ATCO Electric Yukon has consistently exceeded profit guidelines set by the Yukon Utilities Board

ATCO Electric Yukon wants to increase rates by 5.2 per cent for 2024.

There was a four-day public hearing before the Yukon Utilities Board this week about its application to do so, where the private company's return on equity (ROE) became a major sticking point.

Return on equity refers to the profit ATCO Electric is making. That profit goes back to its parent company, and ultimately some of it goes back to its shareholders.

ATCO Electric Yukon is a subsidiary of ATCO Electric in Alberta. ATCO Electric is owned by Canadian Utilities Inc. which is a subsidiary of Canadian Utilities Ltd. — controlled by ATCO Ltd.

John Maissan, a retired engineer, was among a handful of organizations and individuals that intervened at the public hearing. He was the member of the public to intervene and show up in person all four days. (Rafsan Faruque Jugol)

A handful of organizations and individuals intervened at the public hearing. John Maissan, a retired engineer, was the only intervener from the public who appeared in person all four days. He said ATCO Electric Yukon has been exceeding its approved return on equity by the Yukon Utilities Board.

"AEY [ATCO Electric Yukon] has over-earned their reasonable return on equity," he said. "And so it seems to me that perhaps shareholders are being put ahead of ratepayers."

From 2017 to 2022, ATCO Electric Yukon has averaged a return on equity of 12.72 per cent according to documents made public at the hearing. The baseline set by the Yukon Utilities Board since 2017 has been 9 per cent.

Documents made public at the hearing show ATCO Electric Yukon has been exceeding the guidelines set by the Yukon Utilities Board for return on equity. (John Maissan)

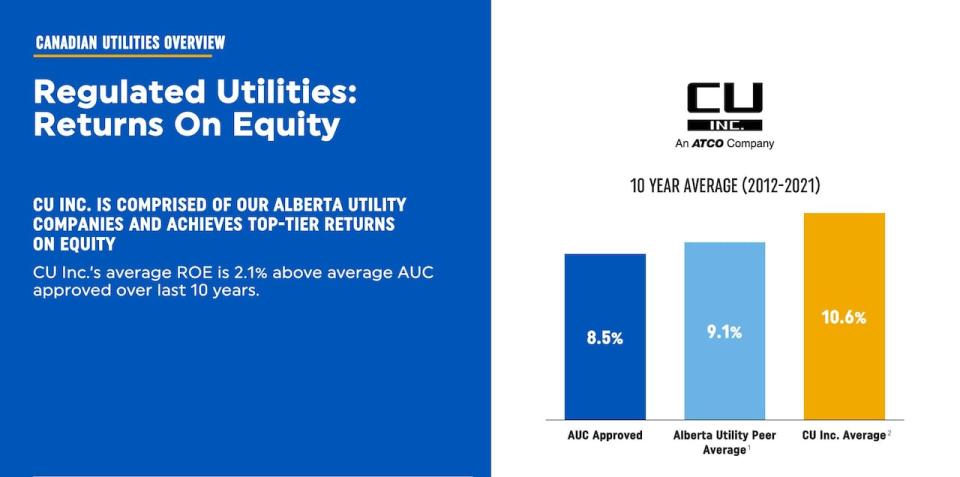

In a presentation to investors in March earlier this year, Canadian Utilities Inc. highlighted the organization's return on equity for investors. Over ten years, they averaged a return of 10.6 per cent which is higher than the 8.5 per cent rate approved by the Alberta Utilities Commission.

Canadian Utilies Inc. has been able to achieve a higher return on equity compared to the guidelines set by the Alberta Utilities Commission. (ATCO Ltd.)

The same presentation also highlighted the increasing dividend paid out to shareholders of ATCO Ltd. Dividends increased every year for shareholders over 30 years.

ATCO Ltd. has been able to achieve a year-over-year dividend growth for shareholders for three decades. (ATCO LTD.)

ATCO Electric Yukon argues a rate increase of 5.2 per cent is needed to upgrade the Yukon's energy systems.

Over 40 business cases for new and continuing projects have been put forward along with their general rate application.

These range from upgrading underground electric infrastructure, replacing old diesel generation units for some communities, and upgrading ATCO Electric Yukon's digital infrastructure.

The company is also asking for a new ROE approved by the Yukon Utilities Board. They want an additional premium of 0.75 per cent above a new baseline, citing the risk factors associated with servicing the Yukon.

CBC Yukon has reached out to ATCO Electric Yukon for comment, but the organization did not make anyone available before publication time.

Political disagreements on energy inflation

The Yukon NDP was an intervener at the public hearing as well. MLA Lane Tredger suggested the profit motive of a privatized energy company is hurting consumers.

"They have been earning millions of dollars on top of what they are allowed to earn," Tredger said. "I certainly think if we go back in time it was a mistake to switch to a private ownership model".

Currie Dixon, the leader of the Yukon Party, suggests the Yukon Energy Corporation — which supplies the majority of ATCO Electric Yukon's energy for distribution — has a significant role to play in driving up the cost of electricity in the Yukon because they also have a general rate application.

"I think that the increase that we're seeing in our power rates is far more driven by Yukon Energy than it is by ATCO," said Dixon.

The 2023-2024 general rate application by the Yukon Energy Corporation suggests a 6.1 per cent increase in residential electricity bills by August 1st if approved by the Yukon Utilities Board.

John Streicker, the Yukon's Minister of Energy, Mines, and Resources, said the rate applications from the Crown Corporation and ATCO are not comparable.

"Yukon Energy, they have not had over earnings so they're in a different situation than ATCO altogether," said Streicker.