Temu is the biggest advertiser on Meta. What could go wrong?

Temu spends tons on advertising — reportedly nearly $2 billion last year on Facebook and Instagram.

That's great for Meta, where Temu was the No. 1 advertiser in 2023, a new report says.

But Temu's Chinese parent company is quite mysterious — a potential risk for Meta and Google.

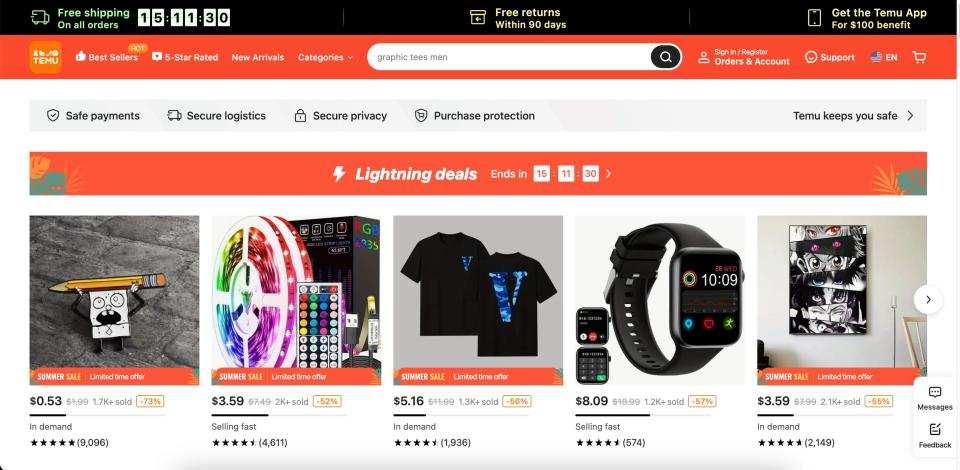

Temu, the e-commerce app of whimsical, boomer-pleasing bargain-bin delights, has been very good to Meta.

It spent about $2 billion last year on Facebook and Instagram ads, according to a report in The Wall Street Journal that cited people familiar with the matter — and it was the No. 1 advertiser by revenue on Meta. So much so that some Meta employees joked they should thank Temu by giving it a gift card.

Other Big Tech companies have also enjoyed the benefits of Temu's swollen ad budget. The company made its way into Google's Top 5 advertisers, too, according to the Journal's report. And Pinterest's CEO pointed out the Temu effect during a recent earnings call, calling it "a nice … contributor." (It also spent tens of millions of dollars on three Super Bowl ads.)

Temu is a division of China-based PDD Holdings, which also operates Pinduoduo in that country. It's deployed a well-known playbook of doing a massive ad spend on social to acquire customers and get app downloads. This is all apparently in hopes that such a big ad spend will pay off later. Sometimes, this works; sometimes, it doesn't. Wish, a Chinese e-commerce app, made this same move in the late 2010s, but it fizzled out.

It seems to be working now: Temu was the second fastest-growing website for 2023, only second to OpenAI. One report found that nearly 1 out of 3 shoppers in the US had used Temu.

A representative for Temu told Business Insider that it disputed the $2 billion figure reported by the Journal. The company wouldn't disclose what it said was Temu's actual ad spend budget.

Temu's ad spending is lining Meta's and Google's pockets

Meta and Google are probably pleased with the ad revenue for now.

Meta just posted record profits for last quarter and has a soaring stock price, with a brief mention in its earnings report that 10% of its global ad revenue came from Chinese e-commerce and gaming ads.

But there's something strange there. John Herrman in New York Magazine noticed a paradox in how Big Tech is very happy to publicly distance itself from connection to China. (Meta has been happy to throw Tiktok under the bus.)

From Herrman:

At the same time, Chinese-American tech interdependence has by many measures increased. Ad-supported firms like Meta and Google have benefited from massive spending from firms like Shein and Temu; online retailers including but not limited to Amazon have become, effectively, conduits for a new form of direct, loophole-enabled cross-border commerce.

I've shopped at Temu, and as someone who loves cheap junk, I see the appeal. But there are serious concerns about potential forced labor practices at its suppliers — and also how the addictive nature of cheap, gamified shopping can lead to our junk pile.

(A representative for Temu told Business Insider, "Temu's commitment to full compliance in the markets it operates in has been unwavering since inception.")

But there's something else going on that might worry companies like Google and Meta that are enjoying the Temu ad bonanza. The Financial Times published a big investigation into Temu's parent company PDD and concluded that it's mysterious in ways that publicly traded companies normally aren't.

Mystery surrounds basics like who owns the company, where its offices are located, and straightforward aspects of its business model and financials, like what the gross value of its merchandise is:

Why does PDD look like much smaller peers when staff levels and research spending are compared? Why haven't competitors described the impact of PDD's rise? Why do balance sheet metrics move at a different pace to revenues? How does a $200bn company own less than $150mn worth of hard assets?

The Financial Times investigation makes a strong case that Temu's parent company is indeed mysterious and very unlike other Chinese e-commerce competitors like Alibaba. But it's not clear what conclusion we should draw. (A PDD spokesperson told the FT that it "disagreed" with the characterization of its company as opaque.)

Mysterious advertisers might raise red flags

However, for Meta and Google, I would humbly suggest that it may not be a great thing if one of your top advertisers has an opaque and mysterious business model that is the subject of a splashy media investigation into how no one seems to know how it makes money.

But it all may not matter too much anyway. According to a Business Insider report, the recent ad blitz from Temu and Shein is expected to cool:

Ad industry insiders expect the retailer ad spend to continue through much of 2024, before tapering off by next year. Far from being a new category of heavy ad spenders, experts expect the spike from retail marketplaces to be short-lived, like the temporary surges created by the cryptocurrency and buy now, pay later firms a few years ago.

Even at $2 billion, Temu's ad spend may not make it stand out. Meta's CFO, Susan Li, told the Journal that of the China ad revenue, Temu, and the other Top 10 ad spenders only accounted for a third of that country's bucket.

Ultimately, Meta and Google will be able to handle losing Temu ad revenue, if and when that day comes — and they have bigger existential crises on their plates, like Meta's lawsuits over child harm and Google's Gemini bungle.

But Temu has quickly become a company with reverberations across all of Big Tech.

March 8, 2024 — This article has been updated to add comment from a Temu representative.

Read the original article on Business Insider