Disney Reveals $25 Billion Return on Investment for Marvel, Star Wars Franchises Amid Proxy Fight

Disney has offered a glimpse at just how profitable its franchises are as its proxy battle with activist investors Trian Fund Management and Blackwells Capital heats up.

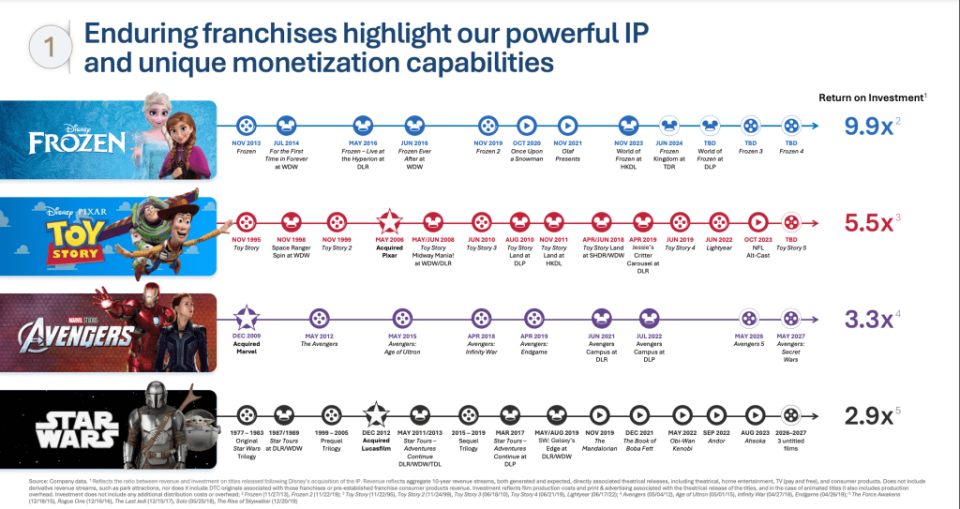

In a presentation released this week, the House of Mouse revealed that it has seen a 9.9 times return on investment on “Frozen,” a 5.5 times ROI on “Toy Story,” a 3.3 times ROI on Marvel and a 2.3 times ROI on “Star Wars.”

Per the filing, Disney suggests that Marvel and Star Wars have generated $11.6 billion and $13.2 billion, respectively, since their $4 billion acquisitions in 2009 and 2012.

The return on investment figures, which were pulled from the company’s data, reflect that ratio between revenue and investment on titles released following Disney’s acquisition of the IP.

The revenue reflects the aggregate 10-year revenue streams, both generated and expected, directly associated with theatrical releases, including theatrical, home entertainment, TV (pay and free), and consumer products. It does not include derivative revenue streams, such as park attractions, nor does it include DTC originals associated with those franchises or pre-established franchise consumer products revenue.

Investment reflects film production costs and print & advertising associated with the theatrical release of the titles, and in the case of animated titles it also includes production overhead. It does not include any additional distribution costs or overhead.

In a timeline highlighting major milestones, Disney cites the releases of Frozen Frozen 2, Once Upon a Snowman and Olaf Presents. It also includes the openings of For the First Time in Forever and Frozen Ever After at Walt Disney World, Frozen – Live at the Hyperion at Disneyland, World of Frozen at Hong Kong Disneyland and Frozen Kingdom at Tokyo Disneyland.

For Toy Story, the timeline includes the releases of its four Toy Story films, “Lightyear,” NFL Alt-Cast, and the openings of Space Ranger Spin at Walt Disney World, Toy Story Midway Mania at WDW and Disneyland, Jessie’s Critter Carousel at Disneyland, and Toy Story Land at WDW, Disneyland Paris, Hong Kong Disneyland and Shanghai Disneyland.

For Marvel, Disney cites all four “Avengers” movies and the openings of Avengers Campus at Disney’s California Adventure and Walt Disney Studios Park in Disneyland Paris.

For Star Wars, it notes the the openings of Star Tours, Star Tours: the Adventure Continues and Galaxy’s Edge, the releases of the original, prequel and sequel trilogies, “The Mandalorian,” “the Book of Boba Fett,” “Obi-Wan Kenobi,” “Andor,” “Ahsoka” and the upcoming release of three untitled films in 2026 and 2027

Trian Fund Management has nominated its co-founder Nelson Peltz and former Disney chief financial officer Jay Rasulo and Blackwells Capital has nominated former Warner Bros. and NBCUniversal executive Jessica Schell, Tribeca Film Festival co-founder Craig Hatkoff and TaskRabbit founder Leah Solivan to stand election at Disney’s annual shareholder meeting on April 3.

Shareholders of record as of the close of business on Feb. 5 will be entitled to vote at the meeting. Disney has approximately 1.8 billion outstanding shares, per its latest proxy filing.

Disney shares have climbed 20.4% in the past year, 23.6% year to date and 31% in the past six months.

The post Disney Reveals $25 Billion Return on Investment for Marvel, Star Wars Franchises Amid Proxy Fight appeared first on TheWrap.