Russia Boosts Pacific Oil Cargoes as Year of War Reshapes Flows

(Bloomberg) -- A year on from Russia’s invasion of Ukraine, Moscow’s seaborne crude exports held close to the highest levels seen since its troops crossed the border, with record volumes leaving its Pacific ports.

Most Read from Bloomberg

TD Bank to Pay $1.2 Billion to End Suit Tied to Ponzi Scheme

Hong Kong Ends One of World’s Longest Mask Mandates After 945 Days

Nigeria Latest: Tinubu Wins Ekiti Vote; Next Briefing at 11 a.m.

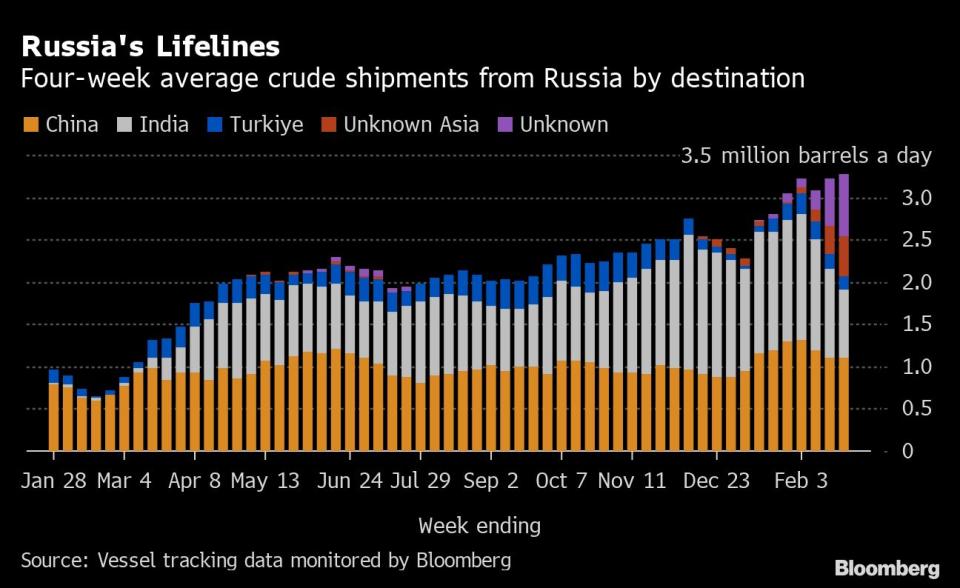

The country’s shipments rose marginally to 3.63 million barrels a day from its ports in the seven days through Friday, a level that has been surpassed just four times since the start of 2022. The less-volatile four-week average also gained, before a 500,000-barrel-a-day production cut that's due to come into effect from Wednesday in response to Western embargoes and price caps on Russian oil cargoes.

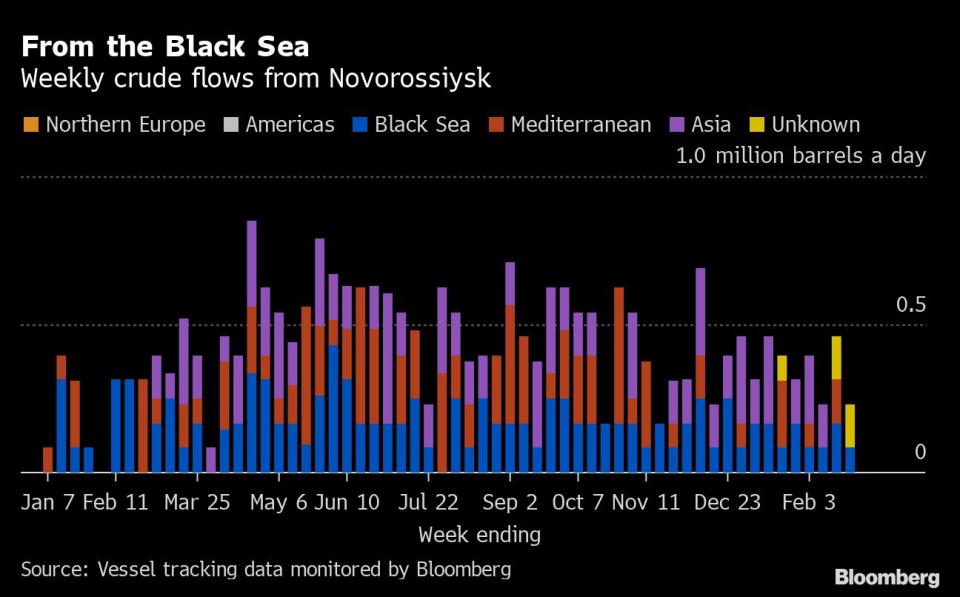

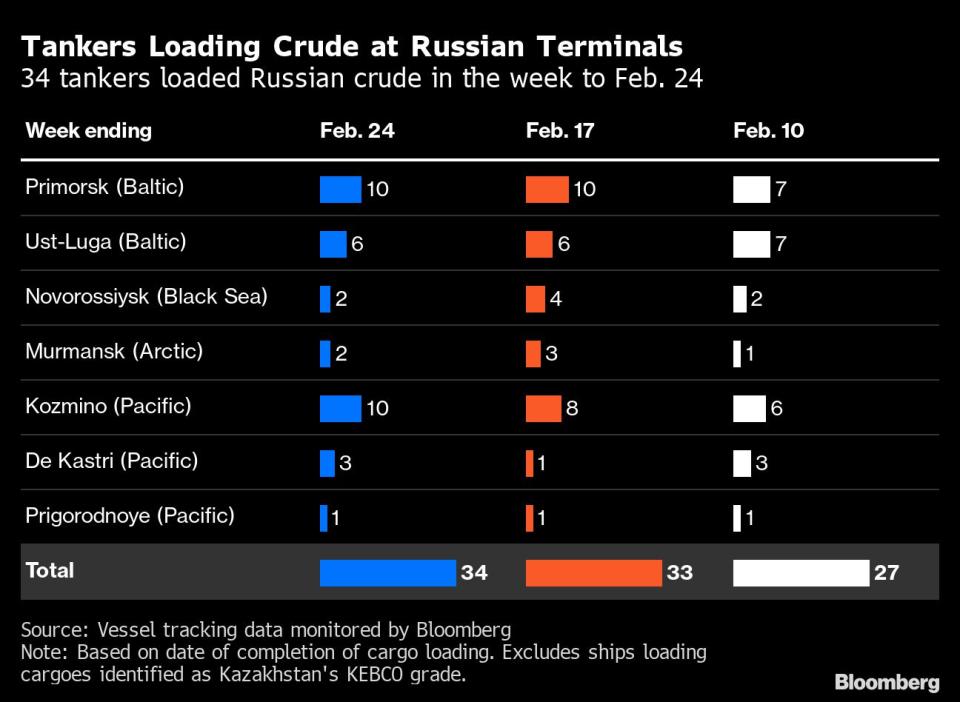

But the steady flow masks some big swings in regional shipments. Exports from the Black Sea fell sharply, with storms closing the port of Novorossiysk for much of the week. Flows from the Arctic terminal at Murmansk were also down, but the drops were more than offset by what are likely to be record volumes leaving the country’s Pacific terminals.A record 10 tankers were loaded at the Pacific port of Kozmino last week, with flows there boosted by the use of drag-reducing agents on the ESPO pipeline and the resumption of crude deliveries by rail. Crude shipments from the country's eastern ports are being sold at prices almost 40% higher than cargoes exported through the Baltic, according to a group of researchers.

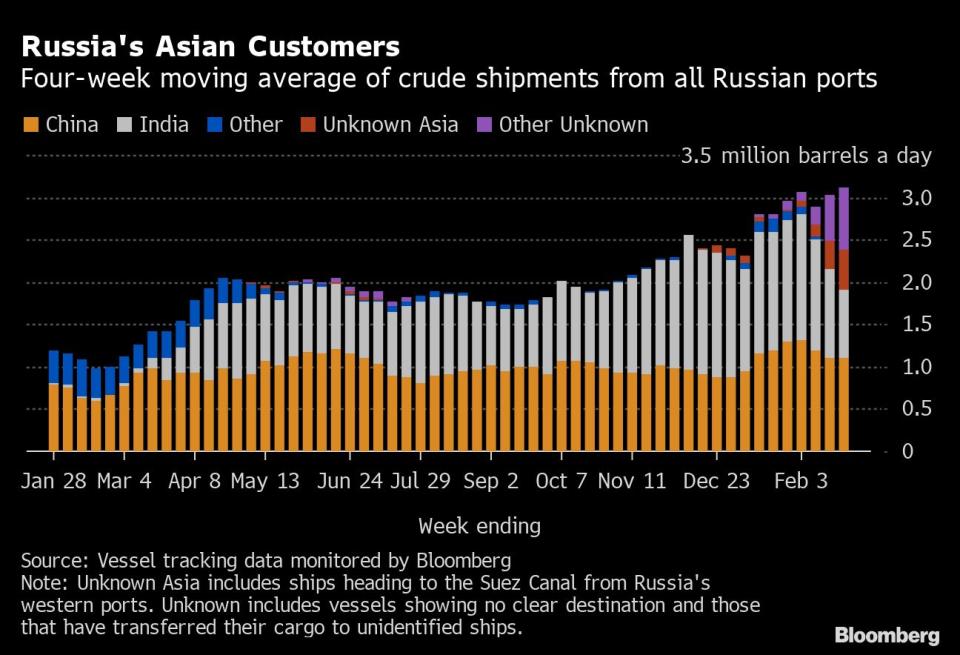

The volume of crude on vessels heading to China and India — plus smaller flows to Türkiye and the quantities on ships that haven’t yet shown a final destination — rose in the four-week period, to an average 3.27 million barrels a day, the highest amount observed since Bloomberg began tracking the shipments at the start of 2022.

As the ultimate destinations of cargoes loading in late January become apparent, flows to China have risen to new post-invasion highs. Historical patterns suggest that most of the cargoes currently identified as “Unknown Asia” or “Other Unknown” will end up in India.

Inflows to the Kremlin's war-chest from crude-export duties have plunged since the start of the year. While an easing of crude prices have both played parts in that drop, the biggest effect has come from a change in the formula used to calculate duty rates. A multi-year move by Russia away from taxing oil exports will limit the impact of any tightening of the price cap on exports, such as that called for by former US Treasury Secretary Lawrence Summers.

Ship-to-ship transfers of cargoes in the Mediterranean continue apace. This has been most visible off the Spanish north African city of Ceuta and off the Greek coast near Kalamata. At least 30 cargoes have been transferred between ships in those two locations since the start of the year. Twelve more Aframax tankers that loaded in the Baltic since late January look likely to transfer their loads to other vessels in the Mediterranean, based on their destination signals.

Crude Flows by Destination:

On a four-week average basis, overall seaborne exports edged up by 39,000 barrels a day to 3.38 million barrels a day.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through the Baltic ports of Ust-Luga and Novorossiysk.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies. Transit crude is specifically exempted from European Union sanctions.

Asia

Most Read from Bloomberg

Four-week average shipments to Russia’s Asian customers, plus those on vessels showing no final destination edged higher in the period to Feb. 24, rising to 3.11 million barrels a day, their highest since Bloomberg began tracking the flows at the start of 2022.

While the volume heading to India appears to have slumped, history shows that most of the cargoes on ships without an initial destination eventually end up there.

The equivalent of 463,000 barrels a day was on vessels showing destinations as either Port Said or Suez in Egypt, or which have already been or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India and show up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at 739,000 barrels a day in the four weeks to Feb. 24, are those on tankers showing a destination of Gibraltar, Malta or no destination at all. Most of those cargoes go on to transit the Suez Canal, but some could end up in Türkiye. An increasing number are being transferred from one vessel to another in the Mediterranean for onward journeys to Asia.

Europe

Most Read from Bloomberg

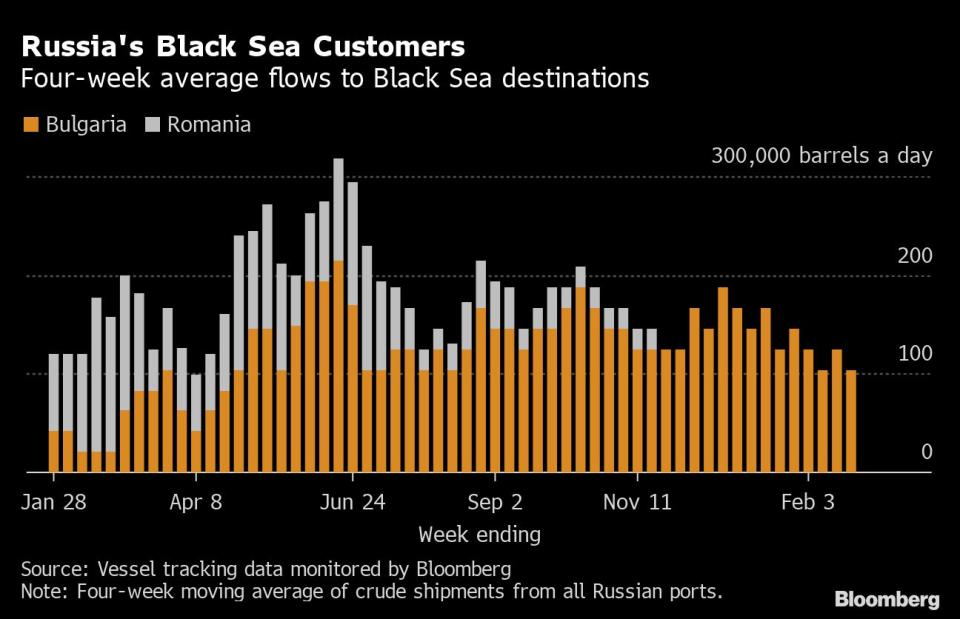

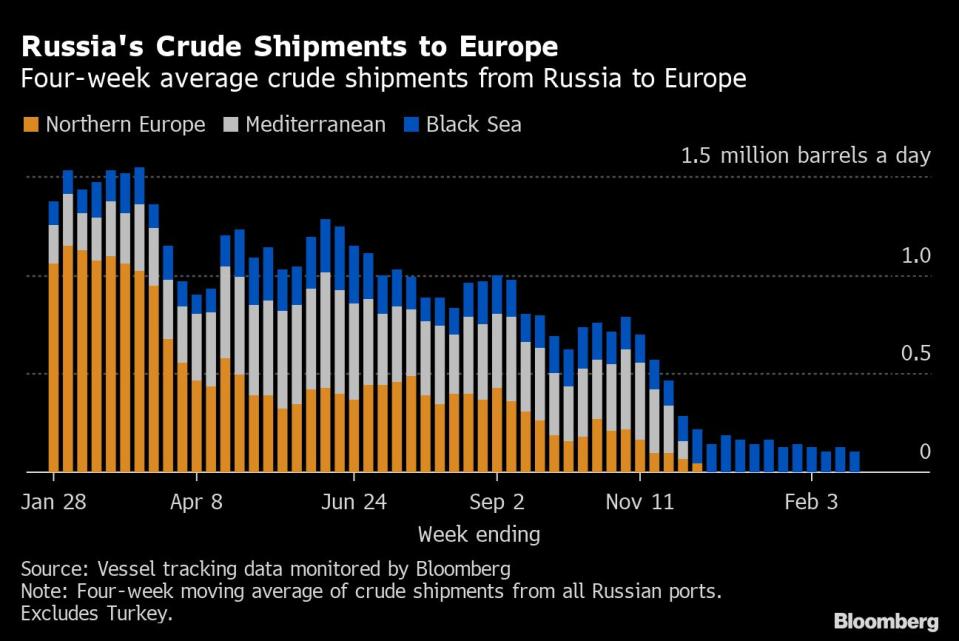

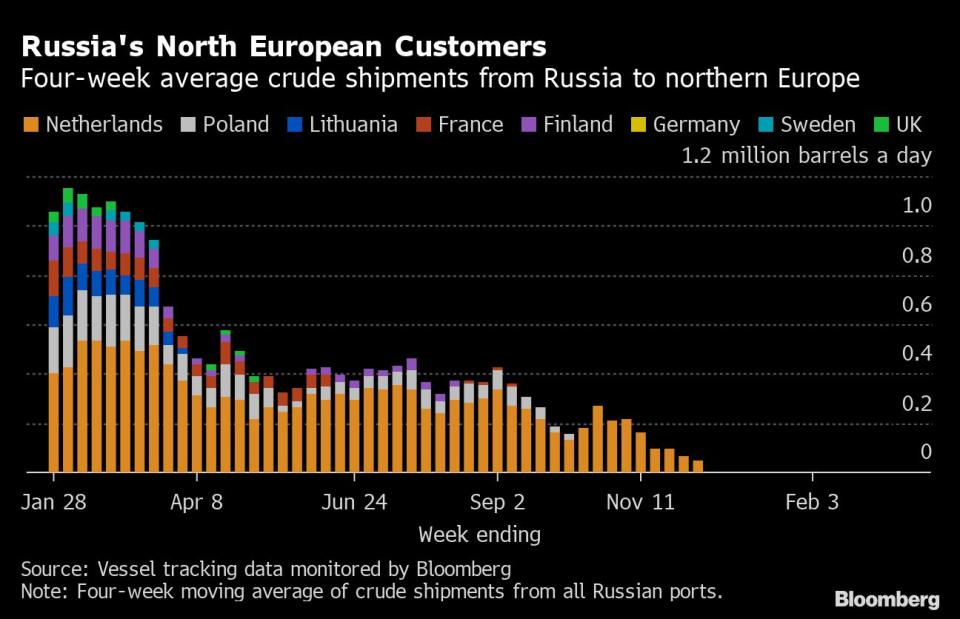

Russia’s seaborne crude exports to European countries fell back to 104,000 barrels a day in the 28 days to Feb. 24, with Bulgaria the sole European destination. These figures do not include shipments to Türkiye.

A market that consumed more than 1.5 million barrels a day of short-haul crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

No Russian crude was shipped to northern European countries in the four weeks to Feb. 24.

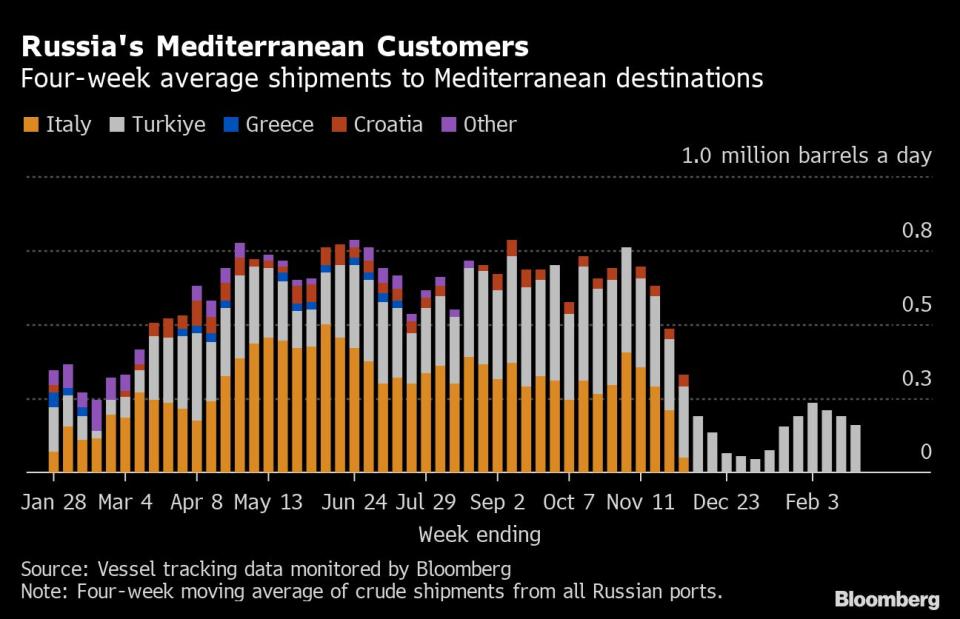

Exports to Mediterranean countries fell for a third week to average 162,000 barrels a day in the four weeks to Feb. 24.

Türkiye was the only destination for Russian seaborne crude into the Mediterranean, but flows there are just a fraction of the highs they reached in September and October. Despite not being a part of European sanctions on Russian crude exports, Türkiye has not remained a significant lifeline for Moscow since the EU import ban came into effect on Dec. 5.

Flows to Bulgaria, now Russia’s only Black Sea market for crude, gave up the previous week’s increase, falling to 104,000 barrels a day. Despite Bulgaria securing a partial exemption from the EU’s import ban, which allows it to continue importing Russian crude by sea, Lukoil PJSC could begin using non-Russian crude in its refinery at Burgas as soon as March.

Flows by Export Location

Aggregate flows of Russian crude edged higher to 3.63 million barrels a day in the week to Feb. 24. A slump in flows from the Black Sea and Arctic terminals was more than offset by a surge in shipments from the Pacific. Figures exclude volumes from Ust-Luga and Novorossiysk identified as Kazakhstan’s KEBCO grade.

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty were virtually changed at $44 million in the seven days to Feb. 24. But four-week average income fell by $3 million to $43.4 million.

President Vladimir Putin signed into law amendments to the way Russia’s oil price is assessed for tax purposes. From April, rates of mineral extraction tax and profit-based tax on oil companies will be calculated using a decreasing discount to prevailing Brent prices, rather than assessments of Urals crude. Export duty, which will be phased out at the end of 2023, will not be affected by the change.

February’s duty rate is set at $1.75 a barrel. That’s down by 23% from January and the lowest per-barrel rate since June 2020, during the depths of the pandemic. The drop is the result of a decline in Urals prices over the measurement period, which ran from mid-December to mid-January. Russia’s benchmark grade averaged $46.82 a barrel according to ministry figures, a discount of almost $35 a barrel to Brent over the same period.

The duty rate for March has been set at $1.94 a barrel, the first increase since December, and is based on a Urals price of $50.51 a barrel during the assessment period that ran from Jan. 15 to Feb. 14.

Origin-to-Location Flows

The following charts show the number of ships leaving each export terminal and the destinations of crude cargoes from the four export regions.

A total of 34 tankers loaded 25.4 million barrels of Russian crude in the week to Feb. 24, vessel-tracking data and port agent reports show. That’s up by 250,000 barrels, or 1%, from the previous week and the highest volume in five weeks. Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress. All figures exclude cargoes identified as Kazakhstan’s KEBCO grade.

The total volume on ships loading Russian crude from Baltic terminals was unchanged at 1.67 million barrels a day.

Shipments from Novorossiysk in the Black Sea fell back from the previous week’s high, with just two ships taking on Russian cargoes.

Arctic shipments also slipped from the previous week’s high.

Flows from the Pacific surged to their highest since at least the start of 2022, when Bloomberg began tracking the flows in detail. A record 14 tankers loaded at the region’s three export terminals in the week to Feb. 24.

The volumes heading to unknown destinations are mostly Sokol cargoes that have recently been transferred to other vessels at Yeosu, or are currently being shuttled to an area off the South Korean port from the loading terminal at De Kastri.

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

Note: Data on crude flows can also be found at {DSET CRUDEJ }. The numbers, which are generated by a bot, may differ from those in this story.

--With assistance from Sherry Su.

Most Read from Bloomberg Businessweek

This Road Could Save the Planet—and Carve Up Alaskan Wilderness

Higher Interest Rates Slam Stocks and Profits But Spare Workers

The Fed-Up Copywriter Who Helped France Finally Embrace #MeToo

Microsoft Expands Game Pass as Regulators Fret Over Activision Deal

Germ-Zapping Lasers Help Cut Down on Infections After Surgery

©2023 Bloomberg L.P.