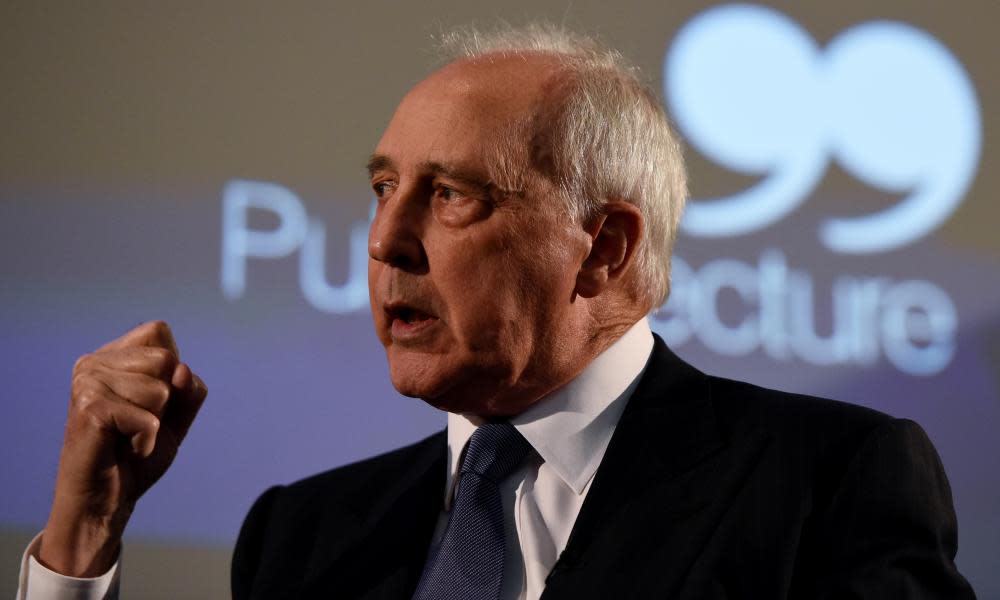

Paul Keating attacks Covid-19 super withdrawal scheme as unfair burden on young

Paul Keating has lashed the Morrison government’s decision to allow people to draw down on their superannuation due to the coronavirus crisis, saying that the decision forced young people to bear the brunt of bailing out the economy and robbed them of their retirement income.

Speaking at an industry super event on Tuesday, the former prime minister and architect of Australia’s super system also attacked the legitimacy of a Treasury inquiry into retirement income and slammed “baby-faced” government backbenchers who have been campaigning against an increase to employer contributions.

Rules announced in March by the treasurer, Josh Frydenberg, allowed workers hit by the crisis to draw as much as $20,000 from their super – a move that funds say has resulted in hundreds of thousands of people, many of them young, completely draining their accounts.

Related: Australian tax office moves to track down people who withdrew super inappropriately

“Of the income support in Australia to date, in this Covid emergency, $32bn has been found and paid for by the most vulnerable, lowest-paid people in the country – that’s the people who’ve taken the $20,000 out – and $30bn has been provided by the commonwealth under jobseeker and jobkeeper,” Keating said.

“The main burden of income support is people ratting their own savings to the tune of where now 600,000 young people, broadly young people under 35, have no superannuation accounts at all now.

“They lose all the compounding – the $20,000 would have multiplied itself by five and a half or six times over their lifetime, so it’s been a very poor choice to them.”

He said the burden fell on young people who were already in a worse situation than previous generations because they had not had the benefit of a pay rise since 2013, were saddled with Hecs debts and had to pay GST and rent.

“Now their pool of savings has been lost to them when in fact it should have been public support from the get-go,” he said.

Keating repeated his support for increasing employer contributions, known as the “super guarantee”, by half a percentage point a year, bringing the current rate of 9% up to 12% by 2025.

He dismissed the idea employers could not afford the increase, saying they had banked almost 10% reaped from the increased productivity of workers since 2013, without handing any back as pay rises.

“What we’re saying is, there’s 10% labour productivity banked on the balance sheets of companies, we’re asking for a quarter of it back.”

He said “so-called economic commentators” made similar arguments that increasing the rate was unaffordable when the guarantee was increased by a point a year in the early 1990s, as Australia emerged from recession.

“Well of course the SG was completely affordable, we had the profit share in the economy rising, as we did the wage share,” he said.

He said that at half a percentage point a year, the currently legislated increase was far smaller than wage rises handed out to low-income workers by the industrial umpire.

“In the blink of an eye you’d miss it,” he said. “It’s so completely affordable.”

Increasing the rate is currently both government policy and the law, but the idea has been under heavy attack from a group of government backbenchers, as well as the business lobby.

“It is L-A-W and that is good,” Keating said – a reference to tax cuts he legislated before the 1993 election but repealed after winning another term in government.

“There’s no economic case for it not to go ahead, none.”

He said the argument against was being run by “these first-term senators, who are a particularly modest form of political life”.

“But they’re out there, commanding a half-page every time they want to in the Financial Review or the Sydney Morning Herald, or the Age, the old Fairfax papers.”

He said business opponents of industry super were “the establishment seeking to keep the existing order of board management through a group of non-executive directors” and were supported by some in the media.

Non-executive directors got “a very bad reference” from the banking royal commission, he said.

“Now, the Financial Review, which has run the case against industry funds, and its editor, Michael Stuchbury, he’s happy with the status quo. He has these soirees every month where all the non-executive directors turn up.

Related: The fight over your superannuation increase

Watch video below

“We don’t want any reform of the capital system, we want a sub-performing stock market, sub-performing economies, and if an industry fund says, ‘Look, we might buy … 20% of Boral or 18% of BHP because we want to improve, we want a board position and we want to improve the performance of the company on a long-term basis for our members,’ some members of the Liberal party regard this as shocking, but not just them but the whole defensive media structure of the Financial Review variety.”

“Stutchbury wants to remain king of the kids, he’s got the non-executive directors turning up once a month, he gives them a cup of tea and a scone.

“This sort of low-grade, modest-grade corporate performance by these non-executive directors is promoted by Australia’s principal financial newspaper.”

He said that while many aspects of the super system needed to be looked into, Treasury’s retirement income review had no mandate to examine whether raising the guarantee rate was a good idea.

This was because the question of the rate increase had been picked up from a previous Productivity Commission inquiry that examined the issue even though it was not in its terms of reference.

“There’s an illegitimacy from the get-go about the retirement income review looking at the 12% because the parliament has already decided on the 12%,” he said.