Bond Markets Have Little Patience for Ecuador’s President-Elect

(Bloomberg) -- A businessman beating a leftist to the presidency would spark a bond rally almost anywhere in the world.

Most Read from Bloomberg

Sam Altman, OpenAI Board Open Talks to Negotiate His Possible Return

Citigroup Cuts Over 300 Senior Manager Roles in Latest Restructuring

Nearly All of OpenAI Staff Threaten to Go to Microsoft If Board Doesn’t Quit

Binance and CEO Plead Guilty, Agree to Pay Billions in Fines

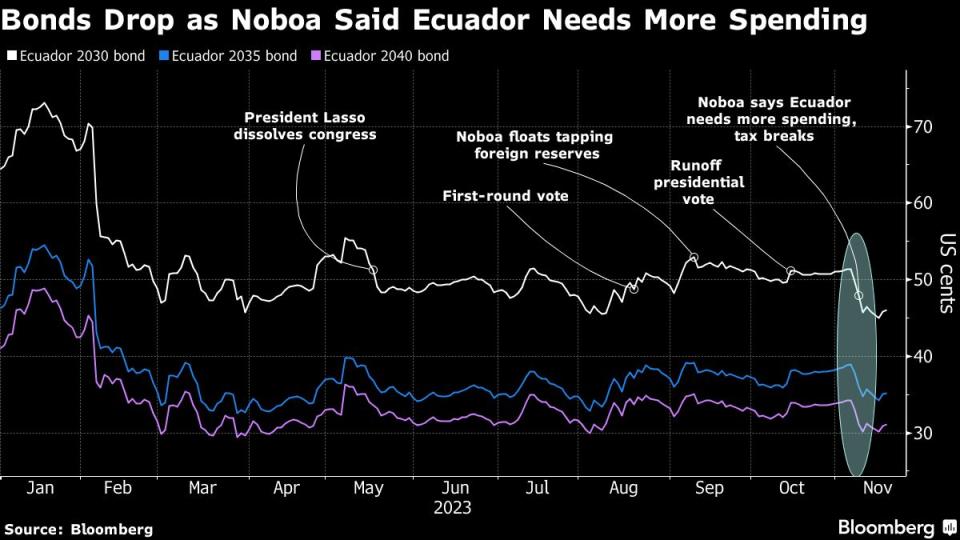

Yet in Ecuador, Daniel Noboa’s win last month led the nation’s debt into a tailspin as he’s failed to convince investors he can fix the South American nation’s fiscal problems after he takes office Thursday.

The notes have lost about 3.4% on average since Noboa’s runoff victory on Oct. 15, among the worst performances among emerging-market sovereign bonds, according to data compiled from a Bloomberg index. The debt, which already traded at deeply distressed levels, took another hit after the president-elect discussed his plans to boost government spending and offer tax breaks in a recent trip to the US.

“This combination is not the best for the fiscal picture,” said Bruno Rovai, a sovereign debt strategist at Macquarie Asset Management in New York. “The start point of the Noboa administration could have been a better one.”

The fall in bonds adds to the pressure building on Noboa, an heir to a banana empire who will take office as one of the youngest head of state in the world. He’s already trying to stem a surge in violent crime, navigate political turmoil and boost an economy set to slow this year. And he only has 17 months to do it as he completes the term of outgoing leader Guillermo Lasso.

That means he will be in “re-election mode” from the start and unlikely to institute the reforms needed to reassure markets, Rovai said.

Noboa’s introduction to investors in New York and DC this month didn’t help assuage those fears. At the Inter-American Dialogue, he said the country needs a bridge loan for public spending including tax breaks for companies that hire new staff.

The bonds due in 2040 sank to a two-month low of 31 cents on the dollar on Nov. 8, as he ended his trip. Adding to concerns, Noboa is inheriting leadership of a country with a dismal track record with the markets: Its most recent default, the 11th in its history, came just over three years ago.

The market for credit default swaps — a type of insurance — is already pricing in a 94% chance of default over the next five years, according to data compiled by Bloomberg.

“History weighs on Ecuadorian asset prices,” Ricardo Penfold, a managing director at Seaport Global wrote in a note. “Noboa seems to be reluctant to adjust the fiscal going into elections in 2025. The threshold to default on debt is low.”

The country may be able to muddle through as its next big bond payment isn’t until 2026. International reserves remain high and debt as a share of gross domestic product fell back under pre-pandemic levels, Penfold wrote.

But Ecuador’s bonds yield about 22%, keeping the nation locked out of global capital markets. What’s more, its deficit is widening. Government revenues are likely to face another drag as voters ordered the shutdown of a major oil field inside the Yasuni national park, suggesting losses of about $16 billion through 2040, according to the estimates of the state-run oil company.

What’s more, Noboa has kept quiet about his plans regarding the International Monetary Fund, though he met with Fund officials during his US trip. Support from the IMF could help unlock additional financing.

“It’s hard to see a catalyst for a rally absent an IMF program, which doesn’t appear to be a priority at least in the short-term,” said Katrina Butt, an economist at AllianceBernstein.

--With assistance from Stephan Kueffner.

Most Read from Bloomberg Businessweek

More Americans on Ozempic Means Smaller Plates at Thanksgiving

The Share of Americans Who Are Mortgage-Free Is at an All-Time High

Guatemalan Town Invests Remittance Dollars to Deter Migration

At REI, a Progressive Company Warns That Unionization Is Bad for Vibes

Inflation Raging in Triple Digits Is Pushing Argentina Down a Radical Path

©2023 Bloomberg L.P.