FEMSA (FMX) Q3 Earnings Miss Estimates, Revenues Decline Y/Y

Fomento Economico Mexicano S.A.B. de C.V’s FMX, alias FEMSA, reported net majority earnings per ADS of 41 cents per share (Ps. 0.90 per FEMSA unit) in third-quarter 2020. The bottom line significantly missed the Zacks Consensus Estimate of 88 cents. Results were primarily marred by the impacts of the coronavirus outbreak across most of its segments.

Net consolidated income for the largest franchise bottler for The Coca-Cola Company KO was Ps. 4,691 million (US$212.2 million) compared with Ps. 9,613 million (US$495 million) reported in the year-ago quarter, reflecting a decline of 51.2%. The decline can primarily be attributed to lower income from operations, higher other non-operating expenses and a non-cash foreign exchange loss linked to FEMSA’s U.S. dollar-denominated cash position, which was hurt by the appreciation of the Mexican peso.

Total revenues were $5,721.4 million (Ps. 126,501 million), which declined 3% year over year in the local currency, owing to the coronavirus outbreak-led impacts across all operations. On an organic basis, total revenues declined 7.1%.

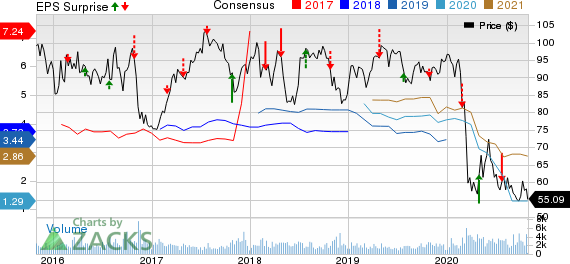

Fomento Economico Mexicano S.A.B. de C.V. Price, Consensus and EPS Surprise

Fomento Economico Mexicano S.A.B. de C.V. price-consensus-eps-surprise-chart | Fomento Economico Mexicano S.A.B. de C.V. Quote

However, the company notes that it is witnessing consistent recovery trends since the middle of the second quarter, which resulted in sequential improvement across most business segments.

Shares of the company declined 2% on Oct 28 on the soft third-quarter 2020 results. However, the Zacks Rank #5 (Strong Sell) company has declined 11.3% in the past three months against the industry’s growth of 1%.

FEMSA’s gross profit declined 0.7% to Ps. 48,536 million (US$2,195.2 million). However, consolidated gross margin expanded 90 basis points (bps) to 38.4%, owing to gross margin expansion of 120 bps at Coca-Cola FEMSA S.A.B. de C.V. KOF as well as 100 bps at FEMSA Comercio’s Health and 360 bps at Fuel Divisions, partially offset by a 50-bps contraction at FEMSA Comercio’s Proximity Division.

FEMSA’s operating income (income from operations) declined 10.1% to Ps. 11,355 million (US$513.6 million). On an organic basis, operating income was down 14.9%. Consolidated operating margin contracted 70 bps to 9%, driven by operating margin contraction at FEMSA Comercio’s Proximity Division, partly negated by margin expansion at Coca-Cola FEMSA and FEMSA Comercio’s Health and Fuel Divisions.

Segmental Discussion

FEMSA Comercio — Proximity Division: Total revenues for the segment declined 6.1% year over year to Ps. 45,478 million (US$2,056.9 million). The decline can primarily be attributed to a 9.1% fall in same-store sales on a 22% decline in store traffic due to reduced customer mobility. However, a 16.5% increase in average ticket, driven by the shift in sales mix toward home consumption categories and SKUs due to the pandemic, partly offset the decline.

In the reported quarter, the company’s OXXO store base increased by 75 stores, including temporary closures. Consequently, FEMSA Comercio’s Proximity division had 19,633 OXXO stores as of Sep 30, 2020.

Operating income declined 43.9% year over year, while operating margin contracted 370 bps to 5.4%, owing to operating deleverage. The increase in operating expenses mainly resulted from the ongoing initiatives to strengthen compensation structure for store personnel as well as higher investments in IT programs and infrastructure.

FEMSA Comercio — Health Division: The segment reported total revenues of Ps. 16,932 million (US$765.8 million), up 6.4% year over year. Revenues benefited from positive trends in Mexican operations and Colombian institutional sales as well as favorable currency translations. This was partially offset by strict mobility restrictions in the Ecuador and Chile operations. Further, same-store sales for drugstores increased 7.5%. On a currency-neutral basis, total revenues increased 3.8%, while same-store sales increased 5.4%. The segment had 3,249 points of sales across all regions, which included temporary closures due to the pandemic.

Operating income fell 42.7% year over year, while operating margin expanded 140 bps to 5.5%. The decline in operating income resulted from higher operating expenses, driven by the Health Division’s organic growth in Colombia and Mexico.

FEMSA Comercio — Fuel Division: Total revenues declined 30.6% to Ps. 8,568 million (US$387.5 million). Same-station sales declined 31.5%, driven by a 27.5% fall in the average volume, reflecting reduced mobility due to the pandemic, as well as a 5.6% decrease in the average price per liter. The company had 551 OXXO GAS service stations as of Sep 30, reflecting the addition of 10 stations in the last 12 months. Operating income declined 4.5%, with a 100-bps expansion in the operating margin to 3.7%, driven by tight expense control and increased expense efficiencies.

Coca-Cola FEMSA: Total revenues for the segment declined 4% year over year to Ps. 46,734 million (US$2,113.7 million). On a comparable basis, revenues remained flat. Coca-Cola FEMSA’s operating income improved 1.5%, while comparable operating income was up 7.1%. The segment’s operating margin expanded 80 bps to 15.2% on efficiencies in labor, maintenance and marketing expense across the operations as well as tax reclaims in Brazil.

Financial Position

FEMSA had cash and cash equivalents of Ps. 134,460 million (US$5,986.6 million) as of Sep 30, 2020. Long-term debt was Ps. 188,259 million (US$8,382 million). Moreover, the company incurred capital expenditure of Ps. 4,851 million (US$219.4 million) in the third quarter, reflecting lower investments in most businesses.

Want A Better-Ranked Beverage Stock? Check This

National Beverage Corp. FIZZ delivered an earnings surprise of 26.6%, on average, in the trailing four quarters. It sports a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by referendums and legislation, this industry is expected to blast from an already robust $17.7 billion in 2019 to a staggering $73.6 billion by 2027. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot stocks we're targeting >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

CocaCola Company The (KO) : Free Stock Analysis Report

Fomento Economico Mexicano S.A.B. de C.V. (FMX) : Free Stock Analysis Report

Coca Cola Femsa S.A.B. de C.V. (KOF) : Free Stock Analysis Report

National Beverage Corp. (FIZZ) : Free Stock Analysis Report

To read this article on Zacks.com click here.