Israel Selling First Public Dollar Bonds Since Start of War

(Bloomberg) -- Israel is set to sell its first international bond in the public market since the war with Hamas erupted in October.

Most Read from Bloomberg

Egypt’s Devaluation and Record Rate Hike Put IMF Deal in Reach

Chemical Linked to Cancer Found in Acne Creams Including Proactiv, Clearasil

The government is offering a dollar bond with tranches of five, 10 and 30 years, according to people familiar with the matter. The transaction has attracted around $25 billion of bids, and final terms, including the yield and size, may be announced later on Tuesday, they said.

Israel has issued several privately-placed bonds in currencies such as the dollar, euros and yen since the conflict began. But it hasn’t entered the public market.

The deal size will probably be around $4 billion to $6 billion, according to Morgan Stanley, which would make it one of Israel’s biggest bonds ever.

It is offering the shortest notes with spread guidance of around 160 basis points over US Treasuries, according to the people, which would equate to a yield of roughly 5.8%. The guidance is around 175 basis points for the 10-year tranche and 205 basis points for the 30-year debt.

The war has roiled the Israeli economy, though much of the shock from the initial few weeks has worn off. The shekel has rallied hard in the past three months and is far stronger than when the conflict started on Oct. 7.

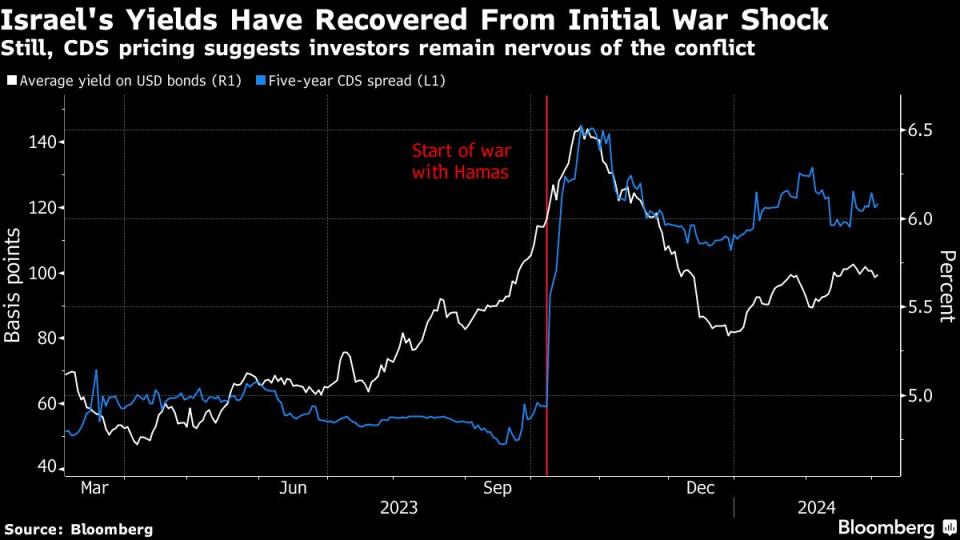

The government’s average dollar yields have fallen to around 5.7% from a peak of 6.5%, suggesting investors are more confident about the economy’s resilience. Nonetheless, Israel’s credit-default swaps — or the cost of protecting against a default — remain elevated.

Israel will have to sell a near-record amount of bonds this year to fund its fight against Hamas, Bloomberg has reported. Most of that issuance will take place in the shekel market, but foreign borrowing is still expected to exceed $10 billion.

The government has “significant funding needs” that may be around $12 billion this year in international markets, Pascal Bode, a London-based strategist with Morgan Stanley, said in a note to clients on Tuesday.

Moody’s Investors Service cut the government’s rating by one level to A2 in February, marking the country’s first-ever downgrade. Yet that still leaves it well within investment grade territory and on a par with Iceland and Chile. Moreover, it’s rated two levels higher, at AA-, by S&P Ratings.

Yali Rothenberg, the general accountant at Israel’s Finance Ministry and often called the “country’s CFO,” has recently traveled to New York and London to meet fixed income investors.

Bank of America Merrill Lynch, BNP Paribas SA, Deutsche Bank AG and Goldman Sachs Group Inc. are arranging Israel’s deal.

Read More: Gaza Cease-Fire Talks Bogged Down as Hunger, Pressure Grow

The war began when Hamas, an Iran-backed group designated a terrorist organization by the US, rampaged through southern Israeli communities, killing around 1,200 people and capturing 250. More than 30,000 have been killed in Gaza by Israel’s retaliatory air and ground assault, according to the Hamas-run health ministry.

--With assistance from Philip Sanders.

(Adds details on demand in second paragraph. An earlier version corrected the date of Moody’s downgrade to February.)

Most Read from Bloomberg Businessweek

Humanoid Robots at Amazon Provide Glimpse of an Automated Workplace

Immigration Rage Drowns Out the US Labor Market’s Need for Workers

Nvidia Is the Latest Shiny Object to Spur Stocks to New Heights

©2024 Bloomberg L.P.