Polish Policymakers Cast Doubt on Central Bank Chief’s 2026 Bet

(Bloomberg) -- Several Polish central bankers said they could begin weighing an interest-rate cut next year as inflation subsides, brushing aside Governor Adam Glapinski’s unexpected bid to stretch easing expectations into 2026.

Most Read from Bloomberg

Saudis Warned G-7 Over Russia Seizures With Debt Sale Threat

Archegos’ Bill Hwang Convicted of Fraud, Market Manipulation

NATO Singles Out China Over Its Support for Russia in Ukraine

The National Bank of Poland chief upended forecasts last week, saying that a government decision to partially lift energy price caps will push any talk of cutting rates into 2026. Interviews with policymakers show that Glapinski’s long-term projection may not prevail.

“I would see space in early 2025 to start a serious discussion about a slightly looser monetary policy,” Ludwik Kotecki, a member of the rate-setting Monetary Policy Council and a Glapinski critic, said on July 5. Cezary Kochalski, who is more aligned with the governor, said easing could be discussed after an inflation forecast due in March 2025.

It wasn’t the first time Glapinski threw market bets for a loop. He sent the zloty into a tailspin last year when he delivered two outsize rate cuts ahead of a crucial election in October, triggering accusations of abetting his nationalist allies in the government.

Prime Minister Donald Tusk, who secured a majority, has accused Glapinski of playing politics as his coalition pushes forward with an investigation. Glapinski has repeatedly denied wrongdoing.

Until now, the rate-setting council had been flagging potential cuts next year, with a projection for inflation to slow down after peaking at the start of 2025 at 6.3%.

‘Mismatch’

Piotr Bujak, the chief economist at PKO Bank Polski SA, said the “positive” outlook for inflation through next year — including lower core inflation levels — open a path for cuts next year.

“There is a mismatch between the projection and the rhetoric,” Bujak said.

In addition to Kochalski, Henryk Wnorowski — who tends to vote with the Glapinski majority — put the start date for talk of rate cuts in the second quarter of 2025 given the “complicated” outlook for price growth.

“I wouldn’t expect a serious rate cut discussion earlier than in the second quarter,” Wnorowski said by phone Monday.

Grzegorz Maliszewski, chief economist at Bank Millennium SA, said individual MPC members differ when it comes to the timing of any easing. But while no members interviewed by Bloomberg weighed in on Glapinski’s projection, the 2025 timeframe appeared to remain dominant.

“Considering the latest economic forecasts, I’d share the opinion that rate cuts are possible next year,” Maliszewski said.

After the firestorm over the jumbo rate cuts last year — and following the defeat of his allies in the election — Glapinski has taken a markedly hawkish turn, at first ruling out easing this year even as the European Central Bank and regional peers waded into borrowing cuts.

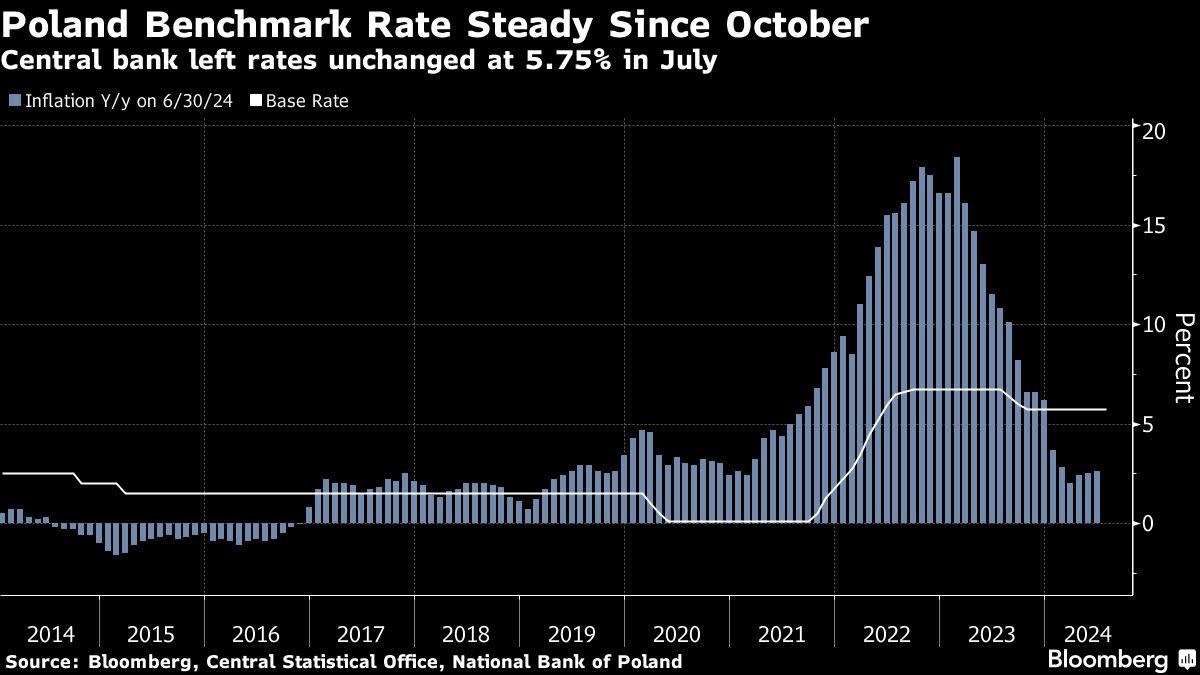

The central bank left interest rates unchanged for a ninth month at 5.75% in July, pointing to a rebound in prices last month.

--With assistance from Piotr Bujnicki.

Most Read from Bloomberg Businessweek

At SpaceX, Elon Musk’s Own Brand of Cancel Culture Is Thriving

Ukraine Is Fighting Russia With Toy Drones and Duct-Taped Bombs

©2024 Bloomberg L.P.