Taiwan Seen Keeping Rates Unchanged in Leadup to Election

(Bloomberg) -- Taiwan’s central bank is likely to hold its benchmark rate steady Thursday as striking the right balance between inflation and economic growth becomes a bigger concern ahead of a key presidential election early next year.

Most Read from Bloomberg

Ex-Goldman Bankers Make a Fortune With Controversial Bet on Coal

‘Dead Space’ Co-Creator Departs Startup After Newest Game Flops

Cisco to Buy Splunk for $28 Billion in Giant AI-Powered Data Bet

The monetary authority is seen erring on the side of supporting the economy and leaving borrowing costs unchanged at 1.875% for a second straight quarter, according to all 19 economists surveyed by Bloomberg.

Inflation appears to be in check for now — despite a weather-related spike in consumer prices last month — after the government took steps to curb fuel and electricity costs, among other measures. At the same time, growth is still being hit by a slump in exports, a key component of the technology-driven manufacturing sector.

“With inflation already back at around 2% recently, when it comes to the downside economic risk, we don’t really need to get into the tricky issue of whether or not to change rates,” Anita Hsu, economist at Taipei-based Masterlink Securities Investment Advisory Corp, said in an interview.

Both growth and inflation will likely be factors in the presidential election in January. The government’s latest forecast is for the economy to expand 1.61% this year, which would be the slowest pace since 2015, largely due to the slump in the electronics cycle. The central bank is likely to cut its own growth estimate of 1.72% on Thursday as well.

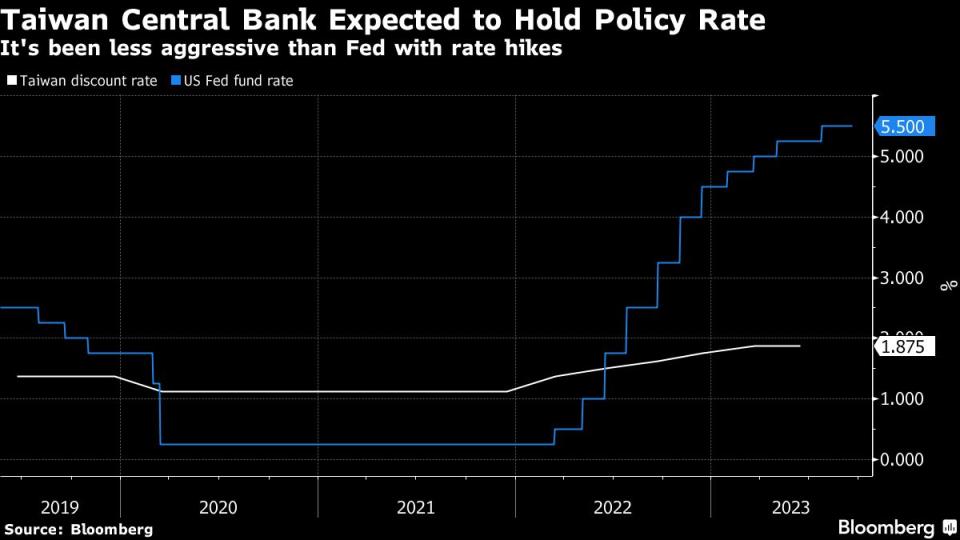

While Taiwan has tightened monetary policy alongside the Federal Reserve, it’s taken a less hawkish approach to hiking rates, given the economy’s slowdown.

The Fed’s pause on Wednesday gives Taiwan’s policymakers scope to keep rates unchanged this month. However, that doesn’t mean they’ll be in any rush to lower borrowing costs soon, according to Hsu, who sees no change in the benchmark rate through 2024.

Higher service prices and expected increases to Taiwan’s minimum wage have had a structural impact on prices in Taiwan, according to Hsu, meaning inflation is unlikely to return to its previous level around 1% in the foreseeable future.

Lending rates also won’t have much effect on the economy right now, according to Cathay United Bank’s chief economist Eupho Lin, because the main problem isn’t companies’ access to credit but rather weak investment demand.

In the run up to the election, most public debate will focus on how to control inflation, according to Lin.

“If the prices of essential staples stay at elevated levels, it will become a political issue and trigger arguments between the political campaigns,” he said. “So the central bank should focus on explaining how its policies are working to contain inflation expectations.”

--With assistance from Argin Chang.

Most Read from Bloomberg Businessweek

©2023 Bloomberg L.P.