Hunt Draws Election Battle Lines With Cuts to Spending and Taxes

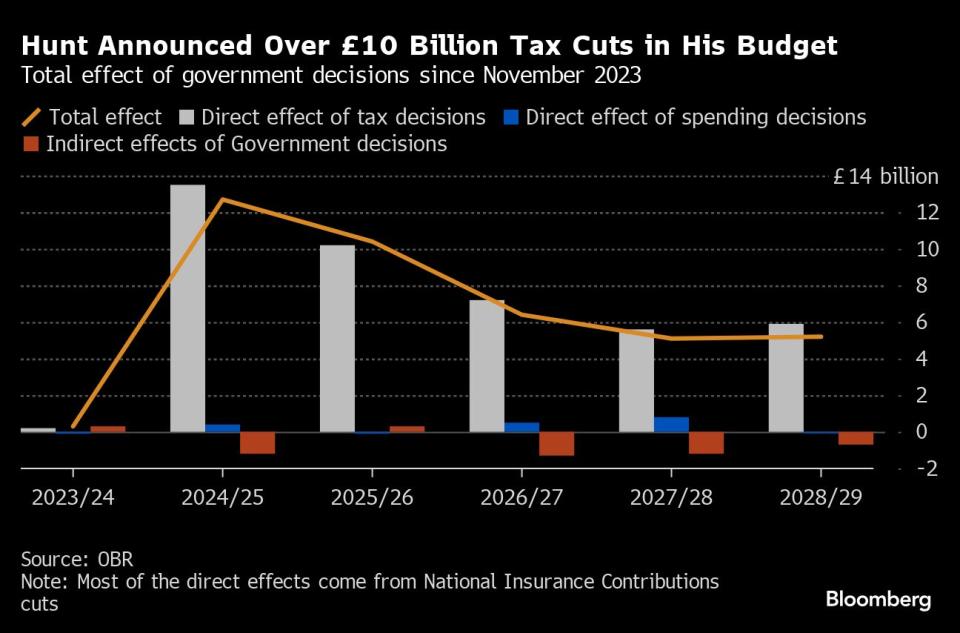

(Bloomberg) -- Chancellor of the Exchequer Jeremy Hunt handed millions of British workers a £10 billion ($12.7 billion) a year tax cut paid for by stealing Labour’s flagship policies and squeezing public services as he drew political battle lines for the upcoming election.

Most Read from Bloomberg

Chemical Linked to Cancer Found in Acne Creams Including Proactiv, Clearasil

How Trump’s Ex-Treasury Chief Landed 2024's Highest-Profile US Bank Deal

New York to Deploy National Guard to NYC Subways to Fight Crime

Stocks Climb on Bets Fed, ECB Closer to Rate Cuts: Markets Wrap

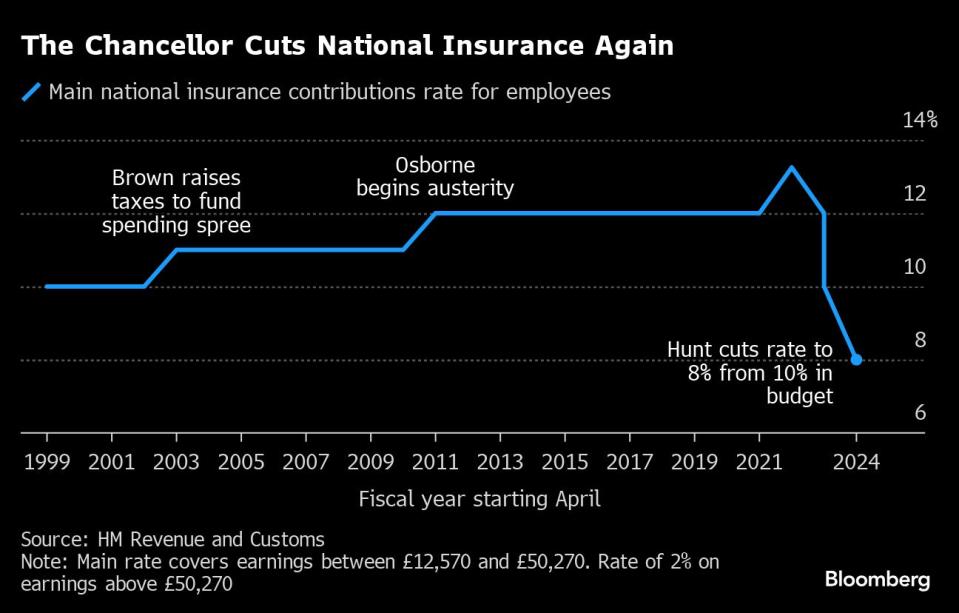

Hunt knocked another 2 percentage points off National Insurance Contributions, repeating November’s reduction, and signaled plans to phase out the payroll levy altogether as he unveiled a “budget for long term growth” with the economy in recession.

For Hunt and Prime Minister Rishi Sunak, whose ruling Conservative Party trails Labour by more than 20 points, the Treasury’s annual budget is potentially the last big policy event before the election that’s widely expected in the autumn.

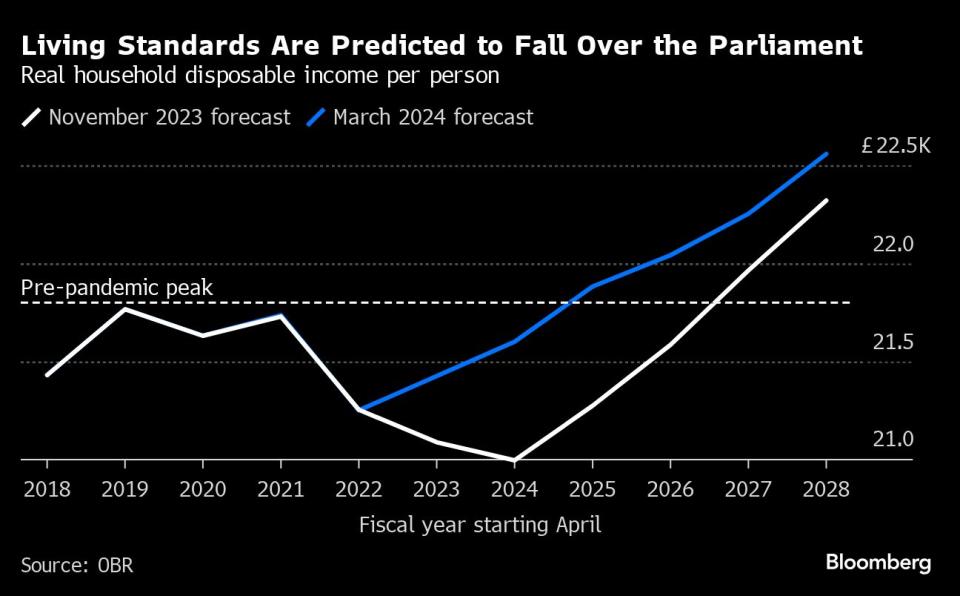

While Hunt pleased businesses with lower taxes, his own members of Parliament were underwhelmed by a package that only marginally improved household living standards that are still lower than they were before the pandemic.

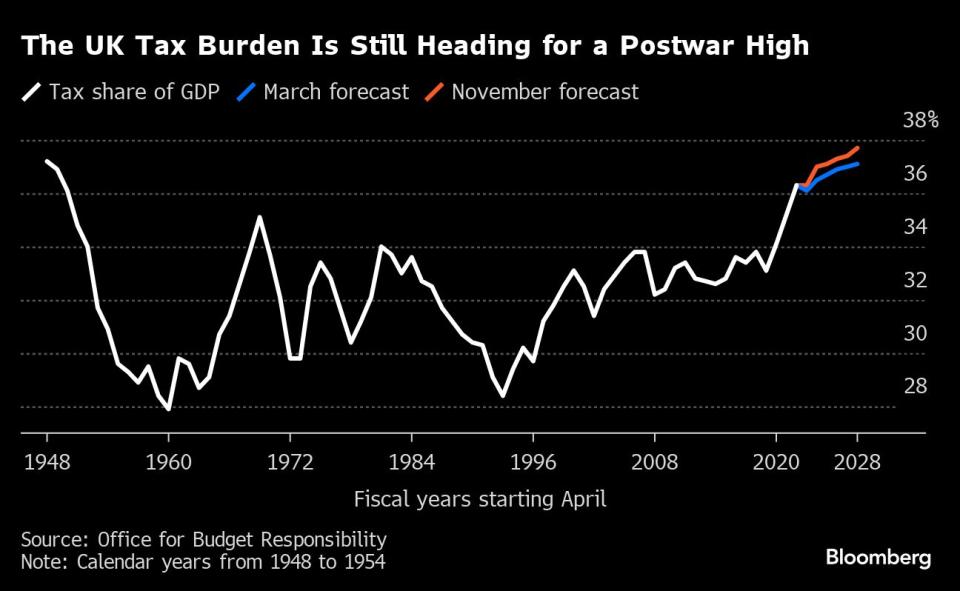

The budget, with forecasts for declining inflation and slowly improving growth, will constrain the next government with a historically low margin for further giveaways and anger across the political spectrum that the tax burden is near the highest since World War II.

“It will require difficult and unpopular tax and spending decisions and suggests a dose of caution that the story can play out quite as well as after the 1997 vote,” which was the last time the Labour Party swept aside the Conservatives in an election, said Kallum Pickering, an economist Berenberg Gossler & Co.

The £10 billion giveaway was part-funded by extending the windfall tax on North Sea oil and gas by a year and limiting an exemption for wealthy foreigners deemed “non-domiciled” in the UK — both measures that Labour had proposed.

Labour leader Keir Starmer described the non-dom tax grab as “a desperate move” after “years of resistance.” A spokesperson added that the party would have to “adapt” some of its spending plans because the government had “burned the house down when it comes to both the public finances and public services.”

For the Conservatives, the moves were used to accentuate what Hunt sees as a major difference with Labour.

“That is money the party opposite planned to use for spending increases,” Hunt said. “We use that revenue to help cut taxes on working families.”

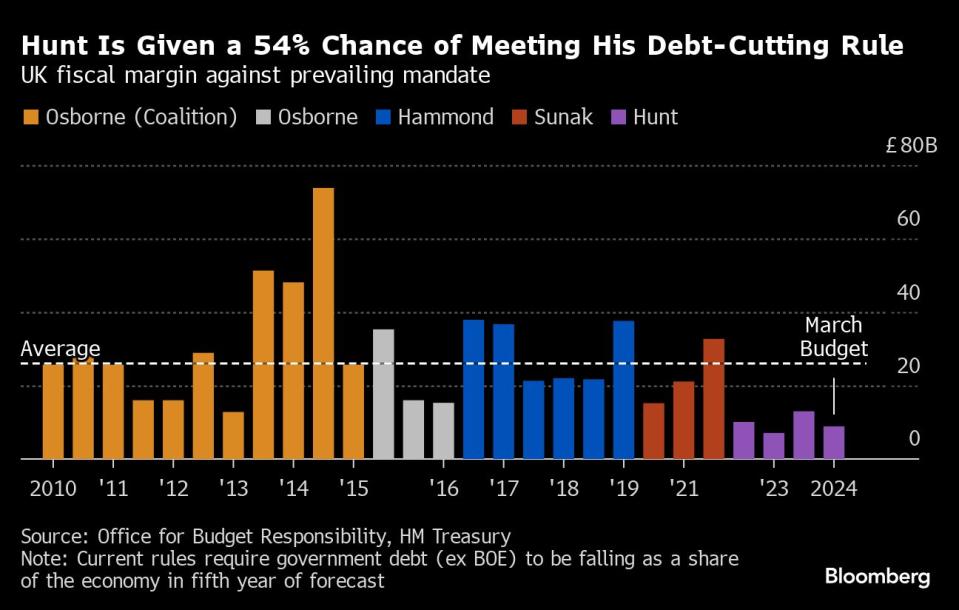

The chancellor also borrowed more, leaving just £8.9 billion of headroom against his fiscal rule, that debt should be falling as a share the economy within five years. That was the second-smallest sum on record, raising questions about Conservative claims to be the party of economic responsibility.

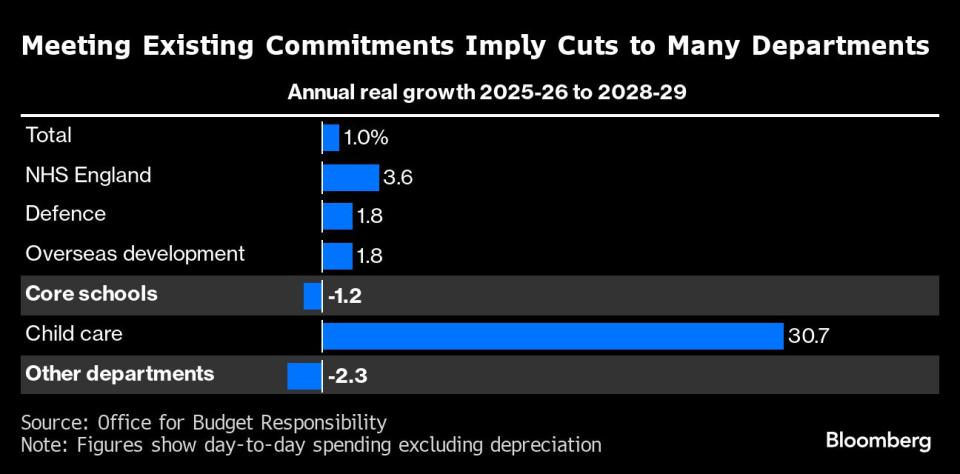

Should market interest rates on government debt rise just 0.3%, Hunt would breach his goal, the Office for Budget Responsibility said. The fiscal watchdog also warned that the government could only afford its plans by effectively squeezing Britain’s crumbling public services harder.

When departmental budgets were set in 2021, per person spending was expected to be £8,200 in 2026-27, the OBR said. The combination of higher inflation and higher migration has reduced that to £7,600.

Cuts that severe are a “fiscal fiction,” said Torsten Bell, chief executive officer of the Resolution Foundation. The Conservatives maintain they will deliver strong public services by improving efficiency and raising productivity.

While financial markets were untroubled, and government borrowing costs fell, economists warned that the assumptions underpinning the forecasts leave the Treasury at risk of having to make deep cuts or borrow significantly more than it plans on what’s already an extremely tight spending program.

“We are still in a multi-year period of sustained and substantial gilt issuance, said Ross Walker, head of global economics at NatWest Markets. “The market should not be complacent about its ability to absorb all of this supply without it weighing on yields or on the curve.”

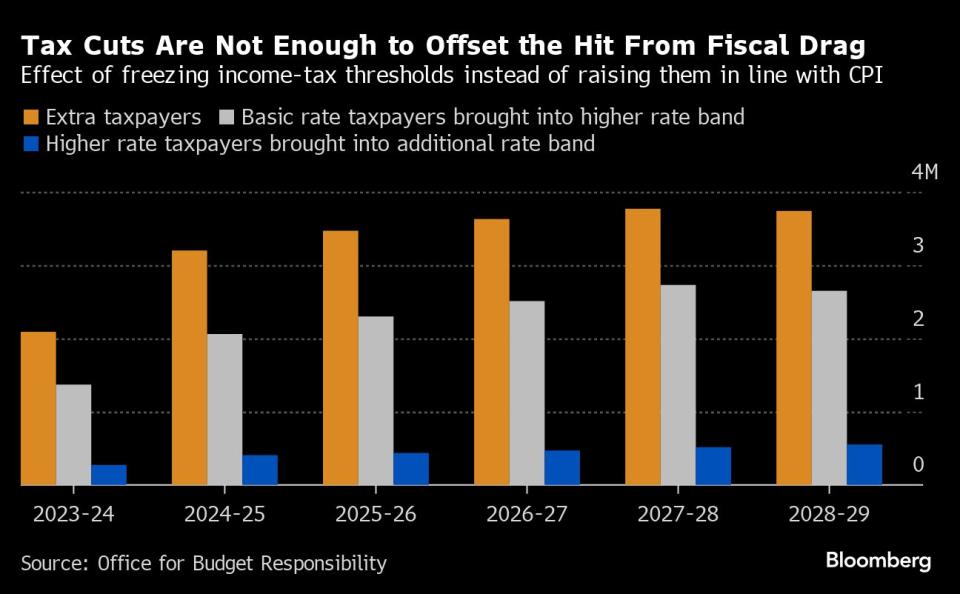

The budget also left the UK with its highest tax burden since 1948, at 37.1% of gross domestic product by the OBR’s estimate. A six-year freeze on tax thresholds more than cancels out the reductions announced in NICs.

Since November’s Autumn Statement, NICs has been reduced to 8% from 12% for employees and to 6% from 10% for the self-employed, a £20 billion package for 30 million workers. The aim is to generate incentives that will bring more people into work and boost growth. The average employee will be £900 better off this year, and the average self-employed worker £650 richer.

“For every £1 given back to workers by the NICs cuts, £1.30 will have been taken away due to threshold changes between 2021 and 2024, with this rising to £1.90 in 2027,” the Institute for Fiscal Studies said.

Hunt’s signature measure was chosen over a cut in income tax because it more clearly boosts the economy. Together with a reform of child benefit, the NICs reduction lifts the level of GDP by 0.2% in 2028-29, the Office for Budget Responsibility estimated.

The child benefit reform, also designed to bring people into work, will save almost half a million families an average of £1,300 next year and allow 170,000 to keep the full benefit. Including other pro-work policies since March last year, the change is likely to bring 200,000 more people into employment, the fiscal watchdog estimated.

“This budget is paving the way for the divide in the elections, and the theme it’s going to be that we’ve cut taxes,” Norman Lamont, the former chancellor, said on Times Radio. “The Labour Party say they’re going to increase spending. Where’s that money going to come from?”

Other giveaways in the budget included:

Cutting NICs rates for employees and the self-employed by 2 percentage points, costing £10.75 billion in the final year of the forecast.

A 5p cut to fuel duty and a freeze on inflation-linked increases, costing £840 million.

Raising the high-income child benefit charge to £60,000 from £50,000 and extending the taper across £20,000 of earnings, costing £660 million.

Freezing alcohol duty until February next year, costing £405 million.

Tax reliefs for creative industries totaling £370 million.

Increasing the VAT threshold for small businesses from £85,000 to £90,000

The chancellor was helped by a forecast from the OBR that showed inflation falling below 2% and interest rate cuts in the coming months, giving living standards a lift. Growth for this year improves to 0.8% from 0.7% in the OBR’s last forecast and to 1.9% from 1.4% in 2025 thanks to stronger household spending.

Better growth didn’t give the chancellor a windfall to spend, however. Instead, he had to find the money from a series of piecemeal tax rises, including:

Abolishing the non-dom regime that allows wealthy foreigners to reside in the UK for 15 years without paying taxes on overseas earnings. Instead, from April 2025, new arrivals will not be required to pay tax on foreign income for four years. The policy raises £2.7 billion.

Extending the Energy Profits Levy by a year to April 2029, raising £1.2 billion.

Introducing a new duty on vapes and tobacco to raise £615 million.

A suite of tax avoidance measures worth £1 billion.

£630m from taxes second homes and holiday lets.

£200 million from a carbon border tax

The OBR also estimated inflation will fall more sharply than it previously expected, delivering an increase to living standards, which will recover to their pre-pandemic peak next year. That reflects both the tax cuts and falling energy prices.

Even so, the economy will be smaller in real per-person terms at the time of the election than it was at the previous election in 2019, “the first time on record,” Resolution said.

“The outlook for the UK’s public finances remains extremely challenging,” said Dan Hanson, chief UK economist at Bloomberg Economics. “With spending cuts hard to implement and tax cuts hard to reverse, today’s policy announcements will further constrain the next government.”

--With assistance from Joe Mayes, Kitty Donaldson, Irina Anghel and Andrew Atkinson.

Most Read from Bloomberg Businessweek

How Apple Sank About $1 Billion a Year Into a Car It Never Built

The Battle to Unseat the Aeron, the World’s Most Coveted Office Chair

Humanoid Robots at Amazon Provide Glimpse of an Automated Workplace

Immigration Rage Drowns Out the US Labor Market’s Need for Workers

How Microsoft’s Bing Helps Maintain Beijing’s Great Firewall

©2024 Bloomberg L.P.