Feds reject New Brunswick carbon tax plan, impose new one

The federal government will impose a carbon tax on greenhouse gas emissions in New Brunswick to fight climate change, rejecting a provincial plan as insufficient.

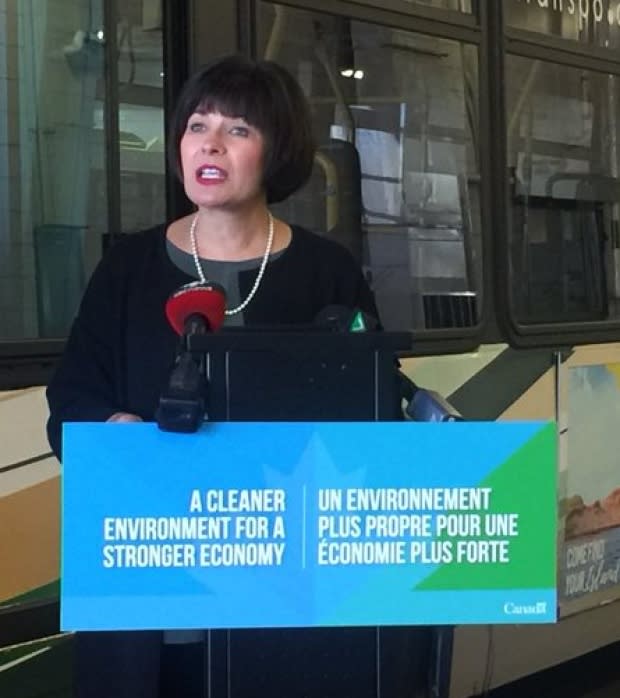

Ginette Petitpas Taylor, federal health minister and Liberal MP for Moncton-Riverview-Dieppe, said the plan presented by the provincial Liberals wouldn't sufficiently lead to emission reductions.

"I can tell you that it just did not meet the federal standards," Petitpas Taylor said Tuesday, though she wasn't able to offer specifics.

The provincial Liberals say they're reviewing the decision.

"It defies logic, the federal approach here," Andrew Harvey, the Liberal provincial environment minister, said in Fredericton. "We don't accept it at all."

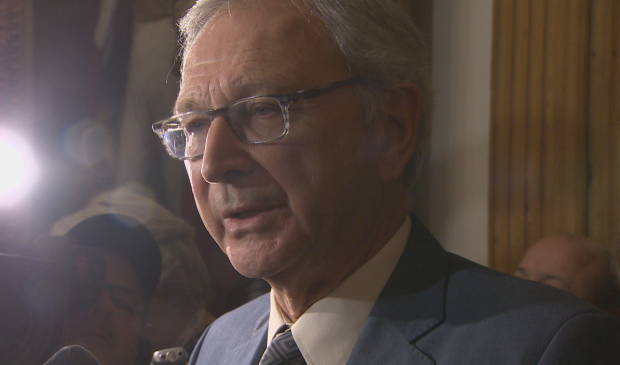

Progressive Conservative Leader Blaine Higgs had vowed to fight the carbon tax but had a different message Tuesday after learning the proposal could see some New Brunswickers get more in rebates than they pay for the tax.

"If New Brunswickers are getting more money than they're being taxed, then I'd have a hard time arguing about it," Higgs said.

Tax starts next year

The federal levy of $20 a tonne for large emitters begins Jan. 1 and would rise to $50 in 2022. A levy on fuel will be added in April.

The new tax system will impose the cost on fuel and production and distribution companies, which in turn will be passed along to consumers buying gasoline, natural gas and home heating.

The price of gas would increase 4.42 cents per litre in 2019, while natural gas used to heat a home would increase 3.91 cents per cubic metre, according to figures provided by the federal government.

But Petitpas Taylor said the federal government plans to return all of the revenue from the new tax system to the province.

Rebates

The plan will see energy users — both people and businesses — pay the higher taxes. But the rebates will only go to people, shifting the burden to businesses.

"For too long, Canadian families have had to shoulder the cost of pollution," she said. "No more. Our government is shifting the cost to those who actually pollute, which will directly benefit families."

Ninety per cent will be sent as rebates directly to individuals in the province when filing income taxes. The rebate amount depends on the size of a family.

In 2019, a single adult will receive $128. A second adult would receive $64, while a single parent would receive that amount for their first child. The payment would be $32 for each child.

Petitpas Taylor said the federal government estimates a family of four will pay an average of $207 and would get a $256 rebate in 2019.

The remaining 10 per cent would be directed to a fund to help pay for schools, hospitals, small and medium-sized businesses, municipalities, non-profit organizations and Indigenous communities to reduce their energy use.

Impact on businesses

Louis-Philippe Gauthier, director of provincial affairs in New Brunswick for the Canadian Federation of Independent Business, said the tax will directly impact small businesses.

"It's going to have an impact, that's for sure," he said, adding the rebate programs likely won't make up the difference.

He also wants to know whether there will be any impact on power rates.

Exemptions, rural credit

Exemptions from the carbon tax will be available to farmers and fishers for fuels.

Those living in rural areas of the province, defined as anywhere except the census metropolitan areas of Saint John and Moncton, will get an additional 10 per cent rebate. Petitpas Taylor said that's in recognition of the additional costs people in rural areas face for transportation.

The federally imposed tax comes two years after provinces and Ottawa agreed to a carbon pricing strategy. Any provinces that implemented a carbon tax deemed insufficient by Ottawa would have a price imposed by the federal government.

That federal plan is now being imposed on Ontario, New Brunswick, Saskatchewan and Manitoba.

New Brunswick submitted its carbon pricing plan for federal review in the midst of the provincial election. The plan proposed redirecting 2.3 cents of the existing 15.5-cent-per-litre gas tax revenue into a fund for climate change projects.

The Liberals said it would effectively create a carbon tax that doesn't force drivers to pay more.

Liberals expressed confidence

The share of the gas tax would rise each year until 2022, reaching 11.6 cents out of 15.5.

The Liberals expressed confidence the plan would be approved.

"I've said a number of times that we're confident when the moment comes to look at the New Brunswick plan, the federal government will see we're meeting their requirements," said former environment minister Serge Rousselle in January this year.

Doubts raised

But the lead author of a report by Canada's Ecofiscal Commission, a national think-tank formed in 2014 that supports carbon taxes, said the province's plan wouldn't measure up.

Dale Beugin told CBC in April that shifting gas tax revenue wouldn't be effective because it doesn't impose a higher cost on carbon dioxide emissions.

The report, called Clearing the Air, states carbon pricing creates a market incentive for people and companies to reduce emissions, from drivers buying more fuel-efficient cars to corporations investing in non-polluting energy.