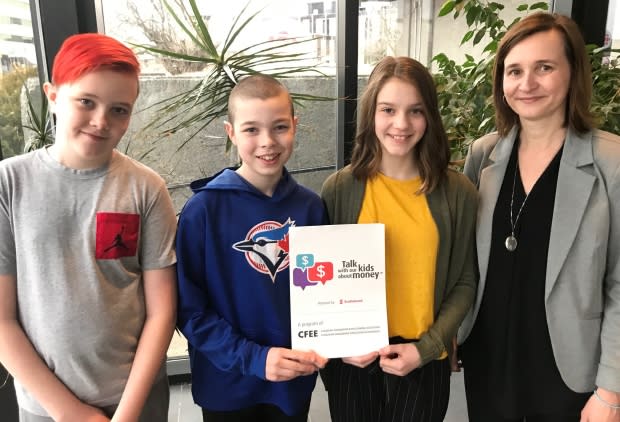

These smart cookies are in Grade 6, but already learning about budgets and saving

Think Grade 6 is too early to learn about personal financial planning? Think again, say three students who are putting their math lessons to use.

April 17 — the day after the Newfoundland and Labrador Liberal government released its latest proposed budget — is Talk With Our Kids About Money Day, organized by the Canadian Foundation for Economic Education.

But for at least three Grade 6 students from Mary Queen of Peace in St. John's, it's not just a day of learning: they've been learning about budgeting and saving money for a while now.

You should put a certain amount into spending, short-term, long-term, and donating. - Fiona DeCost

"I think with saving money, most people, they don't realize how much they put in there," says Fiona DeCost.

"If I just got like maybe five bucks, I'll put a couple in for saving and then just spend the rest. They don't realize they have to save more and more, and then some people, they don't end up having much saved."

The students sat through a presentation about budgeting and finances about a month ago, before organizing an educational game for kids to learn how to put away money.

"We played this game where we rolled the die and whatever number we got on the dice, there was a piece of paper that said, like, 'Earn $10 for your birthday,'" said Jackson Pardy.

"And then we would take that and then decide how much goes into long-term savings, short-term savings, spending and giving/donating."

Not all the students in the class had the same idea of what to do with their money.

"I would put a pretty big chunk of it in spending, just in case something happens. You're gonna need to put some money in there," said Alex Dawe.

"Say you were gonna save up to buy a new video game, you would probably put it in the short-term savings, and then if you were planning to go on a trip in a year or so, you'd probably put it in long-term savings."

'It's gonna make a difference'

Grade 6 might sound a little early to start talking about budgeting, teacher Erin Dawe said, but it's definitely not.

Financial literacy is something that kids will be able to use through literally their entire lives, she said.

"When we all get to be working in our career, you need to be budgeting all the time to figure out how much money is going to go on food, how much money is going to go on your mortgage, your car payment and all those kinds of things, so it's very important.

"And if you start young, it's gonna make a difference long-term to figure out how much you need for day-to-day living."

It's an exercise that has paid off for these kids, who said it got them thinking about long-term life planning with money, as well.

"I know I'm probably gonna need a fair amount because I was always interested in space, so I know that to be an astrophysicist and stuff you're probably gonna need a fair amount of money to go get your PhD," said DeCost.

"I think it's really important for kids to know how to handle their money when they get older, to support them and their family live a good life," added student Dawe.

The lessons are being put to good use, too.

"Recently, my tablet broke," said Pardy.

"And we took all our birthday money, me and my brother, and we saved up to buy a new model of an iPad. Then some of it went into short-term savings."

Passing along their lessons learned

Not all your money needs to be saved, DeCost said, but you should definitely think at least a bit about what to put away, when, and how much.

"There is a difference between being smart about saving and just hoarding your money," she said.

"Some people, they're so worried about not having any saved up that they put it all into savings, but in reality, you should put a certain amount into spending, short-term, long-term, and donating, because you still would need some to spend, as well."

All three students said Grade 6 is the perfect time for them to learn about money, and they plan to pass on their new knowledge to their younger siblings — when they're old enough, that is.

"I have a little brother and he gets money every now and then. Like if he's not cleaning up his room, my parents will be like, 'I'll give you $2 if you go clean up your room.' And every time he gets it, he says, 'Can we go walk to Marie's to go get some candy?'" DeCost said.

"I always tell him, 'Reese, no, you have to save that for when you might actually need it.' It's only $2, but eventually as you build up it will eventually count."

Dawe's little sister is four, and she always wants toys, so he's hoping to tell her about budgeting — just not yet.

"I don't think she'd understand," he said with a laugh. "But yeah, I'll probably tell her in the future."

Read more from CBC Newfoundland and Labrador