Peacock Is Positioned for Streaming Success, but Can NBC Help it Take Flight? | Charts

Peacock emerged as a bright spot in Comcast’s third quarter earnings report on Thursday. The platform added 4 million subscribers for a total of 28 million. This, combined with increased prices for the streamer, grew its revenue to $830 million. In addition to its solid earnings numbers, several other indicators look positive for Peacock in the short, medium and long term. The question is whether NBCUniversal will be able to fully take advantage of these strengths to make Peacock a more competitive platform.

In the immediate term, Peacock has been well positioned to weather the content stoppages of the strikes with its catalog of unscripted content. Highly in-demand competition series from NBC like “America’s Got Talent” and “The Voice” are available on Peacock. The platform’s lineup of Bravo reality series is a cornerstone of its library and WWE shows often rank among the most in-demand on Peacock.

The end of the writers’ strike meant that “Saturday Night Live,” one of Peacock’s key assets, was able to return. Demand for the 49th season premiere was 11% higher than last season and it was the most-watched “SNL” season premiere on Peacock.

While Peacock has lagged other platforms in terms of both the quantity and demand for its original content, the recent slowdown in the pace of new streaming content premiering could relieve some of the competitive pressure faced by the platform in this area. Peacock leads other platforms in the share of demand for shows on its platform originally from broadcast channels (37%).

Another positive indicator that bodes well for the platform in the very near term is high anticipation for the horror movie “Five Nights at Freddy’s,” which premiered simultaneously in theaters and on Peacock on Oct. 27th. The pre-release demand for this movie has been higher than many other recent horror premieres, and it soared to a $78 million opening weekend at the box office.

In the medium term, a major question for Comcast’s NBCUniversal is just how much it can wring out of Disney for its 33% stake in Hulu. With negotiations underway, Disney will try to stick to the $27.5 billion floor for Hulu, while Comcast will hope JPMorgan Chase and Morgan Stanley agree on a significantly higher valuation. Regardless of the final details, Comcast is likely to receive at least $9 billion at just the right time, with Wall Street calling on legacy media companies to cut costs and increase free cash flow.

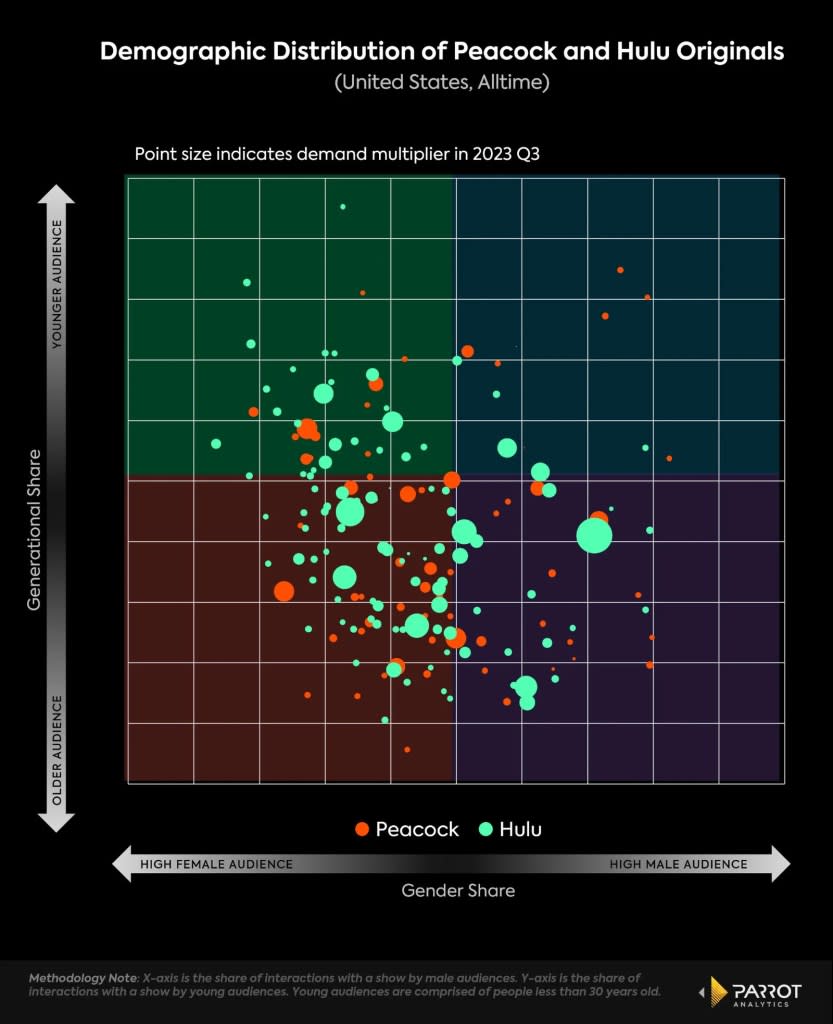

Parrot Analytics audience demographic data suggests a theoretical combo of Peacock and Hulu would not create a true four quadrant service, as both appeal to a slightly older and more female audiences. Originals from these platforms are largely targeting the same audience.

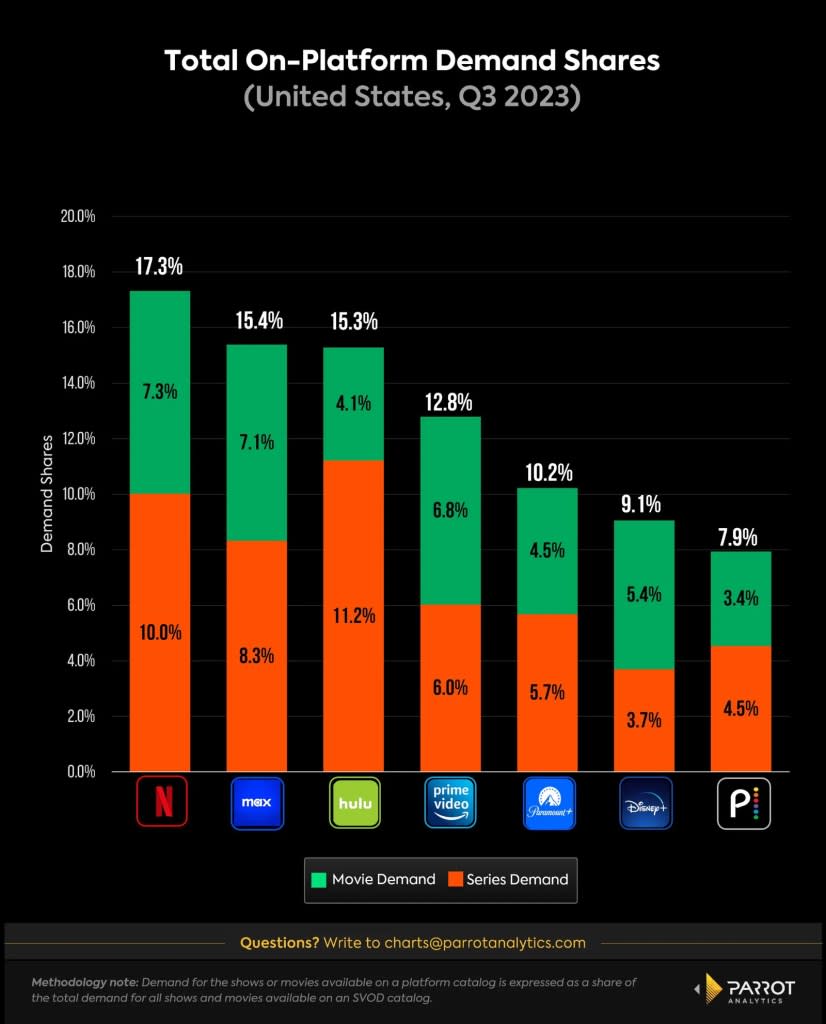

While recent signs look positive for Peacock and any payout for Comcast’s stake in Hulu would be a boon for the company, it is still important to note how the platform trails competitors. The total demand for all shows and movies on Peacock was less than half of the demand for all the content on Netflix in Q3. Even though Peacock’s total demand for its catalog was up in Q3 from Q2, it still trails most major streamers in the U.S. This fact adds some urgency for the platform to take advantage of any near-term tailwinds.

The company sees sports becoming more important to the streaming landscape and anticipates that this will be a strength for Peacock. Mike Cavanagh, Comcast president, emphasized the longer-term timeframe of these ambitions. “While sports over the long-term…are going to be experienced significantly through streaming, for a long time the economics of sports rights is going to be substantially supported by broadcast reach.”

Comcast CEO Brian Roberts further highlighted the importance of sports to Comcast’s streaming strategy. “We see all sports finding a way over the next [few] years to be more and more streamed, and that’s going to require more bandwidth,” he said. “And that’s going to require and create an opportunity for us to have the superior product in the market. That’s our strategy, and sports really is at the heart and soul of a lot of what we do.”

Several recent factors, including a potential windfall from a sale of its parent company’s stake in Hulu, look positive for Peacock’s prospects. The trick will be capitalizing on these near-term strengths and putting the platform in a position where it is able to take advantage of the longer term future, where the company’s leadership feels Peacock will truly be able to take flight.

The post Peacock Is Positioned for Streaming Success, but Can NBC Help it Take Flight? | Charts appeared first on TheWrap.