Poland Keeps Rates Steady as Warsaw Readies Change of Power

(Bloomberg) -- Poland’s central bank kept borrowing costs unchanged for a second-straight month, firming up a more cautious monetary approach as a pro-European government prepares to take power.

Most Read from Bloomberg

Elon Musk's SpaceX Valued at $175 Billion or More in Tender Offer

Apple Readies New iPads and M3 MacBook Air to Combat Sales Slump

Global Bonds Power Ahead as Dovish Bets Take Hold: Markets Wrap

Harvard, Penn Criticized for ‘Insane’ Testimony on Antisemitism

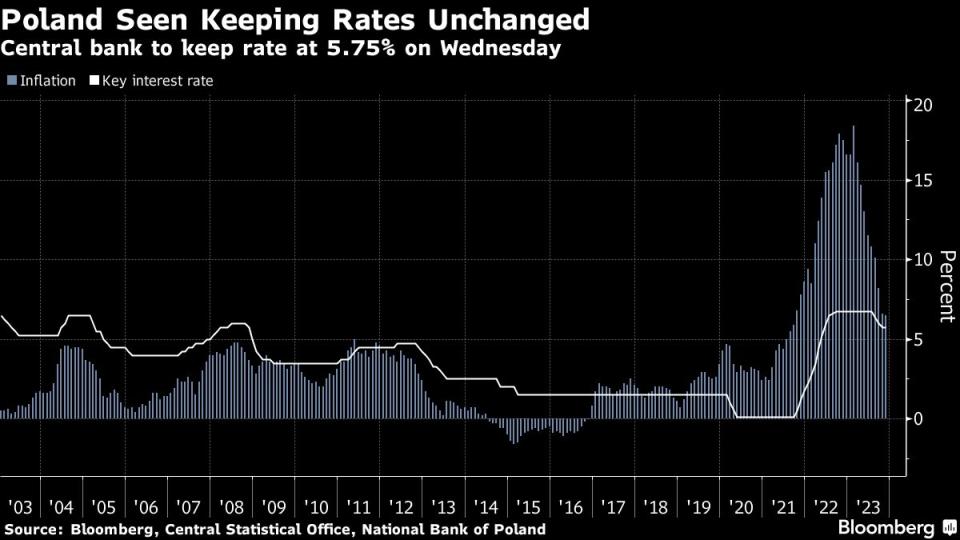

Policymakers in Warsaw left the main rate at 5.75%, in line with all 36 economists surveyed by Bloomberg. The year-on-year inflation rate has fallen for nine months in a row, but at 6.5% in November remains more than double the central bank’s target. The zloty pared loses.

The pause in easing follows a period of monetary turbulence. Governor Adam Glapinski’s unexpected decision to slash the benchmark by 75 basis points in September prompted a plunge in the zloty and accusations about political interference in favor of his allies in the nationalist government.

But after the ruling Law & Justice party lost its majority in the Oct. 15 election, Glapinski reversed course and held rates steady, citing new fiscal risks. The governor, who’s come under scrutiny from the incoming government to be led by Donald Tusk, said he’ll likely hold off further rate moves pending better clarity over policy and a new inflation projection due in March.

“The Council has adopted a wait-and-see attitude, and the market’s attention is being redirected to the press release and tomorrow’s news conference,” said Grzegorz Maliszewski, chief economist at Bank Millennium SA. “These should not change the expectation that in the coming months, and in our opinion until March, rates will be kept at current levels.”

Economists at MBank SA, led by Marcin Mazurek, said “see you in March” in reaction to the announcement, while Bank Pekao SA analysts, led by Ernest Pytlarczyk, said that “nothing will happen for many months.”

Tusk, a former European Council president, and his allies have pledged to put the central bank chief in front of a special tribunal in a probe into political partisanship, irregularities in the bank’s bond-buying program and failures in fighting inflation.

Glapinski, who will hold a press conference Thursday at 3 p.m. Warsaw time, has consistently rebuffed all accusations made against him. The central bank will also publish a statement at 4 p.m. on Wednesday.

The Polish currency has been buoyed by the central bank’s newfound hawkishness, trading near three-year highs against the euro. In reaction to the announcement the zloty pared losses, trading 0.2% weaker to the euro for the day. It has strengthened 6.8% so far this quarter, most among emerging-market currencies tracked by Bloomberg.

--With assistance from Piotr Bujnicki and Barbara Sladkowska.

(Updates with analyst comments and zloty reaction from second paragraph.)

Most Read from Bloomberg Businessweek

The Untold Story of a Massive Hack at HHS in Covid’s Early Days

Hong Kong Takes On Rich-Gone-Rogue in Illegal Building Crackdown

©2023 Bloomberg L.P.