Mexico Economic Growth Tops Forecasts on US Trade, Spending

(Bloomberg) -- Mexico’s economy accelerated more than forecast in the third quarter, buoyed by flourishing trade with the US and solid spending by Mexican consumers.

Most Read from Bloomberg

Real Estate Industry Takes Fresh Hit With Verdict on Commissions

Israel Latest: US Says the First of Its Citizens Depart Gaza

Israel Latest: Blinken Returning to Israel; Refugee Camp Hit

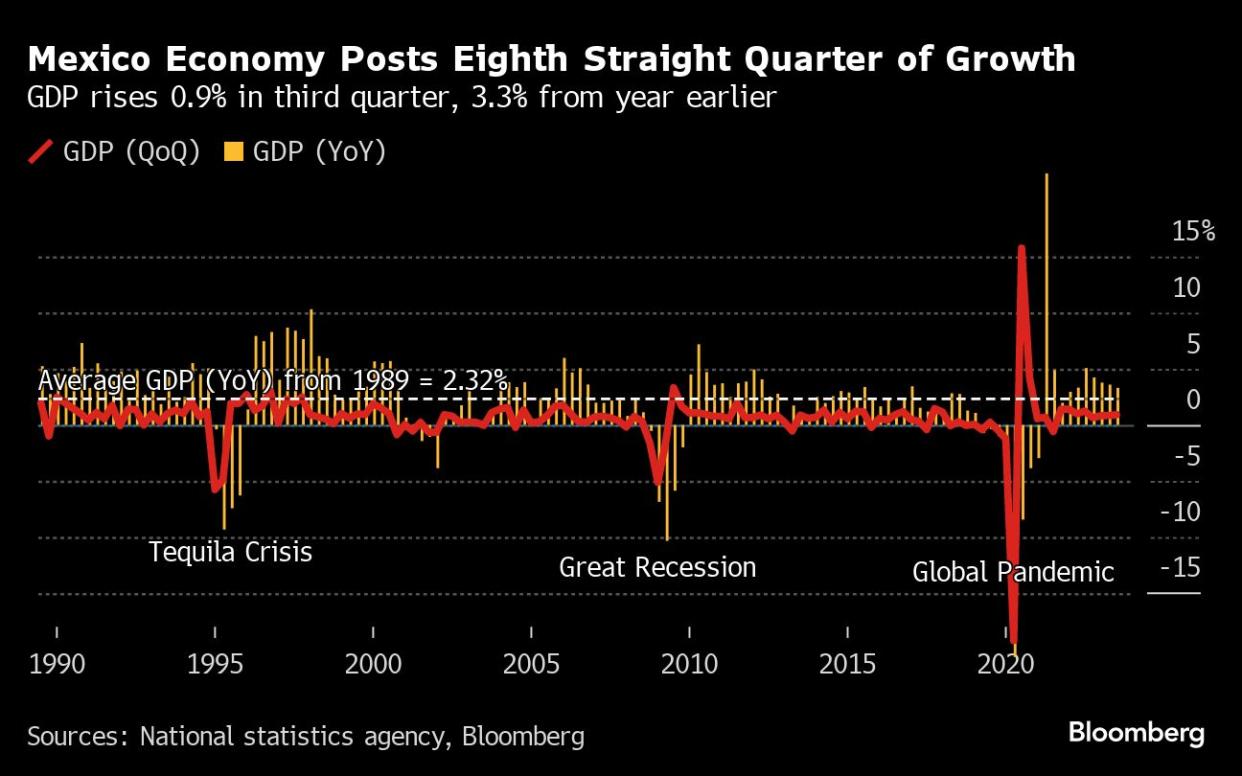

Gross domestic product rose 0.9% in the third quarter from the previous three months, compared with the 0.8% median estimate of analysts surveyed by Bloomberg, according to preliminary data released by Mexico’s national statistics institute Tuesday. From the same period a year ago, the economy grew 3.3%, also slightly faster than economists’ 3.2% estimate.

“It’s confirming the resilience of the economy and the materialization of an upside surprise following the same for the US,” said Ernesto Revilla, chief Latin America economist at Citigroup Inc. “It’s also due to domestic demand, because we are seeing a very strong labor market in Mexico, strong remittances and a probable behavior change on the part of the consumer.”

The agriculture sector grew 3.2% between July and September in comparison to the prior three-month period, while the manufacturing sector expanded 1.4% and the services sector gained 0.6%, according to the official data.

Business growth has contributed to a more robust post-pandemic economy, as manufacturers have invested in industrial space especially in northern and central parts of the country to be close to surging demand from US buyers. The US economy grew at the fastest pace in nearly two years in the third quarter on a burst of consumer spending, which will be tested in coming months.

At the same time, investor sentiment in Mexico has improved toward the end of the administration of President Andres Manuel Lopez Obrador, who despite some blows to business, has welcomed additional jobs.

What Bloomberg Economics Says

“The data will support the strong peso. There’s less economic slack than the central bank estimated and we think a smaller chance that policymakers cut interest rates any time soon. A downturn in the US is still the main risk to Mexico growth ahead.”

— Felipe Hernandez, Latin America economist

— Click here for the full report

Read More: One Blow After Another Roils Markets During AMLO’s Final Year

Growth in Latin America’s second-largest economy is also due in part to extra spending on the part of the government, which has expanded programs and rushed to finish major infrastructure projects before Lopez Obrador’s term ends in late 2024. He is not eligible to run for reelection and despite following a strategy of austerity for much of his government, has proposed a 2024 budget with a 1.2% primary deficit, the largest of his six-year term.

“The transfers will continue, but they are already pressuring public finances,” said Gabriela Siller, director of economic analysis at Banco Base. “The next administration is not going to have the fiscal space for these kinds of infrastructure projects.”

Consumers’ credit card spending has increased, in a sign Mexicans are confident about the economic outlook and that extra aid will flow in from the government, plus from Mexicans working abroad who send money home to their families. This year, remittances are forecast to surpass $63 billion, according to a recent Mexican government estimate.

Read More: Mexico Plans Biggest Budget Gap in 36 Years as AMLO Ends Term

Hurricane Otis

The arrival of Hurricane Otis, a category-5 storm that caught the Pacific Coast city of Acapulco off guard last week, will require additional spending, since residential neighborhoods and the hotel zones that are the motor of the city were destroyed. AMLO, as the president is known, has come under sharp criticism for not warning the city to evacuate on time.

The cost of rebuilding is currently seen at around $15 billion, according to an early estimate. Rodrigo Mariscal, a Finance Ministry official, said Monday that it was too early to say what the impact would be on Mexico’s growth, but that it could likely be “contained.”

Read More: AMLO Defends Acapulco Recovery Effort Amid Criticism of Response

Banco de Mexico is currently holding rates at 11.25%, with one board member saying that it’s possible cuts will only start well into 2024. That could eventually be a drag on the economy.

“I don’t believe the general story that the economy is firing on all cylinders,” said Andres Abadia, chief Latin America economist at Pantheon Macroeconomics. “There are other sectors where the rate of growth is slowing because of the the high interest rates.”

The latest Citibanamex survey in October estimates 2023 GDP growth of 3.3% and 2% in 2024. The Finance Ministry has said that it sees growth of 2.5% to 3.5% next year, according to the draft budget submitted to Mexico’s Congress.

--With assistance from Rafael Gayol.

(Updates with sectoral results in fourth paragraph.)

Most Read from Bloomberg Businessweek

Web Summit Israel Mess Is No Surprise to Those Who Know Its Founder

America’s Culture Wars Have Liberal Parents Opting for Home-Schooling

©2023 Bloomberg L.P.