Mexico’s Inflation Eases After Banxico Hikes Its Key Interest Rate to a Record High

(Bloomberg) -- A key Mexican inflation metric accelerated beyond expectations in early October, keeping pressure on the central bank even as headline price increases may have peaked.

Most Read from Bloomberg

Adidas Cuts Ties With Ye, Absorbing €250 Million Hit to Profit

Renters Hit Breaking Point in a Sudden Reversal for Landlords

China Stocks Slide as Leadership Overhaul Disappoints Traders

California Poised to Overtake Germany as World’s No. 4 Economy

Korean Air Plane Overruns Runway While Landing in Philippines

Core inflation, which excludes volatile items like fuel, sped up to 8.39% in early October from a year prior, the national statistics institute reported Monday. The result was above the 8.29% reading in late September and outpaced the median estimate of 8.32% reported by analysts in a Bloomberg survey.

“Core inflation reflects how entrenched inflation is,” said Pamela Diaz Loubet, a Mexico economist at BNP Paribas. “While non-core price pressures and shocks begin to fade, core inflation shows how those shocks have already created second-order effects.”

Overall, consumer prices rose 8.53% annually, below the 8.64% increase seen in the previous two weeks and under the 8.62% median estimate. On a biweekly basis, prices gained 0.44%, compared to a 0.53% forecast.

“It seems inflation might have peaked in the second week of August,” since the headline figure has now fallen in three straight bi-weekly inflation prints, said Janneth Quiroz Zamora, vice president of economic research at Monex Casa de Bolsa.

Mexico’s central bank, known as Banxico, targets inflation of 3%, plus or minus 1 percentage point.

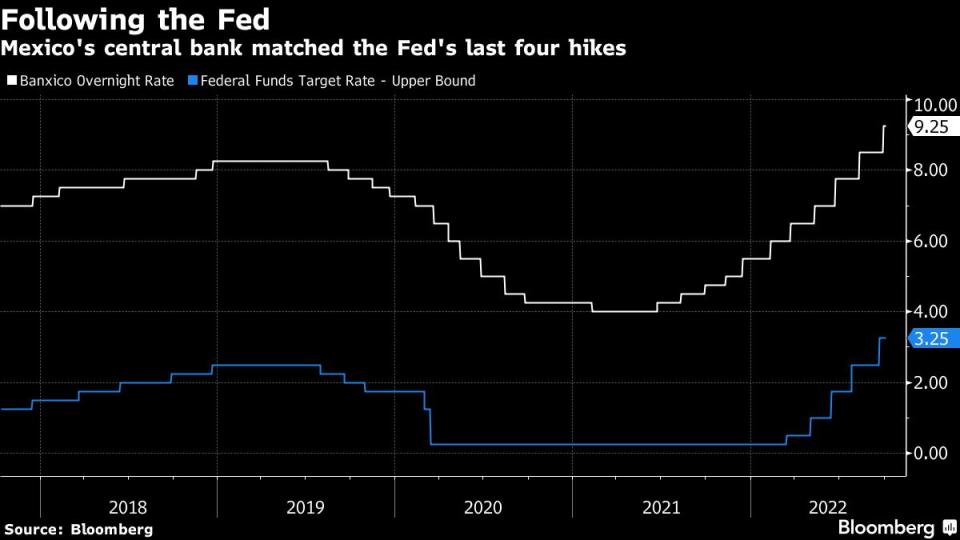

Banxico raised rates last month to 9.25%, the highest since it started targeting inflation in 2008. The 75 basis-point boost continued its run of matching the US Federal Reserve’s increases. The board appeared divided in minutes of the meeting published in October, with one member calling for a smaller hike in November, while another said a bigger increase may be needed.

Read More: Banxico Split Over Future Interest Rate Rises and Fed Decoupling

The price inertia means “we will see the need to maintain a restrictive monetary policy stance for the coming months,” Deputy Governor Irene Espinosa, seen as one of the board’s more hawkish members, said on a panel earlier this month.

Carlos Capistran, Bank of America’s Mexico and Canada economist, predicted that Banxico would keep matching the Fed’s hikes up to 11%, with a 75 basis-point raise coming in November.

Anti-Inflation Measures

The government recently announced it would halt bean and white corn exports and ease sanitary measures on key foods in an effort to stem inflation.

“With the measures we are taking, we are achieving a reduction in inflation,” President Andres Manuel Lopez Obrador said during a news briefing Monday. “It’s small but it’s not growing anymore.”

AMLO, as the president is known, said they are still working on reducing the price of food products and he is sure they will go down due to the anti-inflation pact signed with producers and distributors. In most cases, the price of the basket of 24 products are at or below 1,039 Mexican pesos ($52), according to Lopez Obrador. Walmart has also granted a special license to scrap tariffs on food imports in a bid to reduce prices.

Despite the government’s efforts and the central bank’s tightening cycle, inflation is still far from returning to target in Latin America’s second-largest economy. Analysts have continuously revised up their estimates this year.

Read More: Mexico Halts Bean, White Corn Exports in Bid to Tame Inflation

Banxico also boosted its inflation forecast upwards last month, projecting it will be at 8.6% in the last quarter of 2022 and nearing its 3.1% target only by the third quarter of 2024.

Economists surveyed by Citibanamex see inflation slowing to 5.11% at the end of next year and expect the bank to again hike by 75 basis points in November, with the rate ending the year at 10.5%, according to a poll published this week.

--With assistance from Rafael Gayol and Giovanna Serafim.

(Updates with analyst quotes, recasts lead and add president’s comments in paragraphs 11 and 12)

Most Read from Bloomberg Businessweek

What the Alzheimer’s Drug Breakthrough Means for Other Diseases

The Private Jet That Took 100 Russians Away From Putin’s War

Female Bosses Face a New Bias: Employees Refusing to Work Overtime

©2022 Bloomberg L.P.