Harris Teeter introduces new fees that have customers upset. What to know before you’re charged

A North Carolina-based grocery store chain recently announced a fee for cashback transactions — and customers aren’t happy about it.

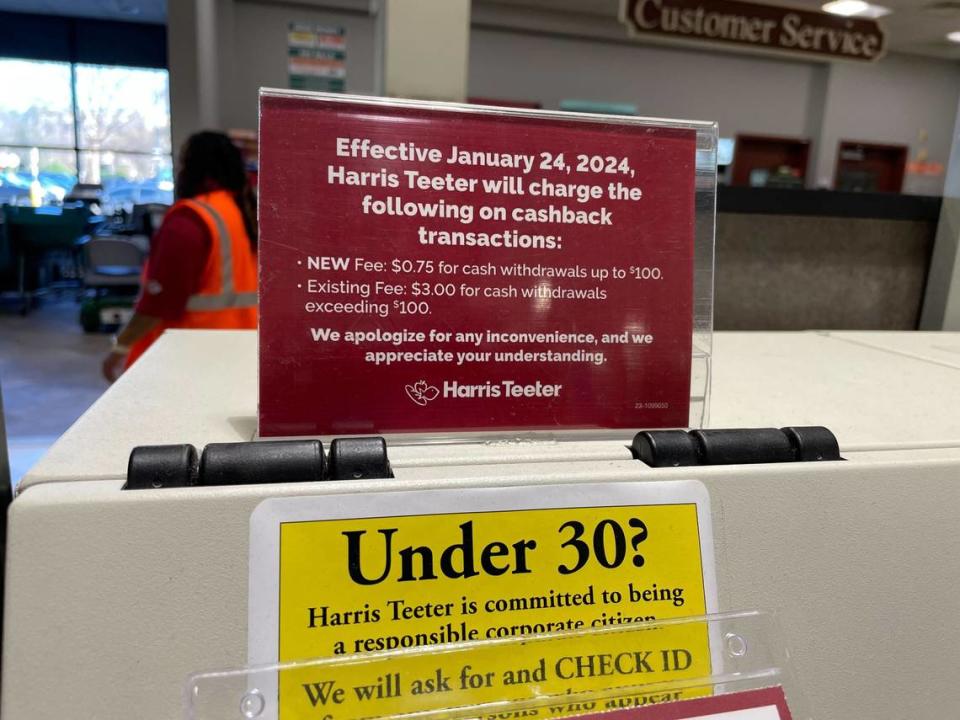

As of Jan. 24, Harris Teeter is charging a 75-cent fee for cash withdrawals up to $100, and a $3 fee for cash withdrawals exceeding $100, according to signs posted in stores around the state.

“We apologize for any inconvenience, and we appreciate your understanding,” the sign says.

Raleigh residents took the opportunity to sound off about the change the comments of a Reddit post last month alerting customers of the new rule, with many criticizing the store for being “too expensive.”

“HT is the only place I ever get cash, so this is going to suck,” one commenter said. “Just gives me a(nother) reason not to shop there anymore.”

“Honestly, how are Harris Teeters still around?” another wrote. “The ones near me don’t have a lot of people going to them.”

In an emailed statement to The Charlotte Observer, Harris Teeter said “customers have historically been charged a $3.00 fee for cash withdrawals exceeding $100” and “the expenses in managing cash transactions have increased over time.”

“To ensure we can continue to offer cashback services, the company introduced a $0.75 fee for cash withdrawals up to $100,” the statement said.

How to get reimbursed for ATM fees

While many places charge ATM fees, some banks offer reimbursements so customers can take out cash without having to pay for it.

Here are some banks that offer payments for out-of-network ATM fees, according to Bankrate:

Alliant Credit Union: Up to $20 per month in ATM fee reimbursements

Ally Bank: Up to $10 per month in ATM fee reimbursements

Axos Bank: Unlimited ATM fee reimbursements with a standard checking account

Charles Schwab Bank: Unlimited ATM fee rebates with a High Yield Investor Checking account

LendingClub: Unlimited ATM fee reimbursements with either a Rewards Checking ot Tailored Business Checking account

Navy Federal Credit Union: Up to $10 in ATM fee rebates per statement cycle for customers who set up direct deposit or make at least 20 transactions each month

TD Bank: Unlimited ATM fee reimbursements for customers with a minimum balance of $2,500

EverBank: Up to $15 per month in ATM fee rebates for customers with no minimum balance requirement, unlimited ATM reimbursements for accounts that require a minimum average daily balance of $5,000.

Other ways to avoid ATM fees

If your bank does not reimburse you for ATM fees, there are other ways you can avoid them.

If you are going to a store or restaurant, you should call ahead to see what forms of payment they take so you don’t have to use cash, according to NerdWallet.

You can also get around ATM fees by using a peer-to-peer payment app, such as Venmo or CashApp, to send money to a family member or friend.

If you have to use cash, you can try finding an ATM in your bank’s network by using an ATM locator on your bank’s mobile app or through a web search, NerdWallet says.

The cheapest ‘essential’ groceries are at this chain with NC locations, says national study

Charlotte has 6 of the top 10 grocery stores in the U.S., report says. Which is best?

Raleigh has 7 of the 10 best grocery chains in the US, says survey. Who’s on top?