Property tax expert says assessment amendments more sensible, but more changes needed

Proposed changes to New Brunswick's property assessments have pros and cons, says Rob Newman, a Moncton property tax expert.

The amendments would change property assessment valuation dates.

Starting in 2025, instead of assessments being based on the upcoming taxation year, they would be based on the previous year.

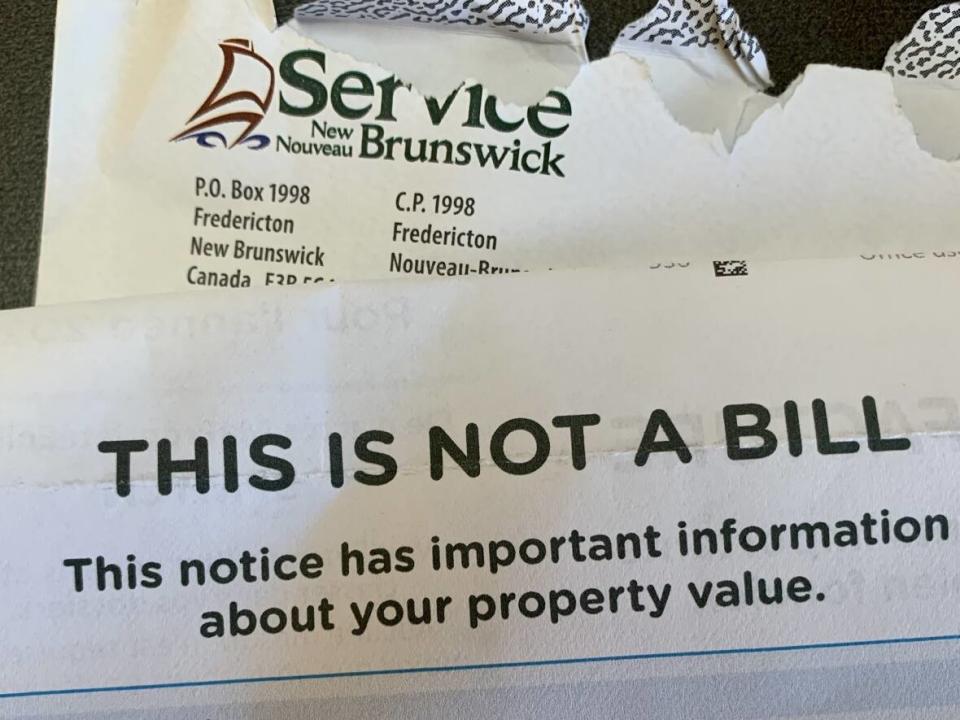

A bill to amend the Assessment Act was introduced this week by Service New Brunswick Minister Jill Green, who said the changes would modernize and streamline the assessment service.

Beginning in 2024, all assessment notices will be mailed in January instead of October.

Newman said the problem with the current system is that assessors have to be "valuing in the future," since notices are sent in October based on assessments for the coming January.

"The valuation date in the future was not sensible," he said.

"But the downfall is that the evaluations become less current."

On par with some provinces, more current than others

New Brunswick's planned new system is not uncommon in Canada. Nova Scotia also has the valuation assessed based on the year prior.

Newman said other provinces even have less current valuation dates.

For example, he said, Ontario doesn't have an annual cycle, so properties are reassessed every four years, and assessments have been frozen since the pandemic. Newman said that in 2023, assessments in Ontario have a valuation date of January 2016.

"The big issue there is that, you know, those values, obviously, are inaccurate," he said. "And, notably, don't take into any consideration, you know, impacts of the pandemic."

More changes called for

But there are two changes that Newman would like to see to assessment legislation in New Brunswick.

One thing New Brunswick is missing, he said, is the ability to contest a property's classification from, for example, a commercial property to a residential one.

The biggest shortcoming is the lack of a uniformity provision, which refers to a requirement that a property must be assessed similarly to others, Newman said.

In most provinces, if you had two identical apartment buildings next to each other with completely different values, you could call it unjust.

"In New Brunswick, technically, you can't," Newman said. "You're really limited to a real and true value argument, which is basically market value."

He said this is a problem because in a commercial realm, where properties are expected to make money, if you have two identical properties with different assessments and tax burdens, then the owner of the property with a higher assessed value will likely have no choice but to increase rent to make up the variance.

"And, as we know, we're certainly facing a housing crisis already in New Brunswick."