Imagine Owning Guangshen Railway (HKG:525) While The Price Tanked 65%

The truth is that if you invest for long enough, you're going to end up with some losing stocks. Long term Guangshen Railway Company Limited (HKG:525) shareholders know that all too well, since the share price is down considerably over three years. Regrettably, they have had to cope with a 65% drop in the share price over that period. And more recent buyers are having a tough time too, with a drop of 45% in the last year. Furthermore, it's down 34% in about a quarter. That's not much fun for holders. Of course, this share price action may well have been influenced by the 15% decline in the broader market, throughout the period.

Check out our latest analysis for Guangshen Railway

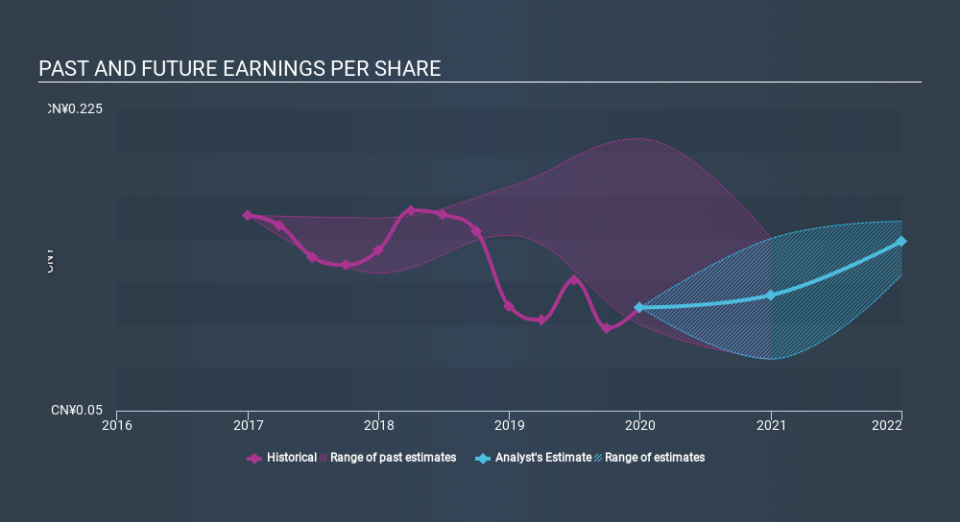

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the three years that the share price fell, Guangshen Railway's earnings per share (EPS) dropped by 12% each year. This reduction in EPS is slower than the 30% annual reduction in the share price. So it's likely that the EPS decline has disappointed the market, leaving investors hesitant to buy.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. It might be well worthwhile taking a look at our free report on Guangshen Railway's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Guangshen Railway, it has a TSR of -62% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

While the broader market lost about 18% in the twelve months, Guangshen Railway shareholders did even worse, losing 44% (even including dividends) . However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 13% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Guangshen Railway is showing 2 warning signs in our investment analysis , you should know about...

But note: Guangshen Railway may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.