ECB Seen Making Fewer Rate Cuts in Fight to Curb Inflation Risks

(Bloomberg) -- Economists are dialing back their expectations for how far the European Central Bank will lower interest rates after it starts cutting next week, according to a Bloomberg survey.

Most Read from Bloomberg

Wall Street Billionaires Are Rushing to Back Trump, Verdict Be Damned

Donald Trump Becomes First Former US President Guilty of Crimes

Fed’s Favored Inflation Gauge Cools, Spending Unexpectedly Drops

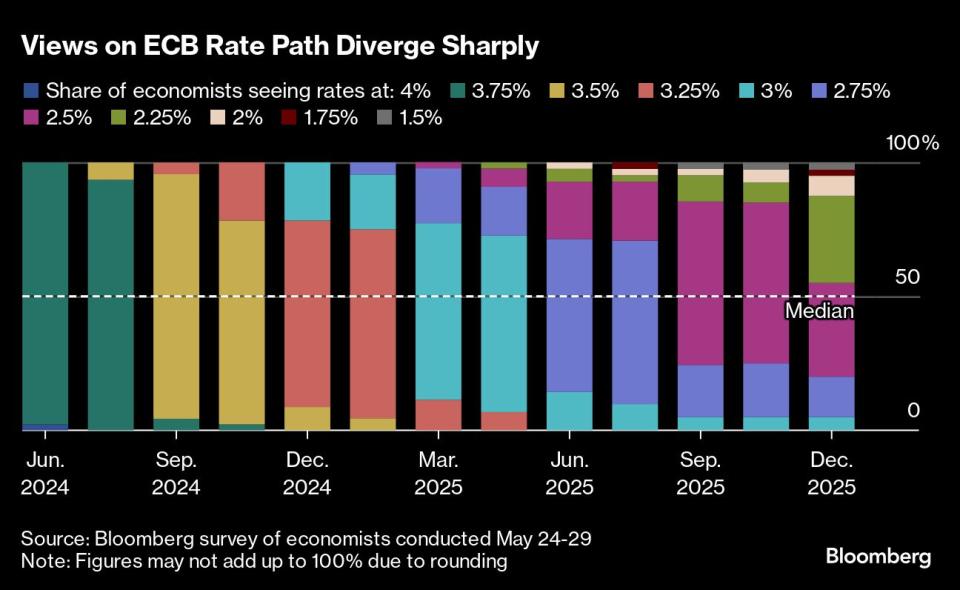

Respondents anticipate that the first of six quarter-point reductions in the deposit rate — currently at 4% — will be announced next week. That’s one step less than they predicted before the Governing Council last set policy in April.

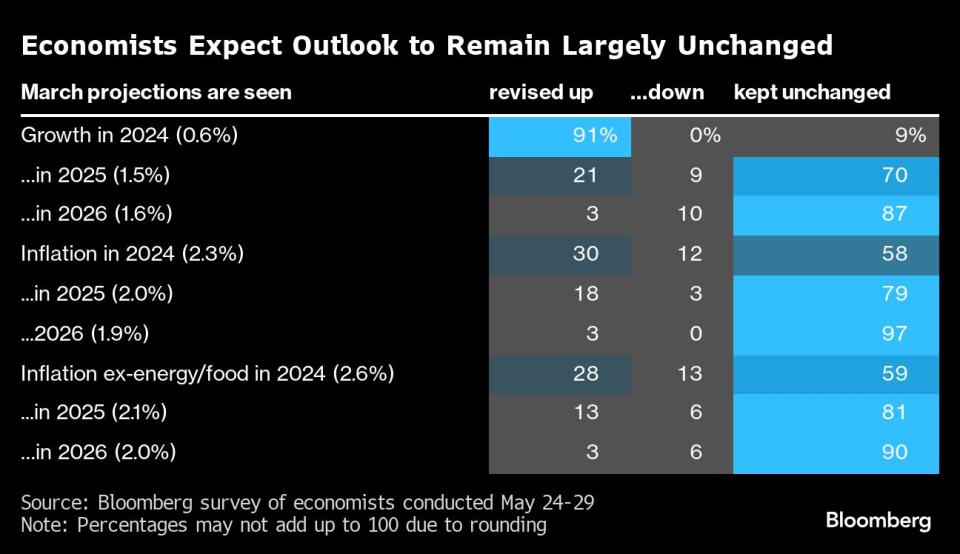

Since then, officials led by President Christine Lagarde have fortified expectations of a June cut that would see ECB move before the Federal Reserve and the Bank of England. But a surprisingly robust rebound in Europe’s economy, sticky wage pressures and upside risks to an already uncertain inflation outlook are fueling debate over subsequent steps.

Hawks like Executive Board member Isabel Schnabel and Bundesbank President Joachim Nagel want to wait until September before considering a second move, and economists reckon a hesitant Fed will limit the ECB’s room to maneuver.

Communicating the ECB’s intentions without locking in a specific scenario may — once again — be the biggest challenge for Lagarde.

“It will be hard to argue why they’re so confident this is the right time to cut while not providing any guidance for further cuts,” said Hugo Le Damany, an economist at AXA Investment Managers. He sees the ECB halting monetary easing next June after just five steps and with the deposit rate at 2.75%.

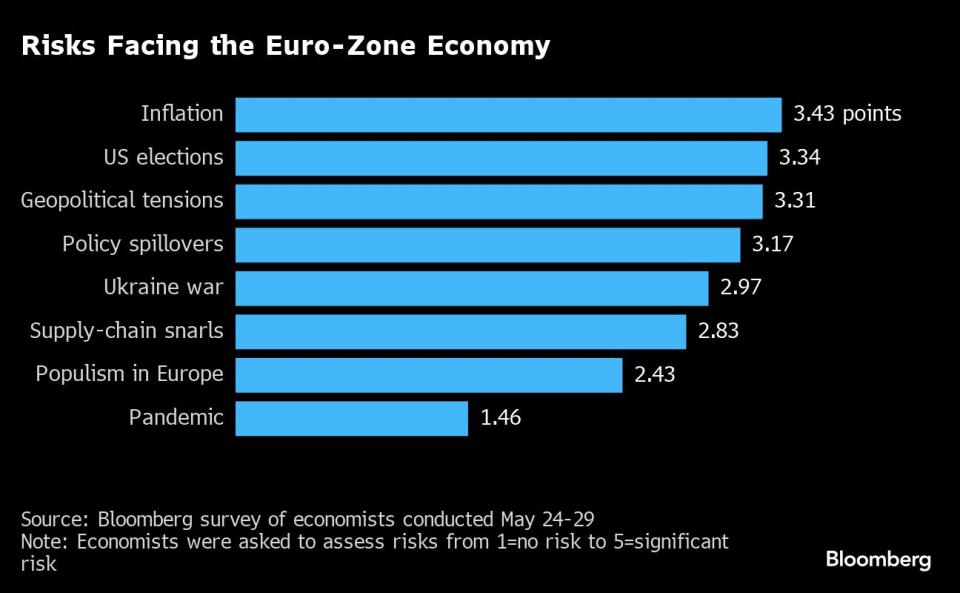

Respondents still deem inflation to be the biggest risk to the euro-zone economy, followed by the fallout from the US presidential election and geopolitical tensions.

Inflation probably quickened a touch in May after two months at 2.4%. Looking under the hood, wage growth unexpectedly failed to ease at the start of 2024, boosting pressure on services prices that continue to rise at a pace of almost 4%.

In such an environment, three-quarters of those surveyed don’t expect the ECB to offer any kind of guidance from one policy meeting to the next — especially because officials have vowed to pay particular attention to quarterly economic projections.

About 84% of economists say such a focus makes rate moves every three months more likely, though 92% say that doesn’t exclude action in between. Underscoring just that possibility, France’s Francois Villeroy de Galhau has warned against discounting another rate cut in July.

This time around, survey respondents don’t anticipate revisions to the ECB’s projections — aside from an increase in the 2024 outlook for economic expansion following a better-than-envisaged first quarter.

“We expect divergences among the doves and the hawks in the Council to emerge, with the former keen to remove all policy restrictions and the latter wanting to move cautiously until they feel confident that inflation is under control,” said Fabio Balboni, an economist at HSBC.

“That might make it hard for the ECB to provide any steer about the future path for rates beyond the present meeting, which could contribute to create uncertainty and volatility in the market,” he said.

Traders have pared bets recently on how many rate cuts they expect the ECB to deliver this year. They’re now fully pricing two moves and one-in-three odds of a third, compared with just one reduction with a 20% chance of a second for the US.

What Bloomberg Economics Says...

“Governing Council members have left little to surprise for June – even the hawks have been indicating a cut is most likely coming. President Lagarde is unlikely to explicitly signal another move in July, but she may give a gentle nod to more action in September. We forecast a cut of 25 bps in June, and, after a pause in July, more reductions of the same size in September, October and December.”

—David Powell, senior euro-area economist. Click here for full preview

While inflation across the Atlantic has cooled substantially, progress has slowed. That’s sparked talk that US borrowing costs may need to stay high for longer — and speculation about what that would mean for Europe.

Almost three-quarters of respondents say the euro zone has its own inflation dynamic and isn’t simply trailing the US. Still, only 6% say the ECB can fully decouple from the Fed in setting rates.

About 85% reckon the ECB will have to keep rates higher than it would otherwise if the Fed delays easing, to counter inflation pressures from a weaker euro. Most economists say the ECB can cut three times should the Fed stand pat.

Europe may, in fact, be showing similar trends to those holding back Fed loosening, according to Nomura’s Andrzej Szczepaniak.

“With stronger activity data, resilient demand, an encouraging labor market, stronger-than-expected wage growth, and still sticky services inflation, we believe the ECB will end up cutting only gradually in order to maintain some level of monetary restrictiveness,” he said. “Cutting too much too quickly will unnecessarily refuel the embers of inflation and undo the ECB’s hard-fought battle.”

--With assistance from James Hirai.

Most Read from Bloomberg Businessweek

Disney Is Banking On Sequels to Help Get Pixar Back on Track

US Malls Avoid Death Spiral With Help of Japanese Video Arcades

The Secret Ozempic Recipe Behind Novo’s Race to Boost Supplies

Why Dave & Buster’s Is Transforming Its Arcades Into Casinos

©2024 Bloomberg L.P.