Russia's Crude Exports Rebound as Signs of Cuts Remain Elusive

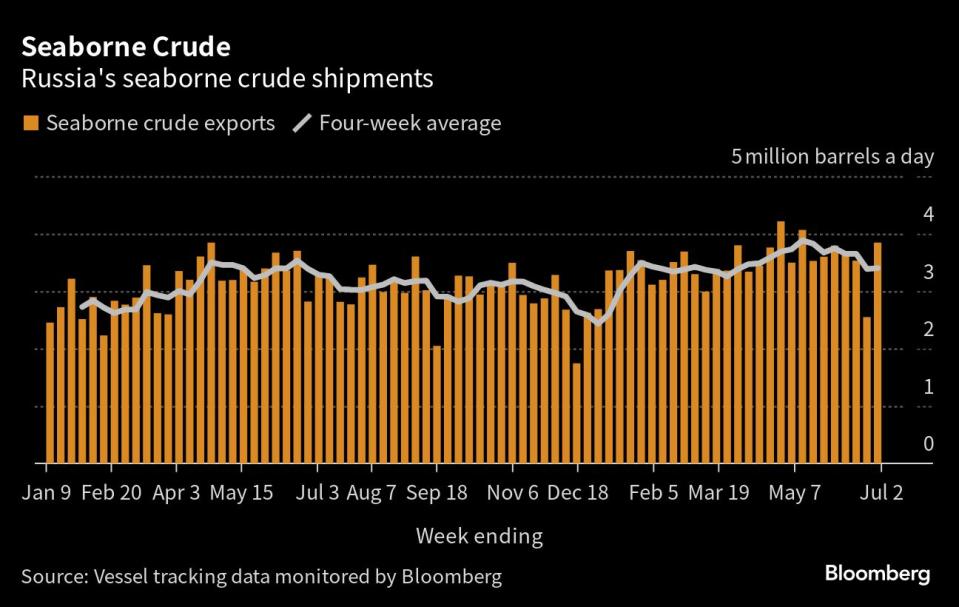

(Bloomberg) -- Russia’s seaborne crude oil flows to international markets rose sharply last week to hit a seven-week high and indicate that the previous week’s drop was maintenance-related.

Most Read from Bloomberg

US Stocks Mixed as Tech Giants Hold Onto Gains: Markets Wrap

Earth Keeps Breaking Temperature Records Due to Global Warming

Xi’s Metal Curbs Risk Backfiring as G-7 Seeks China Alternative

Lazard Fires Senior Banker for Inappropriate Behavior at Party

China Restricts Export of Chipmaking Metals in Clash With US

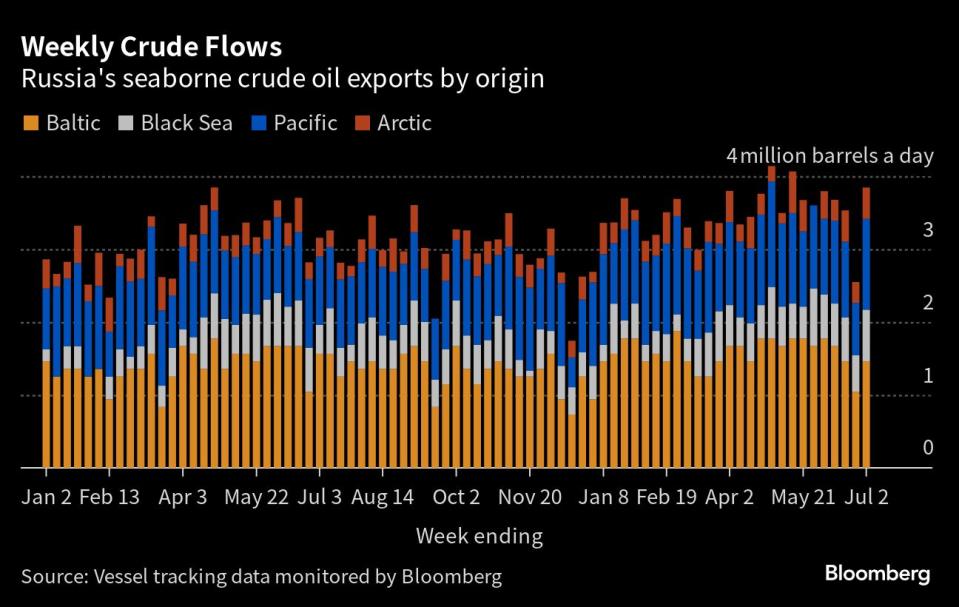

Crude flows through Russian ports jumped by about 1.3 million barrels a day in the week to July 2, as flows through two key export terminals bounced back, following a well-established pattern that previously has been related to maintenance. Bigger shipments were seen from all regions, but the largest gains came from the Baltic and Pacific ports, which had been the hardest hit in the prior week’s slump.

Russia plans to cut crude export flows in August by 500,000 barrels a day in an effort that it says is intended to help keep the global market balanced. Deputy Prime Minister Alexander Novak didn’t give a baseline for the export reduction. A subsequent statement from Novak’s office indicated that output would be scaled back by a similar amount.

So far, there has been little evidence that an initial output cut that was due to come into effect in March — retaliation for Western sanctions imposed after Russia’s invasion of Ukraine — has had any material impact on crude flows out of the country. In the latest four-week period, seaborne exports were still running about 25,000 barrels a day above their average level in February, the baseline month for that reduction, despite the slump in the week to June 25.

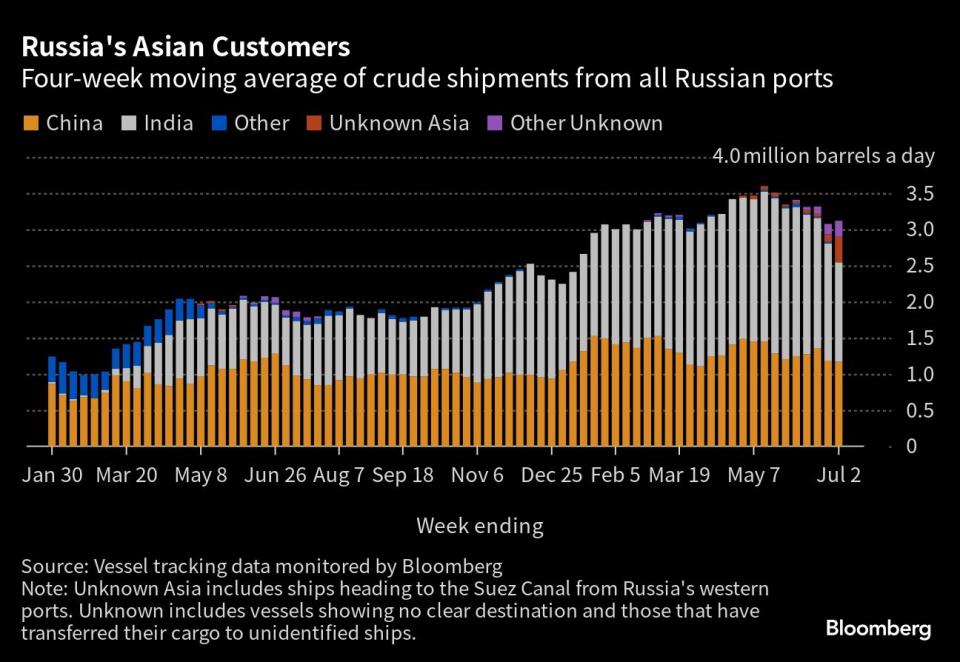

Crude flows to India, which has emerged as the biggest buyer of Russia’s seaborne flows, appear to be slipping as the country starts to reach the limits of its Russian purchases. Shipments exceeded 2 million barrels a day in May, but are set to average at least 50,000 barrels a day less than that in June. The gap could be even wider if some of the vessels currently heading to Asia, but yet to signal a final destination, end up in China.

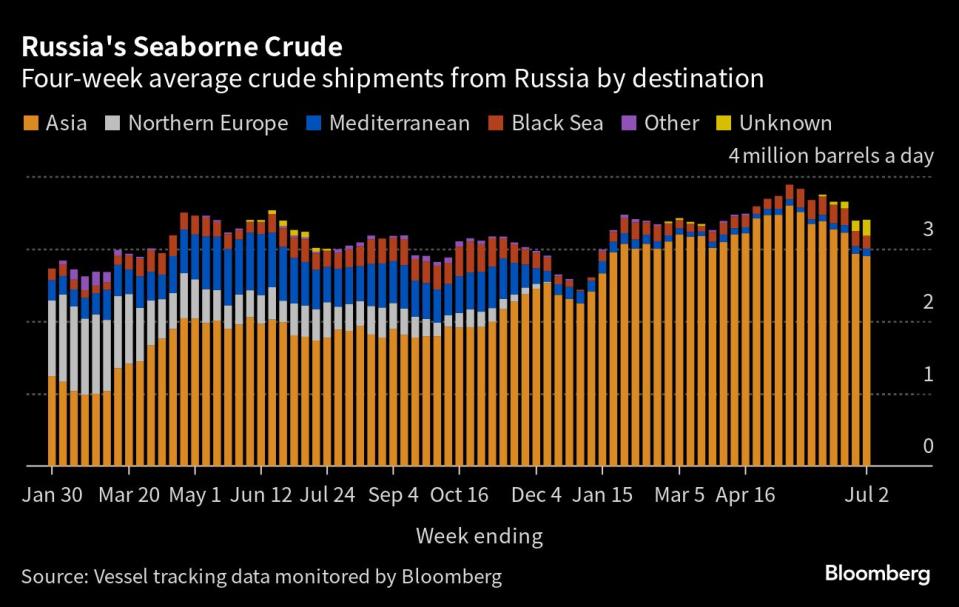

Crude Flows by Destination

On a four-week average basis, overall seaborne exports in the period to July 2 edged up by 12,000 barrels a day to 3.4 million barrels a day. The impact of the previous week’s slump in shipments will be felt in four-week average flows until late July.

Weekly data are affected by the scheduling of tankers and loading delays caused by bad weather. Port maintenance can also disrupt exports for several days at a time.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through the Baltic ports of Ust-Luga and Novorossiysk.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies. Transit crude is specifically exempted from European Union sanctions.

Asia

Most Read from Bloomberg

US Stocks Mixed as Tech Giants Hold Onto Gains: Markets Wrap

Earth Keeps Breaking Temperature Records Due to Global Warming

Xi’s Metal Curbs Risk Backfiring as G-7 Seeks China Alternative

Lazard Fires Senior Banker for Inappropriate Behavior at Party

China Restricts Export of Chipmaking Metals in Clash With US

Four-week average shipments to Russia’s Asian customers, plus those on vessels showing no final destination, edged higher to 3.12 million barrels a day in the period to July 2 from 3.08 million barrels a day in the four weeks to June 25.

While the volumes heading to India appear to have declined from recent highs, history shows that most of the cargoes on ships without an initial destination eventually end up there or in China. But even if all the ships yet to show a final destination head to India, shipments to the nation would still be down by about 250,000 barrels a day from their peak in May.

The equivalent of 354,000 barrels a day was on vessels showing destinations as either Port Said or Suez in Egypt, or which already have been or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India or China and show up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at 221,000 barrels a day in the four weeks to June 18, are those on tankers showing no clear destination. Most of those cargoes originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey, while other cargoes are transferred from one vessel to another, either in the Mediterranean or, more recently, in the Atlantic Ocean.

Europe

Most Read from Bloomberg

US Stocks Mixed as Tech Giants Hold Onto Gains: Markets Wrap

Earth Keeps Breaking Temperature Records Due to Global Warming

Xi’s Metal Curbs Risk Backfiring as G-7 Seeks China Alternative

Lazard Fires Senior Banker for Inappropriate Behavior at Party

China Restricts Export of Chipmaking Metals in Clash With US

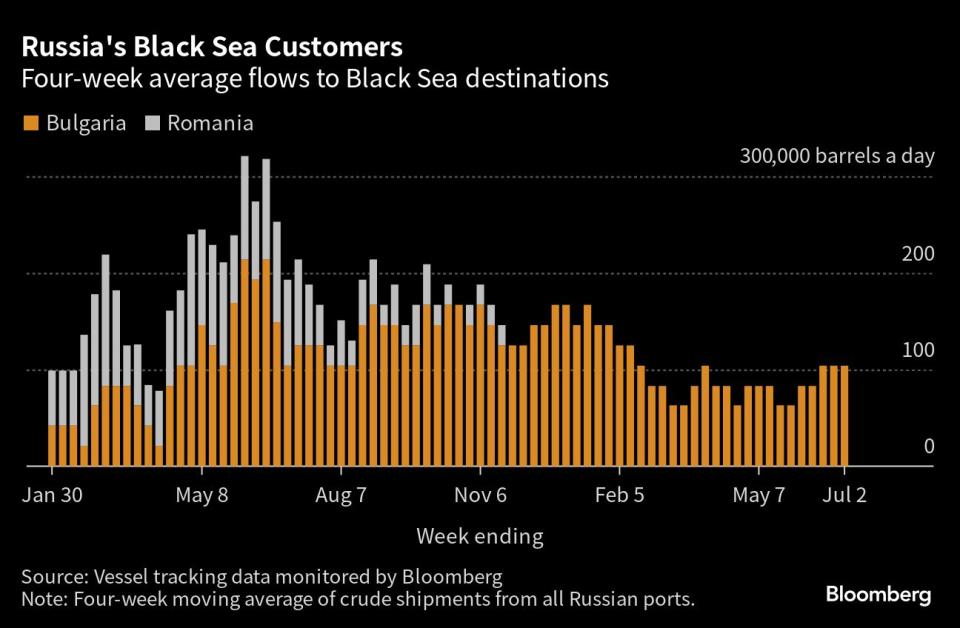

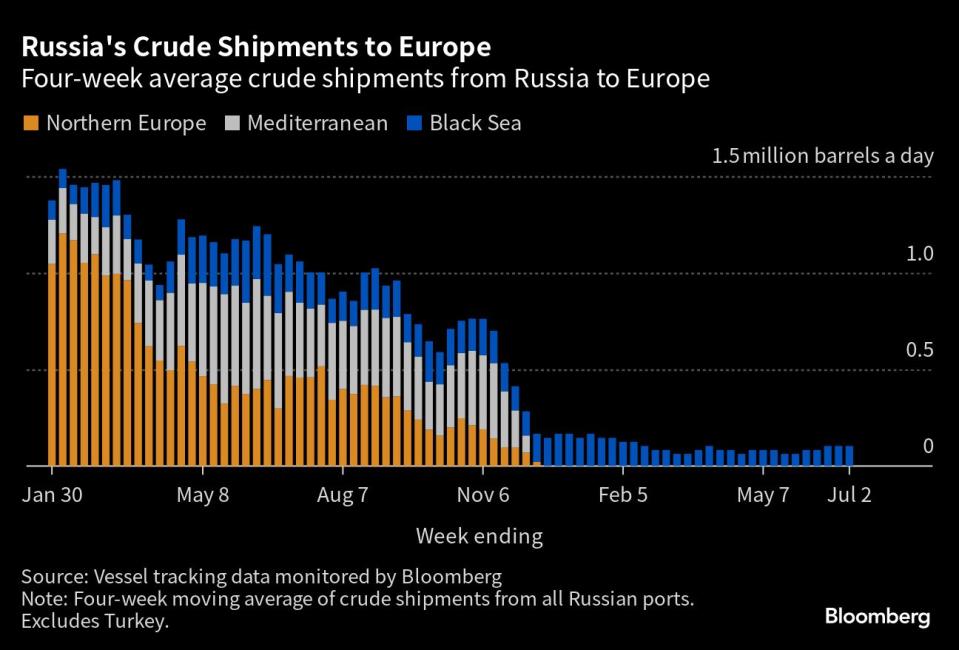

Russia’s seaborne crude exports to European countries were unchanged at 104,000 barrels a day in the 28 days to July 2, with Bulgaria the sole destination. These figures do not include shipments to Turkey.

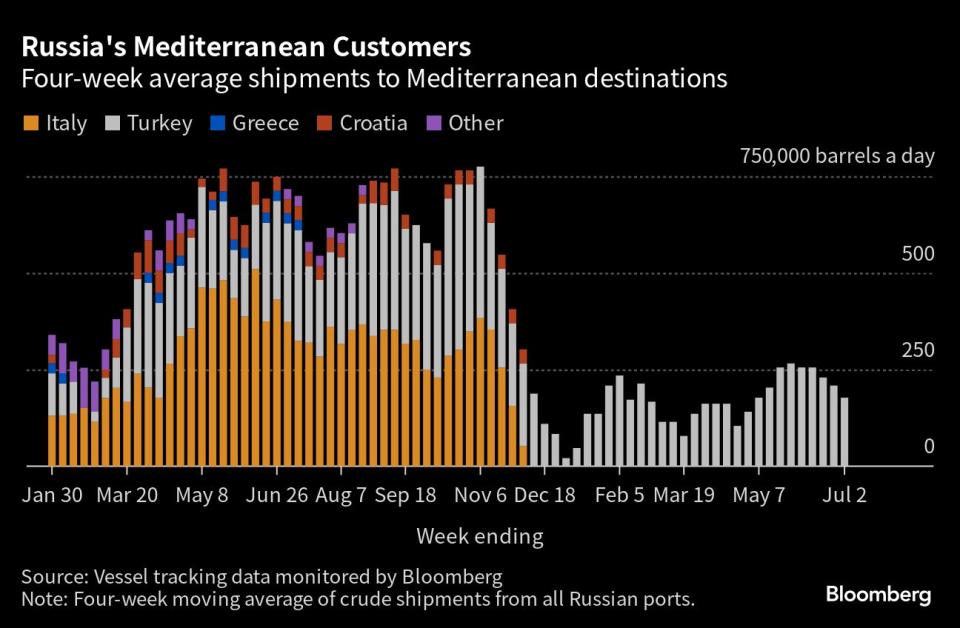

A market that consumed about 1.5 million barrels a day of short-haul seaborne crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve.

No Russian crude was shipped to northern European countries in the four weeks to July 2.

Exports to Turkey, Russia’s only remaining Mediterranean customer, fell to an eight-week low of 177,000 barrels a day in the four weeks to July 2; flows to the country had topped 425,000 barrels a day in October.

Flows to Bulgaria, now Russia’s only Black Sea market for crude, were unchanged, at 104,000 barrels a day for a third week.

Flows by Export Location

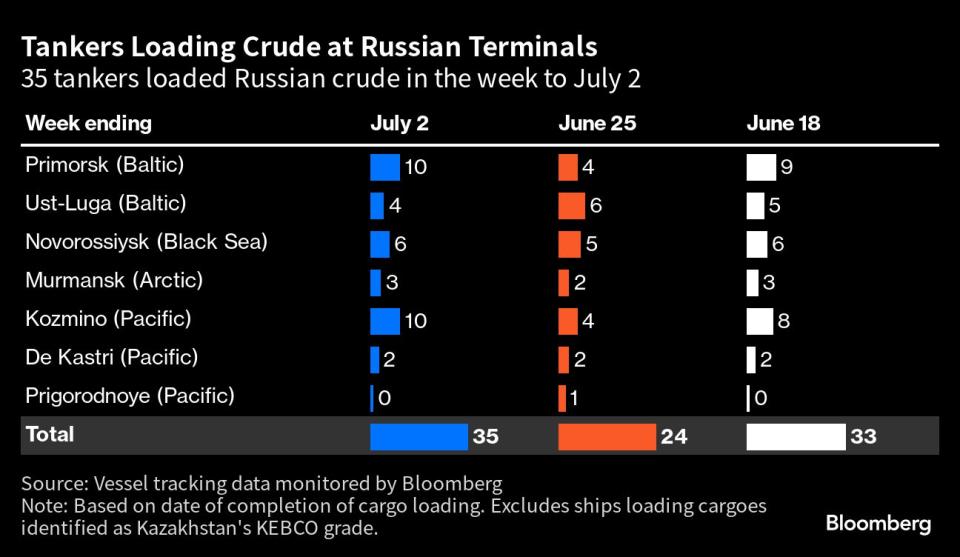

Aggregate flows of Russian crude rebounded to a seven-week high of 3.85 million barrels a day in the seven days to July 2, up from 2.55 million barrels a day the previous week. Shipments rose from all four export regions, with the biggest increases seen at Baltic and Pacific ports, where flows appeared to have been reduced by maintenance work the previous week.

Shipments from Primorsk soared by 626,000 barrels a day, or 150%, from the previous week. The increase was partly offset by a drop in flows from Ust-Luga, where one cargo of Kazakh crude was loaded in addition to the Russian barrels.

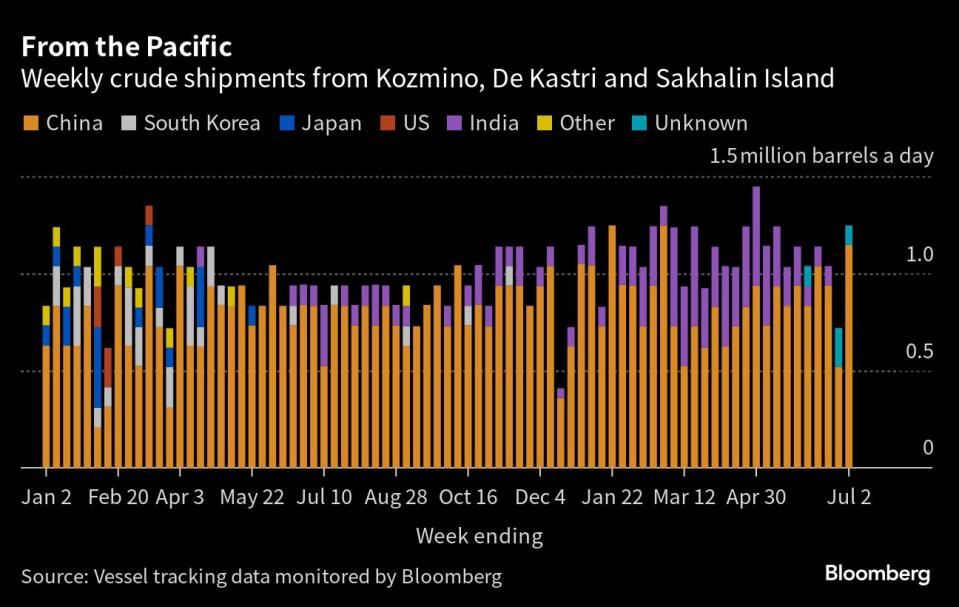

Flows from Kozmino, the largest export terminal in Russia’s Pacific region, were up week-on-week by 628,000 barrels a day to 1.05 million barrels a day, their highest since April.

Figures exclude volumes from Ust-Luga and Novorossiysk identified as Kazakhstan’s KEBCO grade.

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty soared to $59 million in the seven days to July 2, a jump of $20 million or about 50%. Four-week average income rose by $1 million to $52.5 million.

President Vladimir Putin ordered his government to fine-tune existing indicators and establish additional ones to calculate oil prices for tax purposes in order to reduce the discount to global crude prices. Russia’s government calculates oil taxes using a discount to Brent, which sets the floor price for the nation’s crude for budget purposes. If Russian oil trades above that threshold, the Finance Ministry uses the market price for tax calculations, as has been the case in recent months. From July the discount is currently set at $25/bbl, though this may now be narrowed.

The duty rate for June was set at $2.21 a barrel, based on an average Urals price of $55.97, which was $23.90 a barrel below Brent during the period between April 15 and May 14. The rate for July has been cut to $2.13 a barrel, based on an average Urals price of $54.57, which was $20.89 a barrel below Brent during the period between May 15 and June 14.

Origin-to-Location Flows

The following charts show the number of ships leaving each export terminal and the destinations of crude cargoes from the four export regions.

A total of 35 tankers loaded 26.9 million barrels of Russian crude in the week to July 2, vessel-tracking data and port agent reports show. That’s up by 9.1 million barrels from the previous week’s figure and the largest volume in seven weeks. Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress. All figures exclude cargoes identified as Kazakhstan’s KEBCO grade.

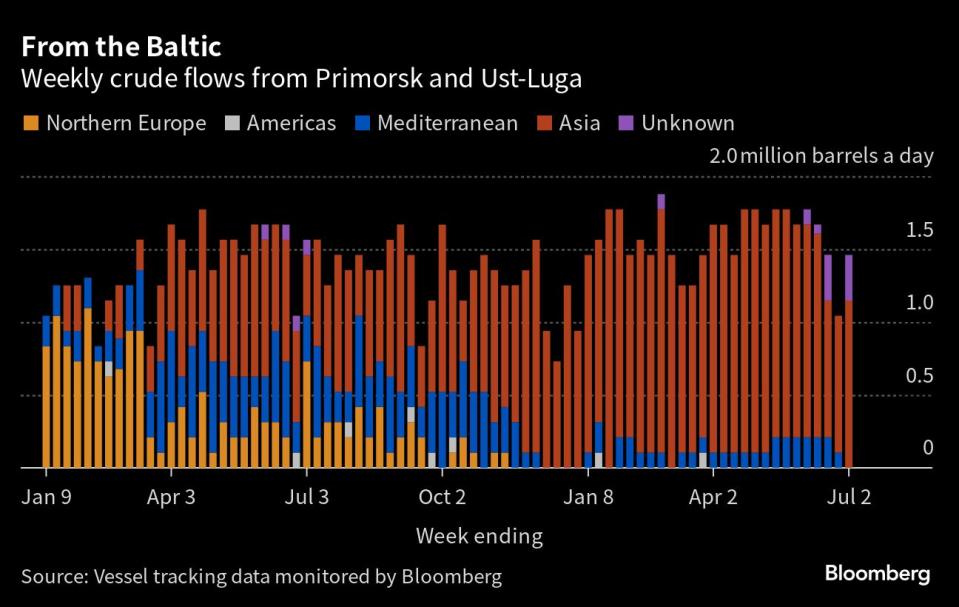

The total volume on ships loading Russian crude from Baltic terminals rebounded from the previous week’s six-month low to average 1.46 million barrels a day in the week to July 2.

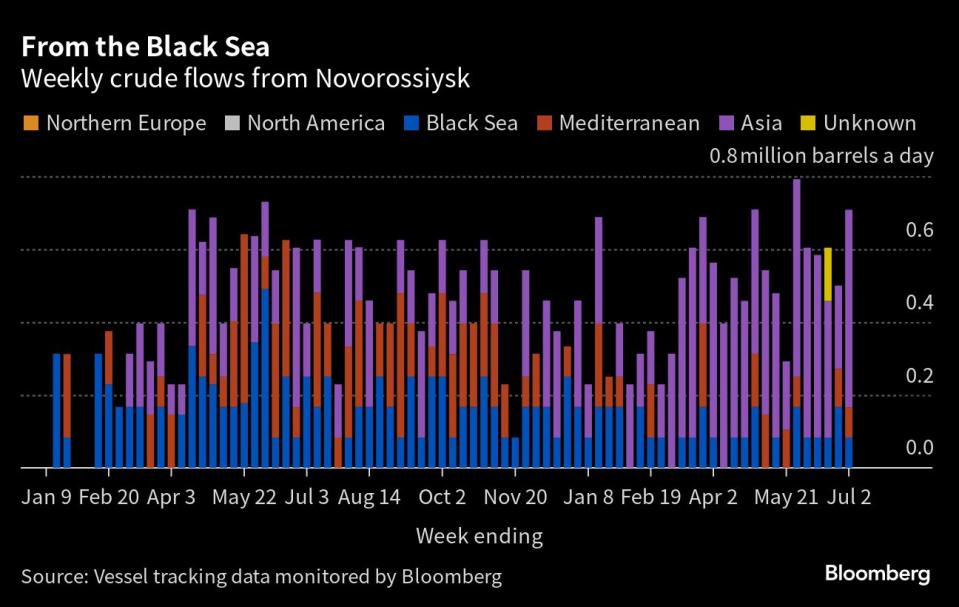

Shipments of Russian crude from Novorossiysk in the Black Sea jumped to five-week high of 708,000 barrels a day. One cargo of Kazakhstani crude was also loaded at the port during the week.

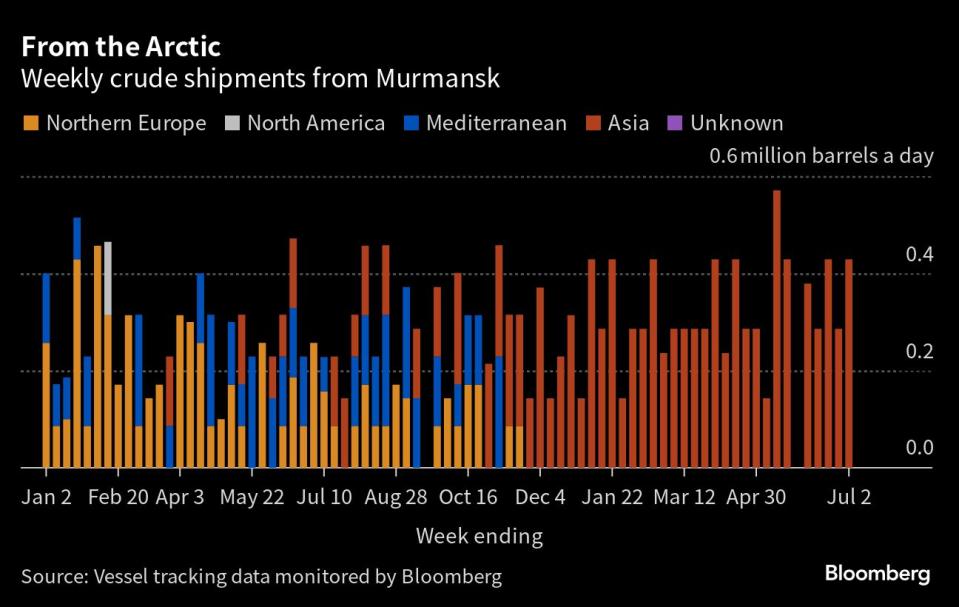

Arctic shipments recovered the previous week’s loss, rising back to 429,000 barrels a day, with three Suezmax tankers leaving the port in the week to July 2.

Twelve tankers loaded at Russia’s three Pacific export terminals, up from seven the previous week. The volume of crude shipped from the region jumped to a nine-week high of 1.25 million barrels a day.

The volumes heading to unknown destinations are mostly Sokol cargoes that recently have been transferred to other vessels at Yeosu, or are currently being shuttled to an area off the South Korean port from the loading terminal at De Kastri. Most of these are also ending up in India.

Some Sokol cargoes are now being transferred a second time in the waters off southern Malaysia. A small number of ESPO shipments are also being moved from one vessel to another in the same area. All of these cargoes have, so far, gone on to India. One cargo of ESPO crude was discharged into the Harmony Star floating storage unit off Malaysia.

No cargoes were loaded from the Sakhalin Island terminal in the week to July 2.

NOTES

Note: This story forms part of a regular weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

Note: Weeks have been revised to run from Monday to Sunday, rather than Saturday to Friday. This change has been implemented throughout the data series and previous weeks’ figures have been revised.

Note: The next update will be published on Tuesday July 11, with future updates also to be published on Tuesdays.

If you are reading this story on the Bloomberg terminal, click here for a link to a PDF file of four-week average flows from Russia to key destinations.

--With assistance from Sherry Su.

Most Read from Bloomberg Businessweek

The Air Jordan Drop So Hot It Blew Up an Alleged $85 Million Ponzi Scheme

A Pop-Up Concert Company Gives Bands a Place to Perform, and 70% of the Profit

How a Prison Gang Inspired by Hollywood Heists Stole $23 Million

EBT Skimmers Are Draining Millions of Dollars From the Neediest Americans

How a $100 Cheetah Cub Becomes an Illegal $50,000 Status Symbol

©2023 Bloomberg L.P.