Bearish: Analysts Just Cut Their Diversified Royalty Corp. (TSE:DIV) Revenue and EPS estimates

Market forces rained on the parade of Diversified Royalty Corp. (TSE:DIV) shareholders today, when the analysts downgraded their forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

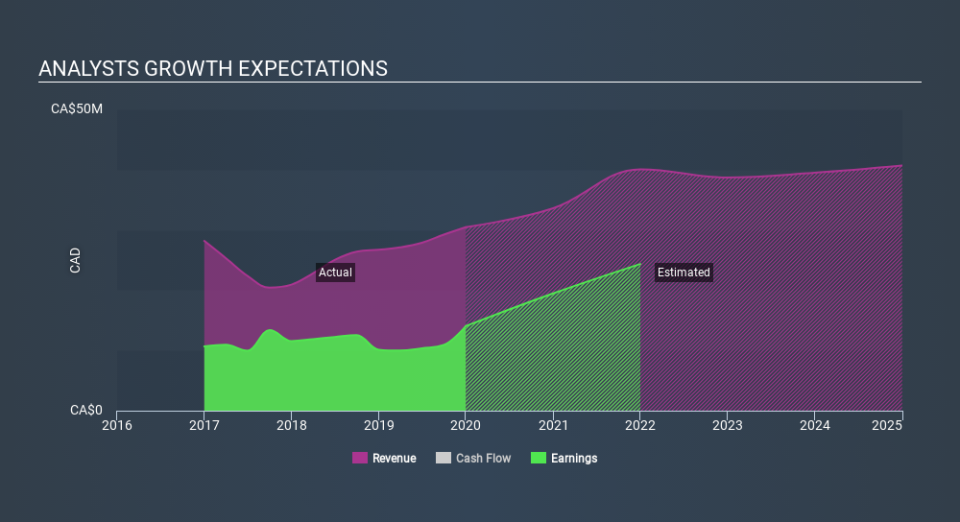

After the downgrade, the six analysts covering Diversified Royalty are now predicting revenues of CA$34m in 2020. If met, this would reflect a notable 10% improvement in sales compared to the last 12 months. Prior to the latest estimates, the analysts were forecasting revenues of CA$39m in 2020. It looks like forecasts have become a fair bit less optimistic on Diversified Royalty, given the substantial drop in revenue estimates.

Check out our latest analysis for Diversified Royalty

Notably, the analysts have cut their price target 14% to CA$3.46, suggesting concerns around Diversified Royalty's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. The most optimistic Diversified Royalty analyst has a price target of CA$4.50 per share, while the most pessimistic values it at CA$2.25. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. We would highlight that Diversified Royalty's revenue growth is expected to slow, with forecast 10% increase next year well below the historical 17% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 3.5% next year. Even after the forecast slowdown in growth, it seems obvious that Diversified Royalty is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for this year. They're also forecasting more rapid revenue growth than the wider market. With a serious cut to this year's expectations and a falling price target, we wouldn't be surprised if investors were becoming wary of Diversified Royalty.

That said, the analysts might have good reason to be negative on Diversified Royalty, given the risk of cutting its dividend. Learn more, and discover the 1 other flag we've identified, for free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.