P.E.I. businesses reluctant to charge credit card fees to customers

Historically credit card transaction fees have been charged directly to merchants, but earlier this month, Visa, MasterCard and other card providers settled a long legal battle on the issue of who pays credit card processing fees.

Now, retailers are able to pass the cost on to the customer, charging them every time they use their credit card.

Some small businesses on P.E.I. aren't willing to do that though.

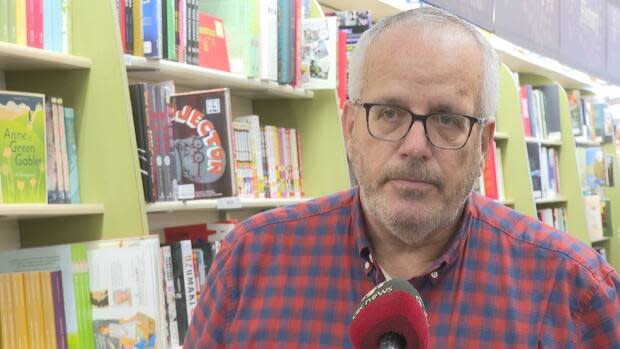

"We're living through a period of high inflation and I don't think now is the time to do something like that," says Dan MacDonald, co-owner of the Bookmark in Charlottetown.

"I think there are probably other steps that should be taken before that is a consideration."

The new rules came into effect Oct. 6. Merchants must give card providers 30 days' notice of their intent to start charging a fee. Retailers are also obligated to make sure customers know at the time of payment there is a surcharge. That surcharge is capped at 2.4 per cent.

Businesses have been dealing with the charge for years and it's already built into the "expense structure" for the Bookmark, MacDonald said.

"In our business it is just over $30,000 a year that we pay to the credit card companies for the processing fees. I think the government should look at what other countries are doing in terms of limiting what the banks and credit card companies can charge businesses," he said.

In other parts of the world such as the UK, the European Union and Australia; the fees, known as interchange fees, are capped at 1.4 per cent.

Tracy Cash, owner of Once Upon a Wedding near Traveller's Rest doesn't plan to put the extra fee on her customers who use credit cards.

"I think it is just something that is part of the cost of doing business," Cash said.

However, Cash thinks it's a great option for businesses who might be hurting due to fees.

In those cases, "customers do have an option to play with debit or pay with cash to avoid these charges," she said.

Passing the fee to customers is not happening in the entire country. In Quebec passing the transaction fee to consumers is prohibited under the province's Consumer Protection Act.