Facebook (FB) Invests $5.7 Billion in India's Reliance Jio

Facebook FB recently announced an investment of $5.7 billion to buy a 10% stake in Jio Platforms Limited, the digital arm of a massive Indian conglomerate, Reliance Industries (RIL).

The deal, which valued Jio at $65.95 billion, makes Facebook the largest minority shareholder in the India-based telecom network.

Jio has emerged as the number one telecom operator in India, both in terms of traffic as well as revenues with stiff competition from Bharti Airtel.

From an RIL perspective, it could leverage on Facebook's technology expertise and talent pool as well as help in its ambitions to make Jio a digital company. This apart, the deal will aid the company to achieve zero debt status by March 2021.

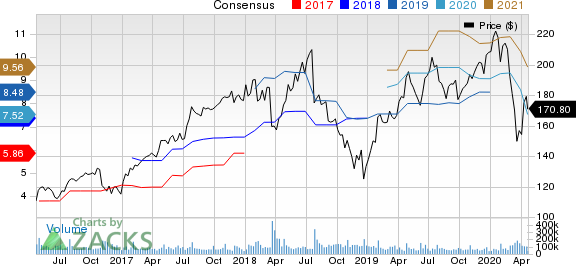

Facebook, Inc. Price and Consensus

Facebook, Inc. price-consensus-chart | Facebook, Inc. Quote

Facebook’s Increasing Interest in India

Facebook is accelerating its expansion in a country that is rapidly embracing online payment and e-commerce. Notably, in 2018, India had over 480 million Internet users and this figure was projected to grow to over 660 million users by 2023, according to market intelligence firm Statista report.

Facebook is moving forward with strategic investments at a fragile time in the global economy. While many businesses have been hurt by the fallout from the coronavirus pandemic, large technology companies are positioned to benefit as more people turn to their services while spending time indoors.

The daily average Internet consumption in India has increased by 13% since the country was put under lockdown on Mar 25.

In the recent quarters, Facebook has started to take interest in India-based startups. Last year, the firm made an investment in social commerce platform Meesho and earlier this year, it invested in edtech startup, Unacademy. Facebook has invested around $15 million each in these two startups.

The recent investment could be crucial for a number of reasons including access to Jio Platforms’ more than 380 million user base.

Facebook’s E-commerce Push

The deal is likely to bring together Facebook’s WhatsApp with JioMart, a joint venture between Jio and Reliance Retail (nation’s largest retail chain) to enable people to connect with businesses.

Through the recent deal, the tech giant looks to expand presence in its largest market in terms of subscriber base with more than 400 million WhatsApp users and more than 300 million people using the company’s core social network.

Per a Reliance report, JioMart and WhatsApp will enable 30 million neighborhood stores called kiranas to transact digitally in the near term.

WhatsApp Payment & Digital Currency Drive

Meanwhile, WhatsApp has been working with the government of India for more than two years to expand its payments service but the project is stuck in regulatory hurdles.

More recently, Facebook was at loggerheads with the local government over WhatsApp. The government demanded that WhatsApp change its encryption to trace messages back to their source, which the latter refused to do. At the same time, regulators have repeatedly stalled WhatsApp’s request to offer a payments service to users in the country.

Facebook is looking at India for its crypto-currency project called Libra and to roll out tools that let users make payments and buy and sell products over the social network’s messaging services much like Tencent’s TCEHY WeChat in China.

We believe that having Reliance Industries as a local partner could help the tech giant in navigating various regulatory issues, including those related to privacy and local storage.

Zacks Rank & Stocks to Consider

Facebook currently has a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader technology sector include Stamps.com Inc. STMP and HP Inc. HPQ, both carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Stamps.com and HP Inc. is currently projected to be 15% and 2.6%, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

HP Inc. (HPQ) : Free Stock Analysis Report

Tencent Holding Ltd. (TCEHY) : Free Stock Analysis Report

Facebook, Inc. (FB) : Free Stock Analysis Report

Stamps.com Inc. (STMP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research