Insider Buying: Brett Paton Just Spent AU$6.9m On PointsBet Holdings Limited (ASX:PBH) Shares

Those following along with PointsBet Holdings Limited (ASX:PBH) will no doubt be intrigued by the recent purchase of shares by insider Brett Paton, who spent a stonking AU$6.9m on stock at an average price of AU$6.50. There's no denying a buy of that magnitude suggests conviction in a brighter future, although we do note that proportionally it only increased their holding by 9.2%.

See our latest analysis for PointsBet Holdings

The Last 12 Months Of Insider Transactions At PointsBet Holdings

Notably, that recent purchase by Brett Paton is the biggest insider purchase of PointsBet Holdings shares that we've seen in the last year. We do like to see buying, but this purchase was made at well below the current price of AU$11.01. Because the shares were purchased at a lower price, this particular buy doesn't tell us much about how insiders feel about the current share price.

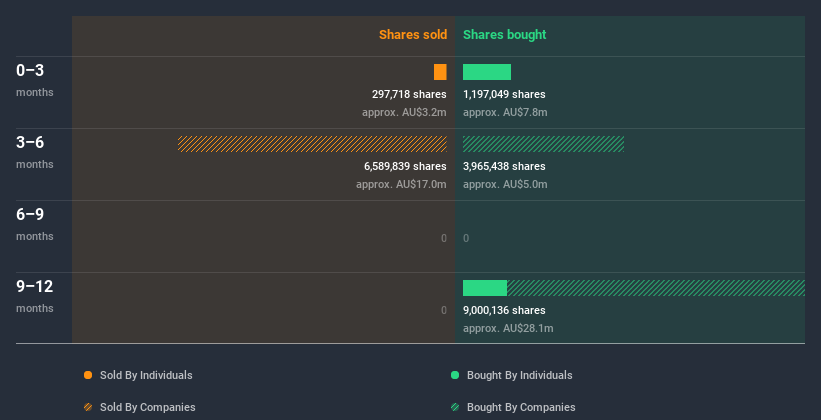

Over the last year, we can see that insiders have bought 2.29m shares worth AU$11m. On the other hand they divested 297.72k shares, for AU$3.4m. In total, PointsBet Holdings insiders bought more than they sold over the last year. Their average price was about AU$4.93. To my mind it is good that insiders have invested their own money in the company. But we must note that the investments were made at well below today's share price. You can see the insider transactions (by companies and individuals) over the last year depicted in the chart below. By clicking on the graph below, you can see the precise details of each insider transaction!

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of PointsBet Holdings

Many investors like to check how much of a company is owned by insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. PointsBet Holdings insiders own about AU$555m worth of shares (which is 26% of the company). This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About PointsBet Holdings Insiders?

The recent insider purchases are heartening. And the longer term insider transactions also give us confidence. But on the other hand, the company made a loss during the last year, which makes us a little cautious. When combined with notable insider ownership, these factors suggest PointsBet Holdings insiders are well aligned, and quite possibly think the share price is too low. Nice! In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing PointsBet Holdings. Every company has risks, and we've spotted 3 warning signs for PointsBet Holdings (of which 1 shouldn't be ignored!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.