Brazil Investors Look Past Vote and See a Rally in the Making

(Bloomberg) -- Emerging-market money managers are putting aside the jitters that often precede elections and touting Brazil as a top investment choice regardless of who wins the presidential vote.

UBS Global Wealth Management expects the MSCI Brazil Index to beat its developing-nation benchmark by as much as 15 percentage points over the next 12 to 18 months. TD Securities sees room for the real to strengthen about 7% by the end of next year. Ashmore Group Plc says government bonds are a bargain after getting hit by political volatility.

At the end of the month, voters will decide whether incumbent President Jair Bolsonaro remains in office for four more years or if leftist former President Luiz Inacio Lula da Silva achieves an epic political comeback. The ballot has ramifications for the environment, social policies and the current government’s privatization push, but investors are betting that the country’s finances will be on solid ground over the short term no matter who wins.

So they’re looking at markers like equity valuations, the interest-rate cycle and the fact that the country stands relatively isolated from geopolitical tensions. The conclusion is that Brazil’s markets may be on the cusp of a takeoff.

“We think Brazil can emerge as the economic power it clearly has the potential to be,” said Amer Bisat, a managing director at BlackRock Inc. and a former senior economist at the International Monetary Fund. “As an investor, what matters is that the upcoming government -- regardless of who wins -- maintains fiscal prudence and institutional integrity.”

Brazil is also well positioned relative to its biggest emerging-market peers. Russia is untouchable for many investors because of its war in Ukraine, while China is facing a bumpy economic reopening from the pandemic. Turkey’s currency has collapsed to a record low, and Chilean assets have become volatile amid talks on a new constitution.

“It’s difficult to find another emerging market with so much liquidity, and the ones that had it are dealing with everything from out-of-control inflation to a war,” says Bruno Pandolfi, a founding partner at SPX Capital, which oversees more than 80 billion reais ($15 billion) of assets. “There aren’t many options left.”

Strategists say it means Brazil has the chance to snap years of lackluster performance and beat developing-nation peers.

It’s already been the case for most of 2022. While every asset class in the developing world is poised to post losses this year amid the surge in global interest rates, Brazil’s stocks, its currency and its bonds are all in the green.

“It’s not a safe haven, but in the context of what’s available out there or what’s going on in the rest of the world,” Brazil looks attractive, said Gorky Urquieta, a money manager at Neuberger Berman, which has about $25 billion in emerging-market assets under management and is overweight Brazil local bonds.

Currency Outlook

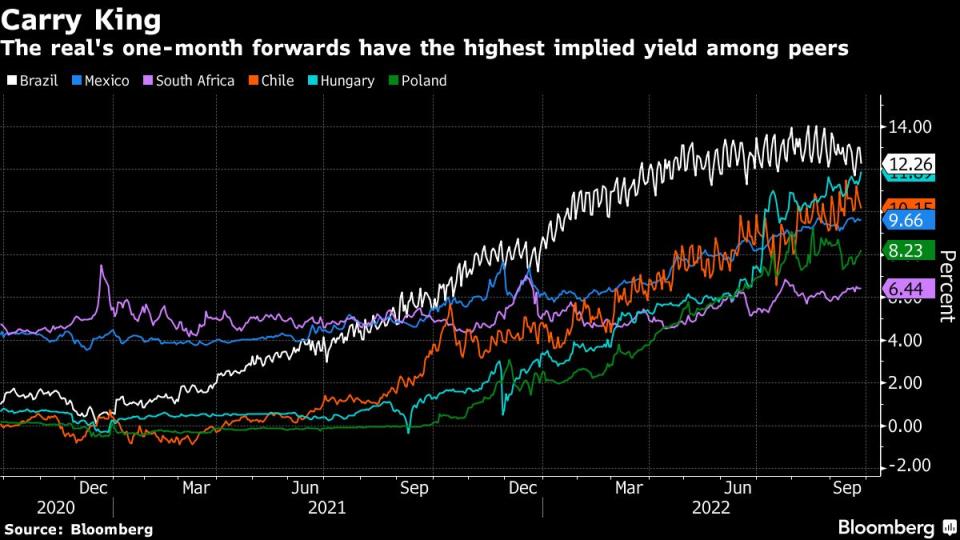

Traders piling into the real are earning a juicy yield, with Brazil’s 13.75% overnight interest rate among the highest in the world. The carry trade -- in which investors borrow in dollars to buy local assets -- has helped lift the currency 7.4% this year to about 5.2 per dollar.

Forecasters now expect interest rates to hold steady through the end of the year before beginning a gradual decline as slow inflation gives policymakers room to cut borrowing costs.

In that environment, Cristian Maggio, the head of portfolio strategy at TD Securities, expects the real to strengthen about 7% to 4.83 per dollar by the end of 2023. Brazil will continue to have among the world’s highest inflation-adjusted rates even as policy loosens, he said.

“Inflation is already starting to fall, and real rates will only go higher, making the BRL very attractive on this basis,” Maggio said.

Local bonds and the currency will likely perform well regardless of the election outcome, and Brazilian assets remain “extremely undervalued,” according to Gustavo Medeiros, the head of research at Ashmore. He correctly predicted the first-round vote on Oct. 2 would be tighter than polls suggested.

“The best strategy would be to use this volatility coming from politics as opportunities to buy Brazilian assets,” he said.

Equity Valuations

Aside from the real and bonds, Brazil’s stocks are some of the world’s best performers this year in dollar terms, yet still offer compelling valuations. After a 12% gain for the MSCI Brazil Index this year, it trades at 6.8 times forward earnings, below its 10-year historical average of 11.2 times.

Jonathan Garner, a strategist at Morgan Stanley, says he’s overweight the country’s equities. The resilience of Brazilian assets this year “is a testament to improved sovereign balance sheets and much better external debt ratio coverage and current account positions.”

Risks Abound

Daniel Shaykevich at Vanguard Group Inc. is more pessimistic. Volatility in global financial markets, he said, may be exacerbated by the uncertainty of the election.

“We are coming in cautious,” he said. “Even when it comes to local markets, you have to think about the long-term trajectory of the country in terms of fiscal and how that affects long-term interest rates.”

Other traders see a more idiosyncratic risk -- the possibility of Jan. 6-style turmoil if the vote ends up contested. It’s not investors’ base-case scenario, but anything that undermines the rule of law could send them fleeing.

Economic Reforms

Natalia Gurushina, an emerging markets fixed-income economist at Van Eck Associates, says the key will be for the next government to keep pursuing changes to tax, labor and other rules that will make it easier to do business in the country.

“Bolsonaro’s reforms started to show results,” she said. “But Brazil needs more structural changes to lift the growth trajectory, and ensure debt sustainability.”

Will Pruett, a portfolio manager at Fidelity Investments, says neither candidate is likely to make deep changes in the business environment. While some investors worry that Lula will overspend, Pruett points out the veteran politician is endorsed by former central banker Henrique Meirelles, and named Geraldo Alckmin as his running mate, which has instilled some confidence he won’t spend too much.

“This is the most powerful signal, in my view, that Lula will be pragmatic, not idealistic, in his management of the Brazilian economy,” Pruett said. “Bolsonaro, obviously, represents continuity and I think would continue to drive positive economic reform if re-elected.”

More stories like this are available on bloomberg.com

©2022 Bloomberg L.P.