When nobody was looking, Tesla turned into a manufacturing juggernaut

Kevork Djansezian/Getty Images

Tesla has frequently been criticized for being bad at making cars.

But as Elon Musk's automaker has increased production, delivering about 250,000 vehicles in 2019, it has steadily honed its manufacturing skills.

The company is now preparing to expand from factories in California, Nevada, and China to plants in Germany and Texas.

Tesla is on the verge of achieving a manufacturing scale that could enable it to capture a massive share of the growing EV market.

A consistent refrain among Tesla critics, myself included, has been that although the automaker's brand loyalty is off the charts, although customers love its cars, and although it's now the most valuable automaker in the world with a stunning $300 billion market capitalization, the company has struggled mightily with what CEO Elon Musk has often called "production hell" — and what its competitors call manufacturing.

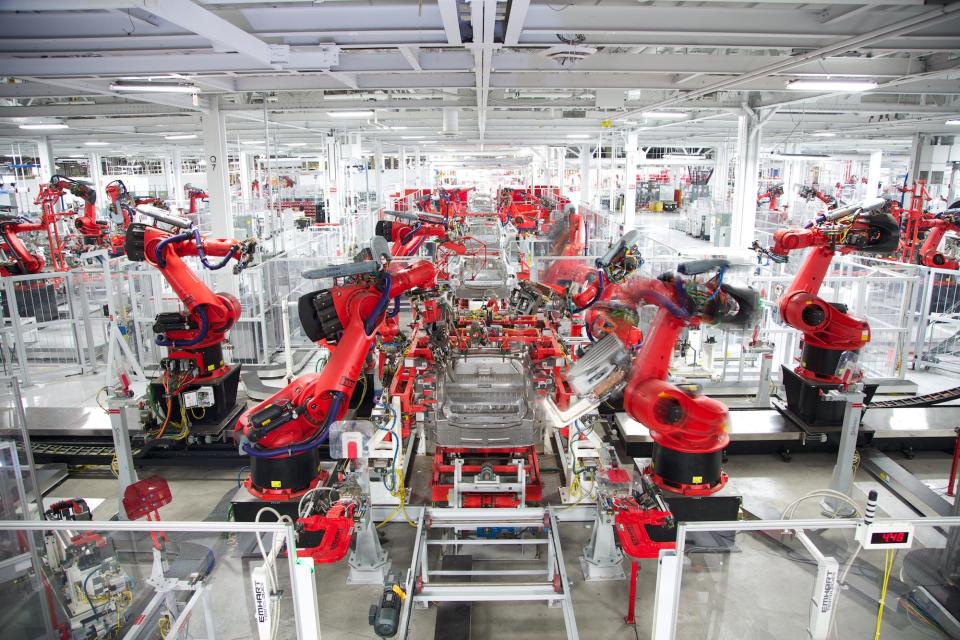

Exhibit A was a failed effort in 2017 to highly automate a new vehicle assembly line for the Model S sedan at Tesla's factory in Fremont, CA. Musk's plans didn't work, and in order to keep the Model 3 on track, Tesla had to throw up a rudimentary assembly line under a tent in the factory parking lot.

The tent, which is still in use, proved an innovative solution to a pressing problem, and helped Tesla deliver around 250,000 vehicles in 2019. But it highlighted the steep angle of the company's learning curve, which baffled industry experts: Carmakers have in the past few decades transformed the process of assembling tens of thousands of parts, brought together by a global supply chain, into a process that's nearly an afterthought. They announce a new vehicle, and year later it hits the showroom floor, just as planned and promised.

Problems arise, of course. Ford, for example, had to overcome challenges with its new F-150 pickup truck in 2014, and recently had issues launching the new Explorer SUV. But these are the sort of exceptions that make the rule.

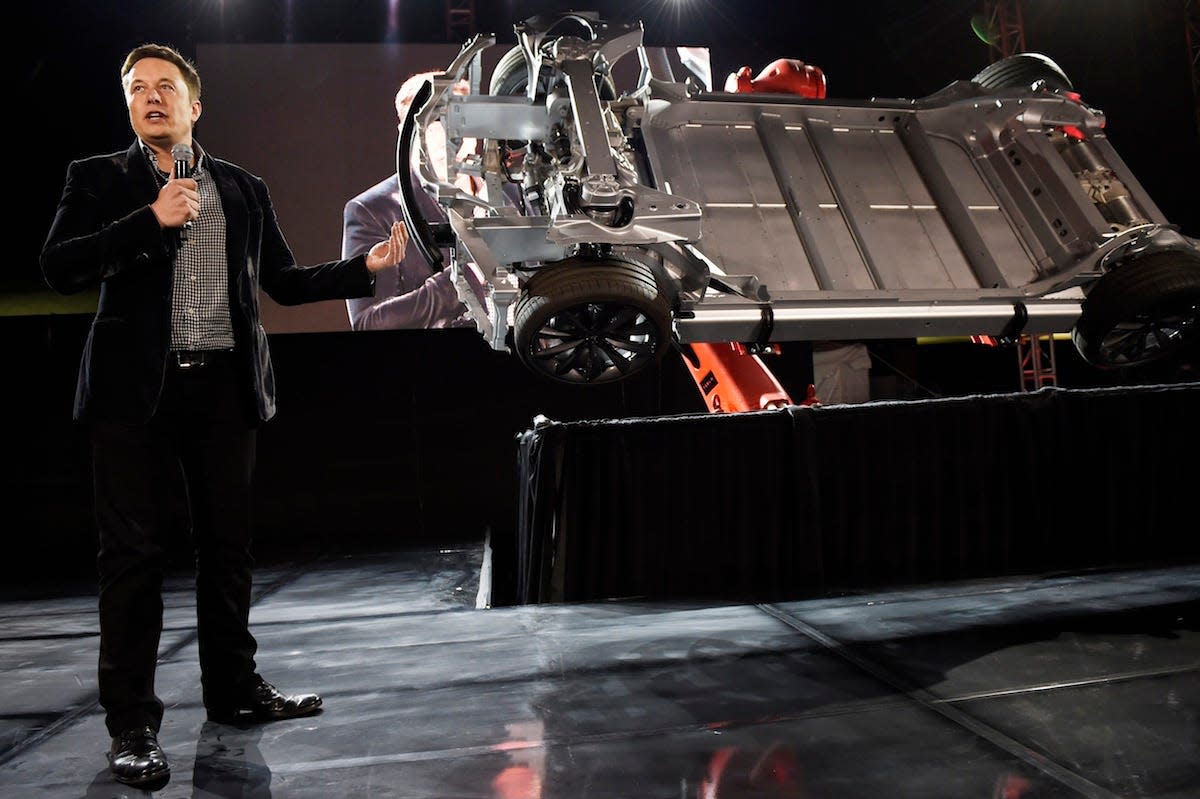

Musk loves manufacturing

Tesla

Tesla, though, keeps manufacturing front of mind. It reported second-quarter earnings on Wednesday and beat Wall Street's expectations, posting a fourth-consecutive quarterly profit against relatively flat sequential revenue of about $5 billion. The profit was modest, and much of it could be chalked up to lower operating costs amid the coronavirus shutdown and to a big sale of emission credits in the quarter.

On a conference call after the results hit, Musk and his executive team laid out the company's expansion plan for new factories and enthused over their manufacturing process. A few years ago, when Musk was still talking about "alien dreadnought" plants and bringing far more robots into the factory, such comments would have induced eye rolls.

But reality bites, and halfway through 2020, Tesla has become a manufacturing force with plenty of growth ahead. The old knock that its vehicles are subpar has lost it resonance. Tesla's build quality now impresses even outspoken critics, such as retired General Motors executive Bob Lutz. (On the flipside, JD Power included Tesla, in a provisional way, in its annual Initial Quality Study, where the company fared poorly.)

Some of Tesla's problems in this context stemmed from operating a revived former GM and Toyota factory in Northern California, which it bought following GM's 2009 bankruptcy. Tesla Fremont isn't ideally set up for the type of manufacturing Tesla wants to do, so it's always been a work-in-progress. Still, Tesla took it from making less than 10,000 vehicles every year to, if 2020 goes somewhat as planned despite the COVID-19 crisis, something like 400,000.

And new facilities — starting with the company's Nevada Gigafactory and now extended to a much more efficient plant in Shanghai with new factories slated for Berlin and Austin, Texas — are going to be optimized from the get-go for what we might call the "Tesla Production System."

In other words, the alien dreadnought is back. And it won't be one-of-a-kind.

The "machine that builds the machine"

REUTERS/Yilei Sun

A rough approximation of output suggests that each new factory could build 250,000 vehicles a year, taking Tesla production to more than a million units. That's far from the nearly eight million vehicles GM made and sold last year, but Tesla isn't spread as thin as GM. It has stayed focused on battery power, and dominates a global EV market that's steadily growing. Competitors' electrics simply aren't selling at commensurate levels.

How did this happen? Well, while Tesla was crafting a compelling new stock market story, we lost sight of how legitimately obsessed Musk is with manufacturing. But Wednesday's earnings were a reminder.

"We bring a massive amount of effort into manufacturing engineering, the machine that makes the machine," he said, reviving terminology that he often tossed around a few years back, as the Model 3 was ramping up.

"We're getting way better at making cars. You can see that in ... Shanghai. You'll see that even more with Berlin. And we're really changing the design of the [Model 3] in order to make it more manufacturable."

"We love manufacturing," he added. "It's awesome. And I really think more smart people should be working on manufacturing." That could be interpreted as a complaint about manufacturing experts at other automakers, but what I think Musk really meant was that vehicle production is a complicated undertaking that should attract more talent, especially as automation becomes a bigger factor.

The upshot is that although it's going to cost Tesla a lot of money to grow its capacity in the short term, the company will soon have local manufacturing in both halves of the US, Europe, and China. In the economics of the car business, this should establish the scale the company needs to achieve more consistent profits. More importantly, it should give it the flexibility to sell is cars at lower prices — something Musk remains eager to do.

That means more market share and a bigger lead over much larger automakers that, when it comes to the electric future, find themselves in serious catch-up mode.

Read the original article on Business Insider