Exaggerated success: Province's pension managers profit from 'joke' target, analysts say

A key measurement used to calculate bonuses for executives of the firm managing New Brunswick government employee pension funds produces exaggerated rewards and needs to be reviewed, say two pension analysts asked to look at the issue by CBC News.

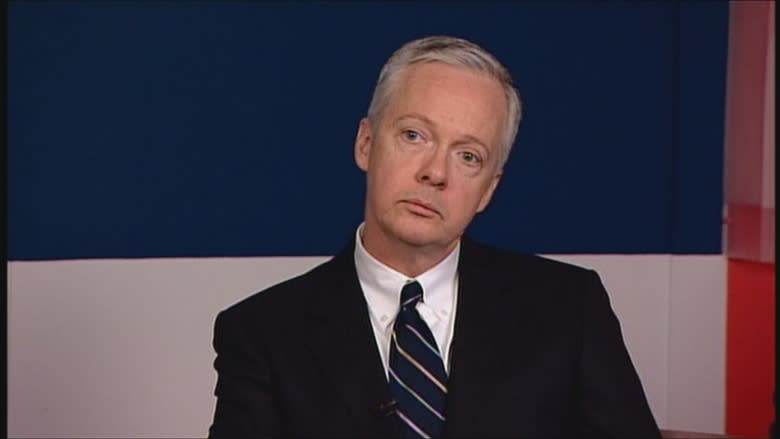

"That benchmark is a joke and you can quote me on that," said Leo Kolivakis about the yardstick used by New Brunswick's Vestcor Investment Management Corporation to judge its managers' achievements handling what are called "absolute return" funds.

The absolute return investments have been generating modest gains for pensioners served by Vestcor but producing major bonuses for its pension executives, including an estimated $600,000 in bonus pay in 2016.

That's primarily because returns managers have to beat to win extra pay from its absolute return portfolio are set at less than one per cent.

"If I was sitting on their board, I would be asking why and I think you have every right to ask why are you compensating people based on (that) benchmark," said Kolivakis, who writes about Canadian pension funds in his publication, Pension Pulse.

Big bonuses

Vestcor, formerly the New Brunswick Investment Management Corporation, looks after more than $15 billion in retirement and other funds for public bodies in New Brunswick, including pension money for teachers, judges, civil servants, hospital workers, University of New Brunswick staff, NB Power employees and others.

Incentive pay has become increasingly important to Vestcor executives. During 2016 its top five managers, led by president John Sinclair, received a combined $1.7 million in bonuses, significantly more than the $1.2 million they were paid in base salary.

Most of those bonus payments are rewards for Vestcor management beating industry average returns, or benchmarks, on investments over a rolling four-year period. And although many of the benchmarks are tough to beat, that has not been the case for its "absolute return" investments.

In the latest four-year period documented in Vestcor's current annual report, the benchmark return managers needed to exceed on absolute return funds to generate bonus pay was just 0.77 per cent — less than the rate of inflation

Managers generated a modest annualized return on the funds of 4.78 per cent, but the difference between the two is so great it flooded management's bonus pool with an estimated $600,000 in rewards in 2016 alone.

Poorly set target

Kolivakis said beating a benchmark by that kind of a margin is normally the sign of a poorly set target, not exceptional investing.

"If I keep seeing investment managers trouncing their benchmarks, if you trounce your benchmarks in any investment activity, there's an issue," said Kolivakis.

Absolute fund investing has become increasingly favoured by Vestcor managers, who nearly quadrupled the amount of money dedicated to it over four years from $353 million to $1.1 billion.

Vestcor's board of directors did not respond to a request for information on why the organization sets the benchmark for management to beat on absolute return investments, and generate bonus pay, below the rate of inflation.

'I could do that'

But Thomas Schneeweis, a professor emeritus of finance at the Isenberg School of Management in Amherst Massachusetts, said the benchmark is inappropriately low and beating it the way Vestcor managers have been suggests it's being over rewarded.

"You don't impress me when you made four per cent. I expect that (from absolute return funds). I could do that," said Schneeweis.

"All markets are amazingly efficient and there is almost no evidence of outperformance over time – if properly measured."

According to Schneeweis, the objective of absolute fund investigating is to generate constant or absolute returns, whether markets rise or fall.

That is done by pairing up investments that tend to move in opposite directions — like betting on both heads and tails during a coin flip — but with enough of an edge built in either way any outcome will still generate a positive return.

But the exercise is not without risk, according to Schneeweis, and that is not reflected in the benchmark Vestcor is letting its managers beat.

"Your benchmark should reflect the risk of your particular portfolio," he said.

"The truth is very few people really understand the alternative investment industry."

There is a general expectation — even at Vestcor — that a properly executed absolute return strategy will generate a return in the area of four per cent per year, and both Schneeweis and Kolivakis say that is the benchmark Vestcor managers should be beating to win their bonus pay.

"I agree there should be tough questions asked about the benchmark returns of absolute return strategies not reflecting the risks they're taking," said Kolivakis.

Schneeweis agrees.

"They (management) have a tendency to say why they are great and it's up to the board of directors to get another point of view on why in certain conditions they aren't so great and where there may be a little puffery," he said.