German Inflation Edges Up Again, Highlighting ECB Challenge

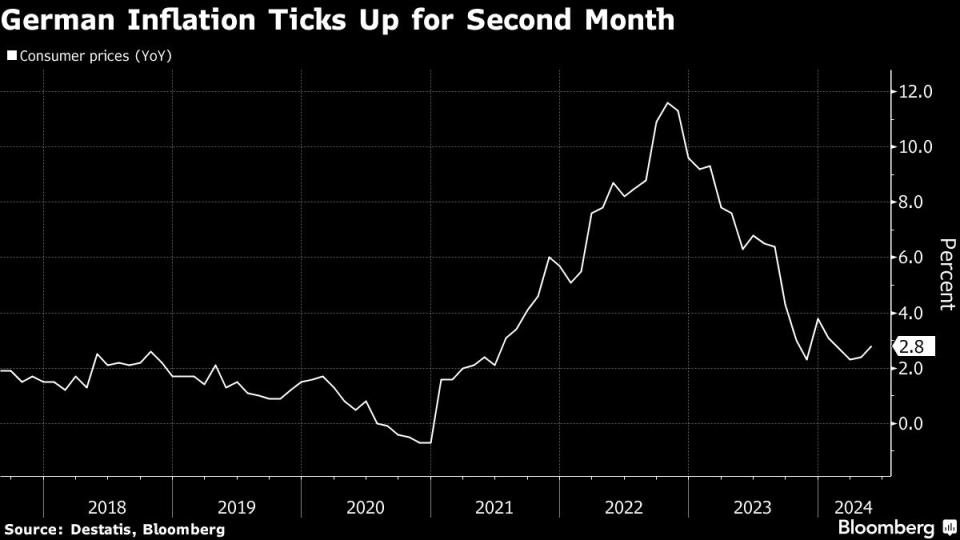

(Bloomberg) -- German inflation quickened for a second month – underscoring the task for the European Central Bank to achieve its 2% target as it prepares to lower interest rates next week.

Most Read from Bloomberg

World’s Largest Nuclear Plant Sits Idle While Energy Needs Soar

‘Not Gonna Be Pretty:’ Covid-Era Homebuyers Face Huge Rate Jump

Warning Signals Are Flashing for Homeowners in Texas and Florida

Insurers Sink as UnitedHealth Sees ‘Disturbance’ in Medicaid

American Air Fired Commercial Head After Sales Strategy Alienated Corporate Clients

Consumer prices rose 2.8% from a year ago in May, the statistics office said Wednesday. That’s up from 2.4% in April and above the 2.7% median estimate in a Bloomberg poll of economists.

The uptick was largely driven by base effects related to the introduction of a cheap public-transportation ticket, which pushed prices down 12 months ago.

German 10-year yields rose six basis points to 2.65% — the highest since November, while its two-year peer, which is more sensitive to changes in interest rates, hovered close to a six-month high at 3.09%.

The figures kick off a raft of inflation readings from the euro zone’s top economies, culminating in data for the 20-nation bloc as a whole on Friday. They’re are also expected to show a slight acceleration, to 2.5% from 2.4%. Core inflation — which excludes volatile items like food and energy, and has been slowing since July — is seen holding steady.

This week’s numbers are unlikely to deter ECB policymakers from reducing borrowing costs on June 6 for the first time since an unprecedented barrage of hikes was deployed to tame runaway price gains. But they may make officials more hesitant on subsequent moves.

Hawks like Executive Board member Isabel Schnabel and Bundesbank President Joachim Nagel recently warned against loosening monetary policy too rapidly and back-to-back steps in June and July. But France’s Francois Villeroy de Gahau said Monday that the ECB shouldn’t rule out such a scenario.

What Bloomberg Economics Says...

“German headline inflation took a notable upward step in May, primarily due to base effects for transport prices. However, the general trend is pointing down. We see inflation decreasing in the coming months and dropping below the 2% mark in the second half of the year. Core and services inflation will likely prove more sticky but also slightly decline in the course of the year.”

—Martin Ademmer, economist. Click here for full REACT

Investors have pared cut bets in the wake of unexpectedly strong first-quarter wage data and surveys signaling healthy private-sector economic activity. They now only fully price two quarter-point reductions in 2024. with a one-in-three chance of a third.

Germany saw particularly robust pay increases at the start of the year. Negotiated wages surged by 6.2% from a year earlier, compared with 4.7% for the entire euro area.

In a report last week, the Bundesbank said inflation probably gathered pace in May, predicting it will “fluctuate at a slightly higher level over the next few months.” Wage growth “has exceeded expectations of late, which could mean that the still high price pressure in services will persist for longer,” it said.

While Germany doesn’t publish a core-inflation reading in its preliminary release, regional data suggest an advance to 3.3% from 2.9% in May, according to Bloomberg Economics, whose Nowcast model predicts a headline number for June of 2.5%, taking the latest data into account.

--With assistance from Martin Ademmer (Economist), Joel Rinneby, Kristian Siedenburg and James Hirai.

(Updates with Bloomberg Economics.)

Most Read from Bloomberg Businessweek

Why Dave & Buster’s Is Transforming Its Arcades Into Casinos

The Secret Ozempic Recipe Behind Novo's Race to Boost Supplies

©2024 Bloomberg L.P.