Egypt Keeps Interest Rate at Record High Even as Inflation Slows

(Bloomberg) -- Egypt held interest rates at an all-time high, opting for caution as authorities await a further slowdown in inflation and build up investor confidence stoked by March’s steep devaluation of the pound.

Most Read from Bloomberg

Harvard Students Walk Out of Commencement Protesting Suspensions

China’s $538 Billion Deposit Exodus Supercharges Rally in Bonds

The central bank maintained the deposit rate at 27.25% and the lending rate at 28.25%, its Monetary Policy Committee said Thursday in a statement. The decision was correctly predicted by every economist in a Bloomberg survey except Goldman Sachs Group Inc., which expected the first cut since 2020.

Read More: A Mega International Bailout Is Getting Egypt Out of Trouble

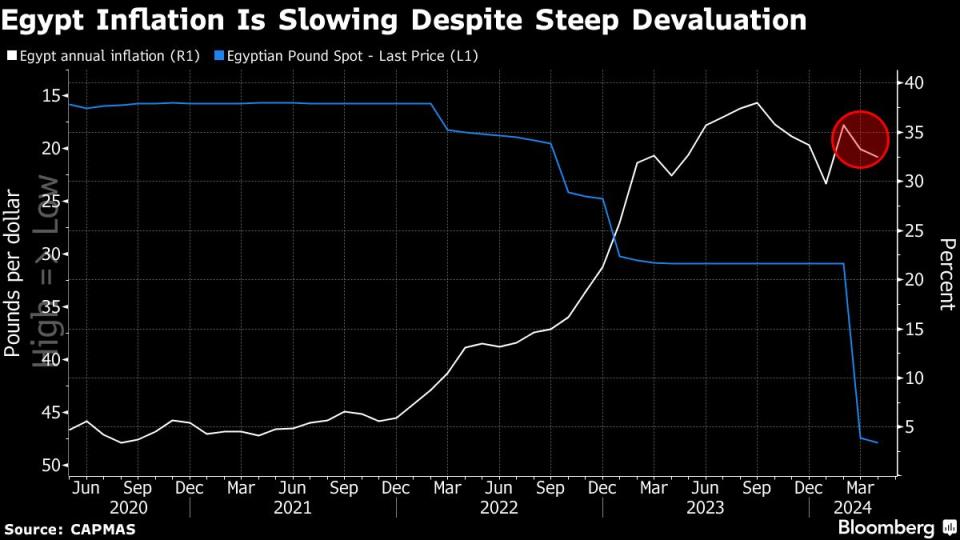

The hold marks a breather after a dramatic first quarter for Egypt’s troubled economy. In a matter of weeks, the Middle East’s most populous country let its currency plunge about 40% against the dollar and secured some $57 billion in foreign investment and aid pledges from the International Monetary Fund, the United Arab Emirates and others, finally giving it a clear path out of a grinding two-year crisis.

Egyptian consumer price growth slowed for a second month in April, defying expectations the pound’s fall would spark another inflationary surge. That suggests many items had already been priced more in line with the currency’s much lower black-market value prior to the March 6 devaluation. In unifying the rates, the regulator all but killed off the illicit trade.

The central bank said it expected a “significant decline” in inflation in the first half of 2025 “due to the combined impact of recent monetary policy tightening, unification of the foreign exchange market, and favorable base effects.”

Annual inflation is now running at 32.5% versus a record 38% last September, with the slowdown helped by a greater availability of foreign exchange and a government drive to limit the costs of some key items. But it still far exceeds the central bank’s target, and another widely-expected hike in fuel costs in the coming months may add more pressures.

“Recent exchange rate dynamics are supporting the tightening of monetary conditions, which will anchor inflation expectations, and dampen the inflation outlook going forward,” the MPC said in the statement.

Still-elevated consumer prices have also cut into Egypt’s inflation-adjusted interest rate, which was once one of the world’s highest and made the country’s local debt market an emerging-market favorite. A cut may have been a shock for portfolio investors, who’ve piled into Egypt’s domestic bonds at a record pace since the devaluation.

Thursday’s decision will likely be welcomed by the IMF, which has agreed an expanded $8 billion program with Egypt that recommends maintaining tight monetary policy. Egypt’s next review with the Washington-based lender is scheduled for June.

--With assistance from Joel Rinneby.

(Updates with quotes from central bank’s statement.)

Most Read from Bloomberg Businessweek

The Dodgers Mogul and the Indian Infrastructure Giant That Wasn’t

A Hidden Variable in the Presidential Race: Fears of ‘Trump Forever’

©2024 Bloomberg L.P.