now they're telling me they're on hold right now and they're going to watch what the loonie does," Miller says.

And there's a new twist: a few of his clients who bought low are now selling high.

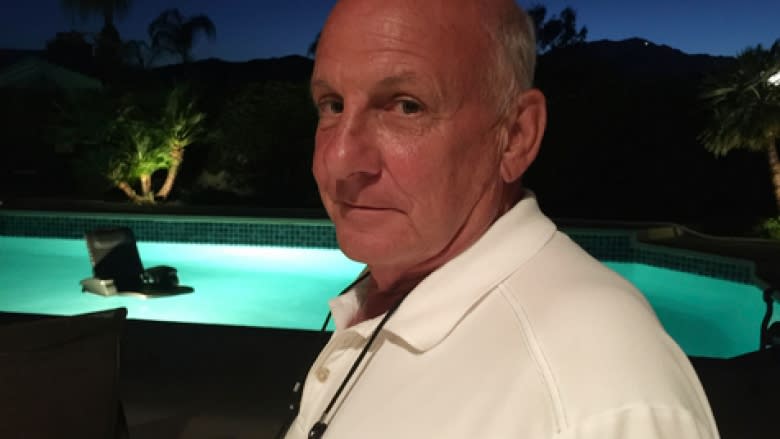

Alan Wood found the weather is decidedly better in Palm Springs than his native Edmonton. Seven years ago he bought a winter home with orange trees and a large pool, and converted plenty of Canadian dollars into American currency.

"I'm still living on the cheap dollars," Wood says. "But I'm running out."

So this year, in part because of the low exchange rate, he and his wife took a huge step.

"We decided, 'Hey let's sell it,' " Wood says as he grills some of the thick Canadian pork chops he favours over the local meat. "As a matter of fact, today we signed the deal."

Now they will move back to Edmonton and change the proceeds of the sale into Canadian dollars, making about 20 per cent on the conversion.

"With the way the dollar went, what the heck, you know?" Woods says.

It may be a savvy financial decision, but not all of his family is on board.

Ten-year-old granddaughter Gabby is still coming to terms with the fact that there will be no more 30 C March breaks at Grandpa's.

"Oh, I'm so very happy for them," she says. "Now I'm going to cry in a corner."