Egypt Bonds Slump After S&P Cuts Outlook on Grim Forecasts

(Bloomberg) -- Egyptian bonds slumped after S&P Global Ratings took a far more downbeat view of the nation’s finances than the International Monetary Fund, forecasting further currency depreciation and lowering its outlook to negative.

Most Read from Bloomberg

Fox Fired Its Biggest Star Tucker Carlson, Who Badmouthed Bosses

Clarence Thomas’s Billionaire Friend Did Have Business Before the Supreme Court

Javice Moved Millions From JPMorgan to Signature Months Before Collapse

Dollar bonds maturing in 2025 dropped 1.6 cents on Monday while notes maturing in 2032 fell 0.9 cents, pushing their yields to 20.2% and 17.4% respectively, data compiled by Bloomberg showed. As of 4 p.m. in London, Egyptian debt of varying maturities made up nine of the ten worst-performing bonds in emerging markets on the day.

While S&P said net flows should cover Egypt’s current-account deficits through fiscal year 2026, it projected the central bank’s gross reserves will average about $32 billion during the period — half the level the IMF sees them reaching over the same time. The stockpile has risen above $34 billion in recent months.

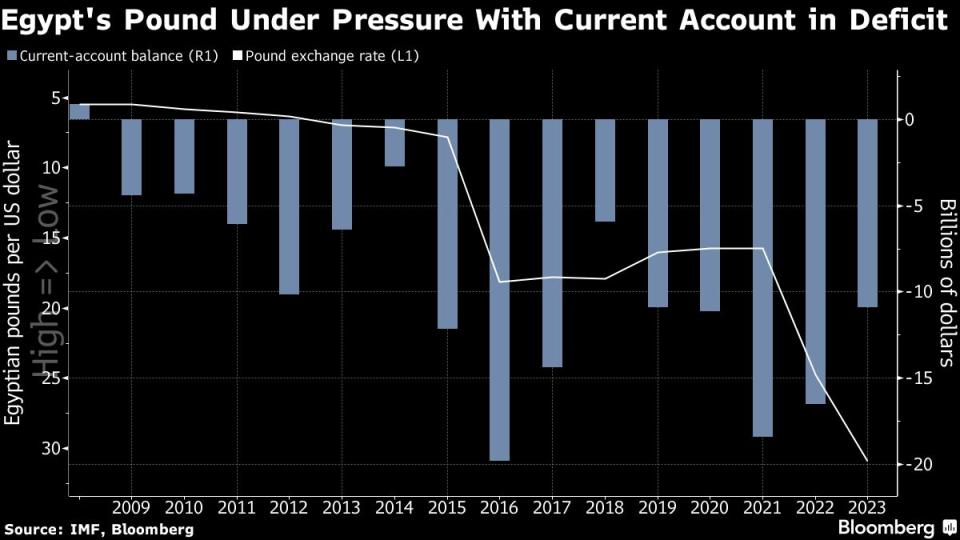

S&P also anticipated that the local currency would decline by about 53% by the end of this fiscal year to June 30, from 12 months earlier, “followed by a modest depreciation in the subsequent years,” analysts led by Trevor Cullinan said in a statement. The pound is down 39% since last June 30, according to data compiled by Bloomberg.

In S&P’s view, “Egypt’s funding sources may not cover its high external financing requirements” this fiscal year and next, which it estimates at about $37 billion cumulative. It warned that lack of progress in implementing reforms announced last December increases risks that backers including wealthy Gulf allies “potentially delay or do not provide Egypt with the agreed funds, with implications for imports, inflation, interest rates, and the government’s debt stock and interest payments.”

The rating company affirmed Egypt at B, seven notches above default and on par with nations including Nicaragua, Montenegro and Uganda.

In a note on Friday, Deutsche Bank analysts also said that they expect more pound weakness, while remaining neutral on the outlook for bonds.

“While Eurobonds now appear attractive from a valuations perspective, particularly in the short end, we maintain our marketweight stance due to the uncertainty around policy direction,” wrote analysts including Christian Wietoska and Danelee Masia.

Ratings Action

Around 70% of Egypt’s government debt is domestic and in local currency, according to S&P. It estimates the government channels over two-fifths of all revenue to interest payments, the third-highest ratio among the 137 sovereigns it rates globally.

S&P is the third major credit assessor to take negative action on Egypt in recent months, as the economic fallout of Russia’s invasion of Ukraine contributed to the country’s worst foreign-currency crunch and highest inflation in years.

In February, Moody’s Investors Service downgraded Egypt’s debt score deeper into junk territory, following a decision by Fitch Ratings last November to lower its outlook to negative from stable. While Fitch rates Egypt one step above S&P, Moody’s has it a notch lower at B3.

The government has committed to allowing a more flexible exchange rate, enabling it to clinch a $3 billion deal with the IMF. S&P said the IMF has “a more optimistic view” on Egypt’s gross reserves “as the balance of payments improves and program financing is disbursed.”

For now, the IMF wants Egypt to enact more of the wide-ranging measures it pledged before carrying out the first review of its assistance program, waiting to see privatization deals for state assets and genuine flexibility in the currency.

Though the pound has traded little changed in the spot market, concern among investors has built over what would be Egypt’s fourth devaluation since March 2022. The currency remains far stronger than rates quoted in the black market, underscoring the risk of further depreciation.

S&P said a major reason the currency has recently been under pressure is that businesses are “hoarding foreign-currency earnings, given the uncertainty regarding the Egyptian pound’s value.”

--With assistance from Kerim Karakaya.

(Updates markets.)

Most Read from Bloomberg Businessweek

Fishing Boats Can’t Stop Running Over Undersea Internet Cables

How a Brazen Plot to Rig Oil Auctions Cost Venezuela Billions

Sprite Is So Popular That Pepsi Launched a New Lemon-Lime War

©2023 Bloomberg L.P.