After 42 years, Irving Oil property tax exemption comes to mysterious end

A property tax exemption that New Brunswick granted Irving Oil 42 years ago on its coastal crude-oil terminal in Saint John appears to have ended, at least temporarily, although exactly what killed it is not clear.

The Department of Finance referred questions about the change to Service New Brunswick, but Service New Brunswick said it cannot comment on what happened.

"We are unable to discuss individual accounts," Jennifer Vienneau, Service New Brunswick's director of communications, wrote in an email about the terminal's new tax status.

Vienneau said information about a change in the oil terminal's tax treatment would have to come from the "property owner."

Irving Oil, however, did not respond to a request for information.

The revoked tax exemption is related to Canaport, a large crude-oil tank farm owned by Irving Oil on Mispec Point, at the edge of the Bay of Fundy.

The facility has a storage capacity of six million barrels and supplies Irving Oil's Saint John refinery from shipments it receives from ocean-going tankers that arrive from around the world multiple times every month.

The tank farm and related infrastructure cover 430 hectares of land and sea floor in the east end of the city and is assessed for taxes by Service New Brunswick to be worth $30.2 million.

It has always had to pay full municipal property taxes to Saint John, but since 1981 it has been one of a handful of New Brunswick business properties exempt from paying any provincial property tax.

Response to oil crisis

The concession was granted by the former government of Richard Hatfield to help Irving Oil weather the 1979 oil crisis that saw crude prices spike and North American demand for petroleum products crater in response.

The oil crisis eventually passed and consumer demand returned, but the New Brunswick tax concession has continued on decades later.

In its most recent annual tax expenditure report, New Brunswick's Department of Finance valued the exemption in 2021 to be worth $674,929. Over 42 years it has saved Irving Oil more than $20 million in property tax on the location.

The "objective" of the exemption, according to the Department of Finance, is "to support the competitiveness of infrastructure that is important to economic development."

But according to updated New Brunswick property records, the crude-oil tank farm has been switched from its longtime status as "provincial rate excluded" to "fully taxable" for 2023.

Although declining to comment on what caused the change, Vienneau did confirm that the exemption has not been cancelled by the province.

"There have been no changes," she said, about whether the exemption has been removed from legislation or altered in some way.

That means the tax change has been caused by another issue. Potentially, that could be the sale of unrefined crude by Irving Oil.

According to the exact wording of the tax exemption statute in the Assessment Act, it requires all of the oil arriving at the Canaport tank farm to be sent to the refinery for processing to qualify for tax-free treatment.

"Provincial taxes or rates shall not be … levied on crude oil storage tanks connected with an oil refinery … when such crude oil storage tanks … are used solely for supplying crude oil to the oil refinery for the sole purpose of manufacturing or producing petroleum products," the statute reads.

Irving Oil does not solely use crude oil to process at the refinery.

On its website, the company advertises that in addition to refined products, it also sells and ships unprocessed crude oil to large-volume customers who place orders of "50,000 barrels" or more.

"Talk with one of our expert advisors about crude oil for your business," says the company's website.

It is not certain if reselling crude oil, rather than processing it, would be enough to cancel the property tax exemption. Neither the company nor the province will say.

In addition, selling unprocessed crude oil does not appear to be a new business venture for Irving Oil and if it cancelled the tax exemption for 2023, it is not clear how it would have survived in earlier years.

The tax exemption has been politically controversial for several years.

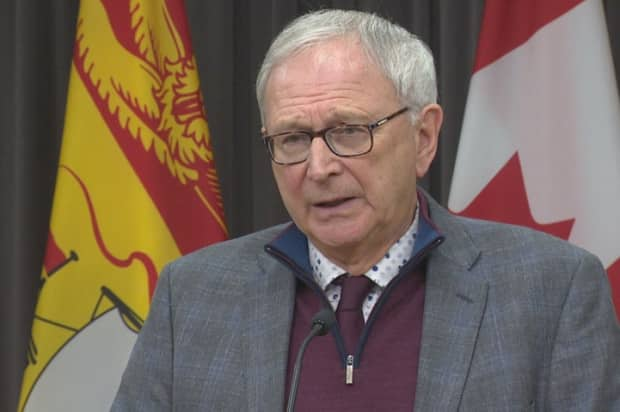

In 2016, then-opposition leader Blaine Higgs said the exemption should be reviewed and potentially cancelled, since the crisis it was created to help Irving Oil survive resolved itself in the 1980s.

"A lot of policies in government … start for a good reason, but they never end," Higgs said.

"There's no exit clause, so it just doesn't hit the radar again."

In 2018, the New Brunswick Green Party put the cancellation of the property tax exemption on crude-oil storage tanks into its election platform.

In an interview, Green Leader David Coon said whatever caused the suspension in this year should be made permanent by removing the exemption from legislation.

"It never should have been granted in the first place, Coon said.

"The timing couldn't be better to rip the Band-Aid off."