Russia's Oil Flows Overshoot Target Even as Demand Outlook Dims

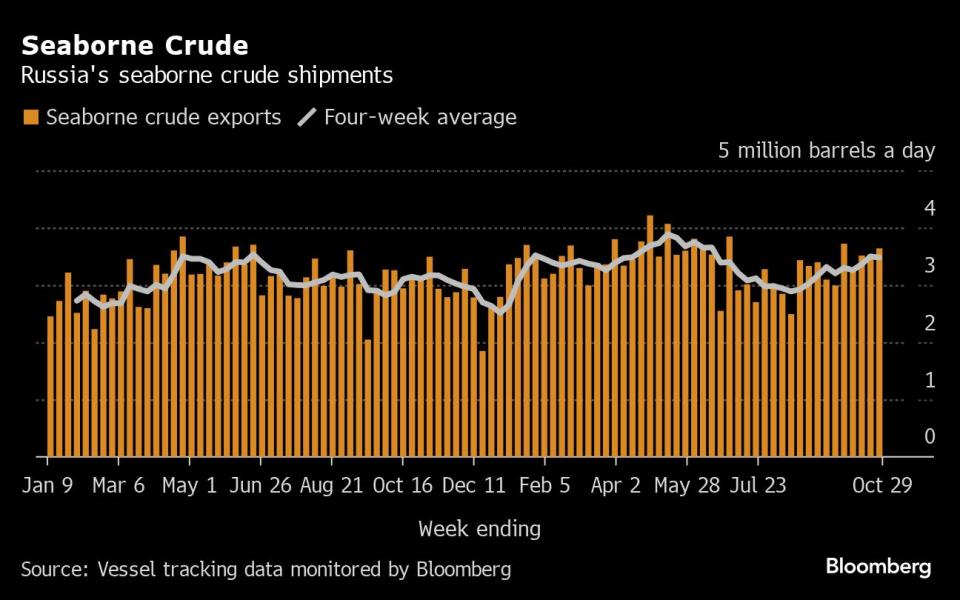

(Bloomberg) -- Russia’s oil flows climbed for a third week, with shipments exceeding a target set as part of a pact with Saudi Arabia to keep barrels off the market and adding to supply even as the demand outlook weakens.

Most Read from Bloomberg

Real Estate Industry Takes Fresh Hit With Verdict on Commissions

Israel Latest: Blinken Returning to Israel; Refugee Camp Hit

Sony’s Bungie Game Unit Cut 8% of Staff After ‘Destiny’ Play Wilted

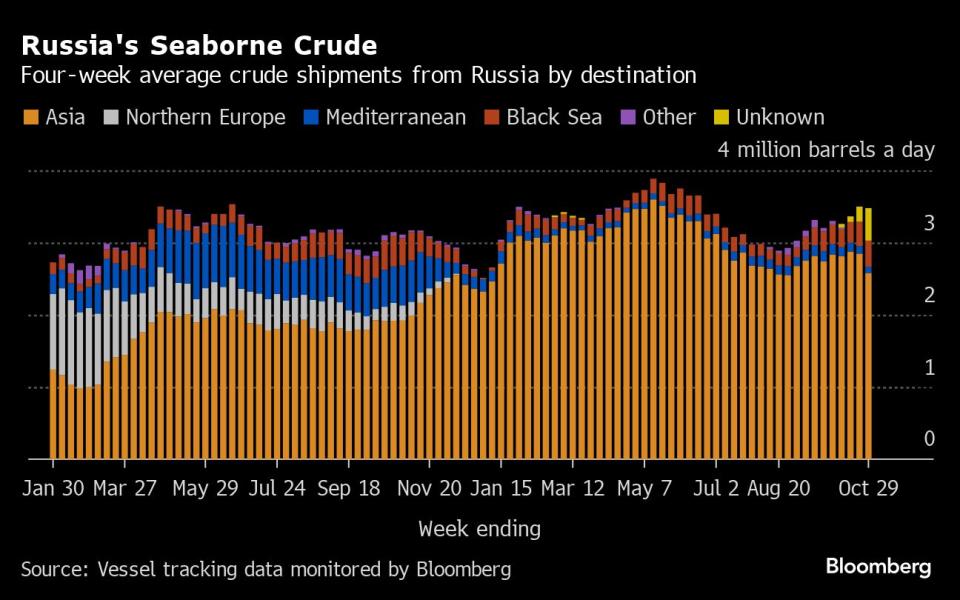

About 3.64 million barrels a day of crude was shipped from Russian ports in the week to Oct. 29, an increase of 110,000 barrels a day from the previous seven days, tanker-tracking data monitored by Bloomberg show. Despite that gain, the less volatile four-week average edged lower to 3.48 million barrels a day, down by about 20,000 barrels a day from the period to Oct. 22.

The weekly advance reflected a jump in shipments from Novorossiysk in the Black Sea, which was partly offset by a drop in the number of vessels leaving Russia’s Baltic and Pacific ports.

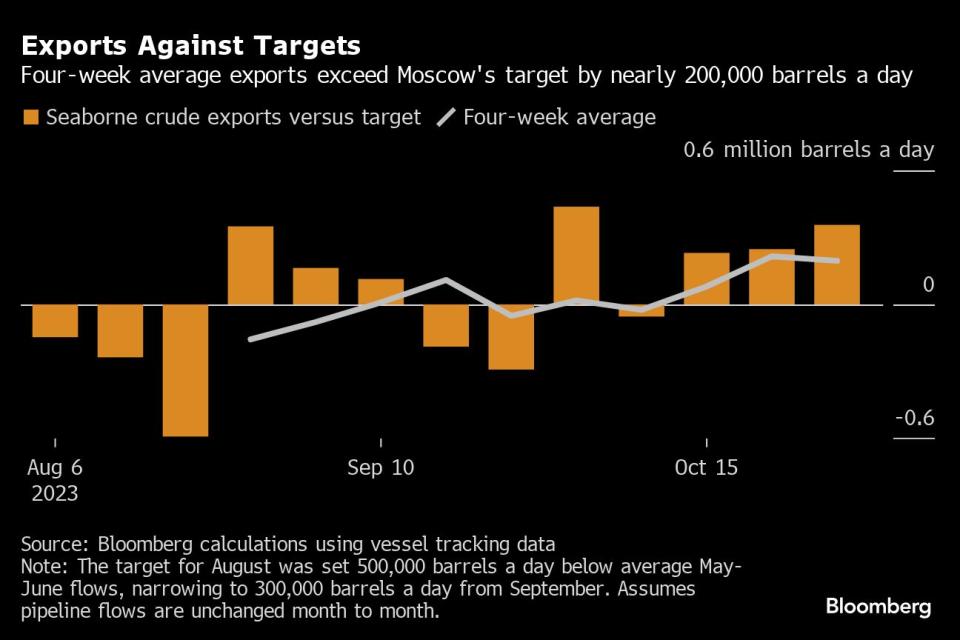

Deputy Prime Minister Alexander Novak said in early August that Moscow would prolong export restrictions at a reduced level of 300,000 barrels a day below their May-June average until the end of the year. Bloomberg calculations indicate that shipments through ports should be running now at about 3.28 million barrels a day.Weekly shipments exceeded Moscow’s target by the most in four weeks, overshooting by about 360,000 barrels a day. Despite edging lower, four-week average volumes exceeded it by almost 200,000 barrels a day in the most recent period.

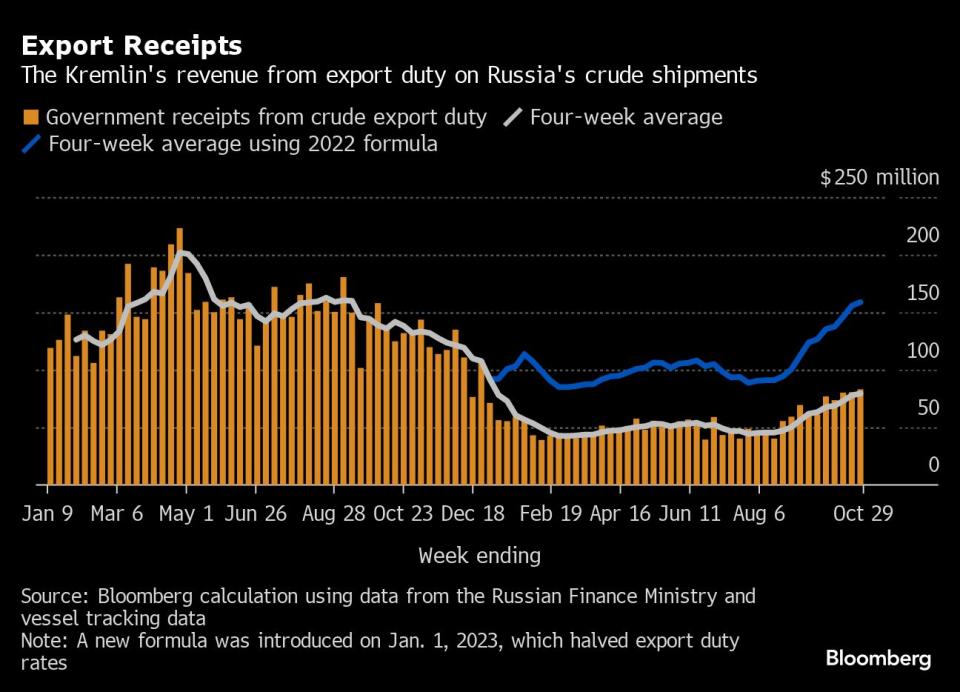

The increase in volumes raised the Kremlin’s weekly revenues from oil export duties to a new high for the year, while the four-week average rose for a 13th straight week, setting a new high for the period since the start of January.

Rising exports come even as Russia’s oil refining rate climbed to a seven-week high last week, with runs up by 210,000 barrels a day in the seven days to Oct. 25 from the previous week. Refinery runs have improved as routine maintenance that’s set to run through next month draws to an end. That boosted Russia’s average daily processing during the Oct. 1-25 period to 5.31 million barrels a day, though that’s still below the 5.38 million barrels a day for most of September.

Flows by Destination

Russia’s seaborne crude flows edged lower in the four weeks to Oct. 29 to average 3.48 million barrels a day. That’s down from 3.5 million barrels a day in the period to Oct. 22. Shipments remain about 105,000 barrels a day below the average seen during the surge in volumes between April and June.

All figures exclude cargoes identified as Kazakhstan’s KEBCO grade. Those are shipments made by KazTransoil JSC that transit Russia for export through Novorossiysk and the Baltic port of Ust-Luga and are not subject to European Union sanctions or a price cap.

The Kazakh barrels are blended with crude of Russian origin to create a uniform export grade. Since Russia’s invasion of Ukraine, Kazakhstan has rebranded its cargoes to distinguish them from those shipped by Russian companies.

Asia

Most Read from Bloomberg

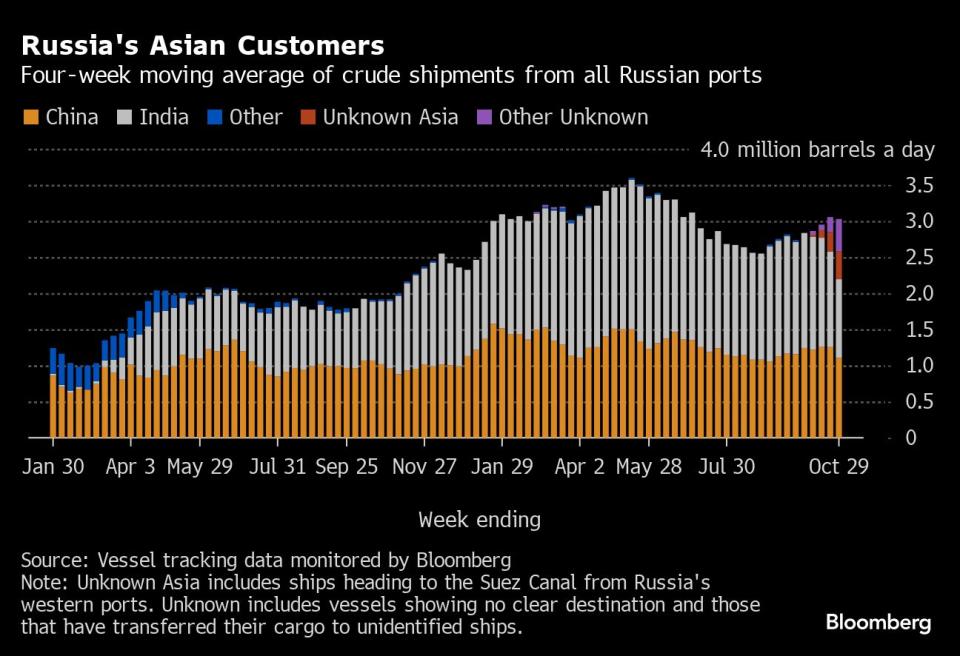

Observed shipments to Russia’s Asian customers, including those showing no final destination, edged lower to 3.03 million barrels a day in the four weeks to Oct. 29, from 3.06 million barrels a day in the period to Oct. 22. That’s well below a peak of about 3.6 million barrels a day seen in May.

About 1.1 million barrels a day of crude was shipped to China in the four weeks to Oct. 29, but that figure may rise once the destinations become apparent for more than 23 million barrels of crude on tankers that have yet to signal their final port of call. Shipments to China are similar to the volume on ships heading to India, but China’s seaborne imports are supplemented by about 800,000 barrels a day of crude delivered directly from Russia by pipeline.

Flows to India are rising, but remain well below peak levels seen earlier this year. Even if all of the cargoes on ships without an initial destination eventually end up in India, shipments to the country will be about 220,000 barrels a day, or 10%, down from their May high. Adding the “Unknown Asia” and “Other Unknown” volumes to the total for India gives a figure of 1.92 million barrels a day in the four weeks to Oct. 29. That’s the most in 21 weeks, but down from a high of 2.15 million barrels a day in the period to May 21.

India’s Bharat Petroleum is taking as much of Russia’s Urals crude as it can, according to Finance Director Vetsa Ramakrishna Gupta, with Russian barrels accounting for as much as 45% of the company’s total crude consumption.

The equivalent of about 384,000 barrels a day was on vessels signaling Port Said or Suez in Egypt, or are expected to be transferred from one ship to another off the South Korean port of Yeosu. Those voyages typically end at ports in India or China and show up in the chart below as “Unknown Asia” until a final destination becomes apparent.

The “Other Unknown” volumes, running at about 450,000 barrels a day in the four weeks to Oct. 29, are those on tankers showing no clear destination. Most of those cargoes originate from Russia’s western ports and go on to transit the Suez Canal, but some could end up in Turkey. Others could be moved from one vessel to another, with most such transfers now taking place in the Mediterranean, off the coast of Greece.

Pakistan Refinery Ltd. has signed a long-term supply deal with Russia under which it will receive as much as 75,000 tons of crude a month, equivalent to about 18,000 barrels a day. The first cargo is due to arrive in December.

Europe and Turkey

Most Read from Bloomberg

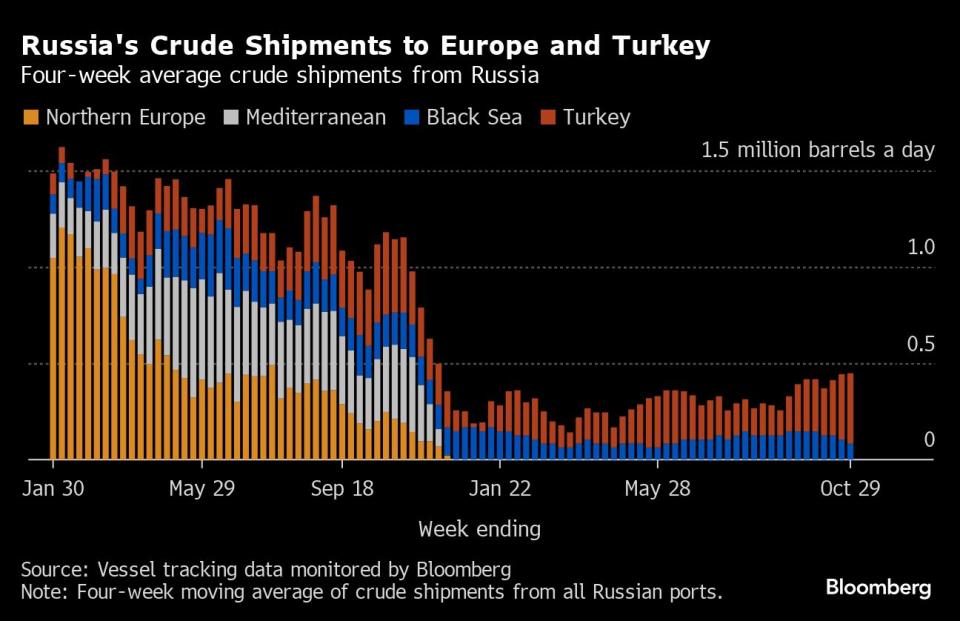

Russia’s seaborne crude exports to European countries have collapsed since Moscow’s troops invaded Ukraine in February 2022. A market that consumed about 1.5 million barrels a day of short-haul seaborne crude, coming from export terminals in the Baltic, Black Sea and Arctic has been lost almost completely, to be replaced by long-haul destinations in Asia that are much more costly and time-consuming to serve. These figures do not include shipments to Turkey.

No Russian crude was shipped to northern European countries, or those in the Mediterranean in the four weeks to Oct. 29.

Flows to Bulgaria, now Russia’s only European market for crude, fell to a 20-week low of about 83,000 barrels a day.

Exports to Turkey jumped to about 365,000 barrels a day in the four weeks to Oct. 29. That’s the highest in 51 weeks and makes the country the third-biggest importer of seaborne crude from Russia. Flows had topped 425,000 barrels a day in October 2022, before falling sharply after a Group of Seven price cap came into effect in early December. The recent increase comes after Lukoil resumed deliveries to the Azerbaijani-owned Star refinery at Aliaga. Supplies are expected at about 100,000 barrels a day, equivalent to half of the refinery’s capacity.

Vessel-tracking data are cross-checked against port agent reports as well as flows and ship movements reported by other information providers including Kpler and Vortexa Ltd.

Export Revenue

Inflows to the Kremlin's war chest from its crude-export duty rose to $83 million in the seven days to Oct. 29, while four-week average income jumped to $79.4 million. The four-week average set a new high for the period since the start of January. Rising oil prices and the rebound in flows are both contributing to the increase in receipts.

The duty rate for October has been set at $3.26 a barrel, based on an average Urals price of $77.03 during the calculation period between Aug. 15 and Sept. 14. That was $11.60 a barrel below Brent over the same period. October’s duty rate sets a new high for the year. The rate for November has been set at $3.57 a barrel, based on an average Urals price of $83.35 during the calculation period between Sept. 15 and Oct. 14. That was about $7.70 a barrel below Brent over the same period. November’s duty rate sets another new high for the year.

Origin-to-Location Flows

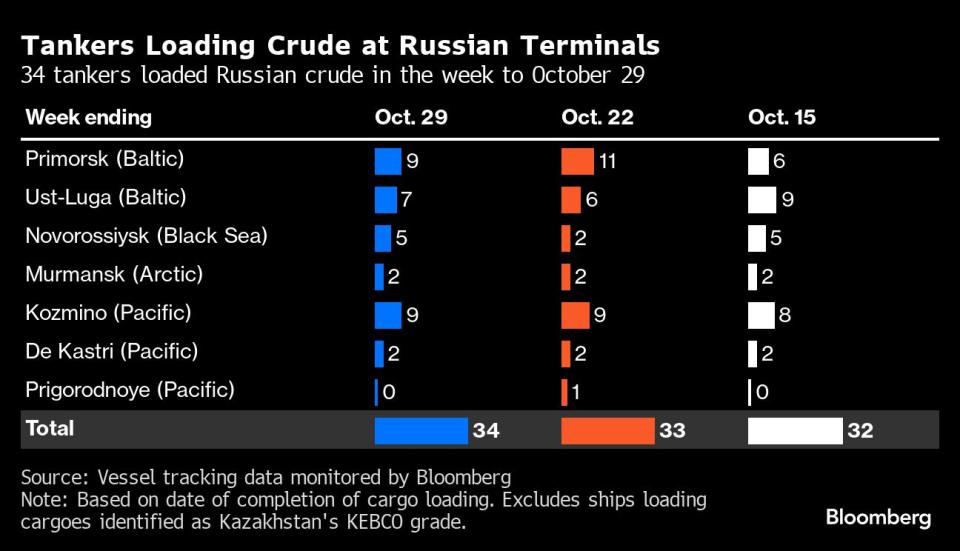

The following table shows the number of ships leaving each export terminal.

A total of 34 tankers loaded 25.5 million barrels of Russian crude in the week to Oct. 29, vessel-tracking data and port agent reports show. That’s up by about 760,000 barrels from the previous week.

A jump in shipments from Novorossiysk in the Black Sea was partly offset by a drop in the number of vessels leaving Russia’s Baltic and Pacific ports.

Destinations are based on where vessels signal they are heading at the time of writing, and some will almost certainly change as voyages progress. All figures exclude cargoes identified as Kazakhstan’s KEBCO grade.

In addition, one cargo of KEBCO was loaded at Ust-Luga during the week.

NOTES

Note: This story forms part of a weekly series tracking shipments of crude from Russian export terminals and the export duty revenues earned from them by the Russian government. Weeks run from Monday to Sunday. The next update will be on Tuesday, Nov. 7.

Note: All figures exclude cargoes owned by Kazakhstan’s KazTransOil JSC, which transit Russia and are shipped from Novorossiysk and Ust-Luga as KEBCO grade crude.

If you are reading this story on the Bloomberg terminal, click here for a link to a PDF file of four-week average flows from Russia to key destinations.

--With assistance from Sherry Su.

Most Read from Bloomberg Businessweek

Web Summit Israel Mess No Surprise to Those Who Know its Founder

America’s Culture Wars Have Liberal Parents Opting for Home-Schooling

©2023 Bloomberg L.P.