Thailand to Hold Rate as Government Piles Pressure to Ease

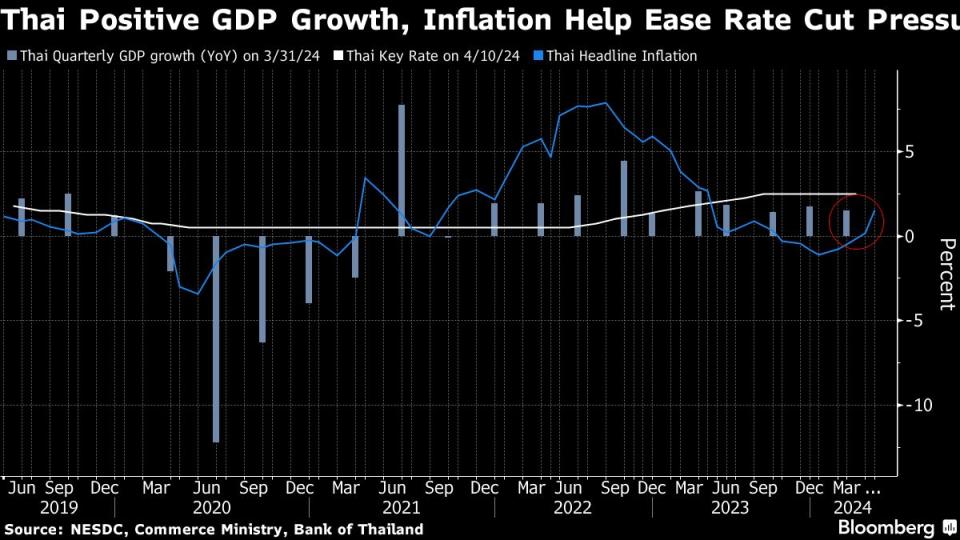

(Bloomberg) -- Thailand’s central bank is poised to maintain its benchmark interest rate at a decade high on Wednesday as spending and inflation gather pace, giving policymakers more room to withstand government calls for an immediate rate cut.

Most Read from Bloomberg

US Inflation Broadly Cools in Encouraging Sign for Fed Officials

Blinken Casts Doubt on Cease-Fire Hopes After Hamas Responds

Britain’s ‘Quiet Quitters’ Are Costing the Economy £257 Billion

Twenty-one out of 24 analysts surveyed by Bloomberg expect the Bank of Thailand to keep the one-day repurchase rate unchanged at 2.5% for a fourth meeting, with the rest predicting a quarter-point cut. A growing number of economists including those from Goldman Sachs Group Inc. and CIMB Group Holdings Bhd have pushed their calls for monetary easing to 2025, if not later this year.

The window for the BOT to cut this year is narrowing, according to Goldman Sachs, as tailwind from delayed government spending will help underpin growth while diminishing energy subsidies bolster price risks. Banks, responding to the government’s appeal to lower borrowing costs, have cut lending rates 25 basis points, reducing pressure on policymakers.

Rising political turbulence though may revive calls for BOT support if the spending plan falters. Thai courts are set to decide in the coming weeks the fate of Prime Minister Srettha Thavisin, former premier Thaksin Shinawatra and the opposition party Move Forward in separate cases. The uncertainty poses risks to Srettha’s nearly $14-billion cash handout in the fourth quarter to lift Southeast Asia’s second-largest economy out of sub-2% growth in the past decade.

When asked on Wednesday morning about his expectations for the BOT’s rate decision, Srettha declined to mention a cut outright, saying instead that his “expectations are clear as they reflect people’s desire.”

“I don’t want to comment too much because this could be interpreted as interfering or guiding the direction” of monetary policy, the prime minister said. “Let’s leave this as the Bank of Thailand’s duty.”

“Political uncertainty could disrupt fiscal policy implementation, which would be a drag on the economy,” Standard Chartered Plc economist Tim Leelahaphan said.

If the $3.3 billion supplementary budget is passed by August, “it would reduce the likelihood of a BOT rate cut this year,” Australia & New Zealand Banking Group said in a June 7 note. “That said, we continue to see scope for an easing pivot over the next year as growth is likely to slow as one-off boost from fiscal stimulus fades.”

Here’s what to watch out for in the decision expected at 2 p.m. local time:

Policy Signal

Stanchart’s Tim expects “a hawkish hold,” with two dissenting votes calling for a quarter-point cut, similar to the previous two meetings.

BOT has left the key rate unchanged since hiking it to 2.5% in September even as inflation slipped into negative territory in the next six months. Price growth returned to within the central bank’s 1%-3% target in May for the first time in a year.

Still, the government has repeatedly pushed the central bank to ease monetary policy. Deputy Finance Minister Paopoom Rojanasakul was the latest to exert pressure as he called for a quarter-point cut at today’s meeting, saying borrowing costs were “too high” for the state of Thailand’s economy.

Last month, Finance Minister Pichai Chunhavajira also sought an upward revision of the inflation target, a move that market watchers said may be a strategy to spur rate cuts. Analysts including Bloomberg Economics’ Tamara Henderson said the tactic was futile and would only complicate efforts to keep costs of living in check.

BOT Deputy Governor Alisara Mahasandana told Thai media outlet Krungthep Turakij last month that the inflation target remains “appropriate” for the prevailing economic conditions.

As the BOT and Srettha’s administration disagreed on economic policy, the government is discussing ways to exert more control over the monetary authority, Bloomberg News reported earlier this month, fueling concern over central bank independence.

Growth Outlook

The BOT had forecast gross domestic product growth of 2.6% this year and 3% in 2025 at its April meeting.

That outlook “looks challenging” even with the anticipated spending boost after a much-delayed budget bill approval, Stanchart’s Tim said.

Citigroup Inc. and Nomura Holdings Inc. see uncertainty in some economic policies including Srettha’s handout plan given the latest political turbulence.

The baht has gone from the best-performing Asian currency in the fourth quarter to be among the biggest losers this year. The local currency has weakened more than 7% this year.

Alisara had said the BOT wants the local currency to move in line with market mechanisms and will intervene only when it moves too excessively or not in sync with economic fundamentals.

--With assistance from Tomoko Sato and Pathom Sangwongwanich.

(Updates with Prime Minister’s comments in fifth and sixth paragraphs.)

Most Read from Bloomberg Businessweek

China’s Economic Powerhouse Is Feeling the Brunt of Its Slowdown

As Banking Moves Online, Branch Design Takes Cues From Starbucks

Food Companies Hope You Won’t Notice Shortages Are Raising Prices

The World’s Most Online Male Gymnast Prepares for the Paris Olympics

©2024 Bloomberg L.P.