TIFF Market: Why Netflix Is Shelling Out Big Bucks for Festival Flicks | Analysis

Netflix spent big at this year’s Toronto International Film Festival, picking up Anna Kendrick’s directorial debut “Woman of the Hour” for $11 million and Richard Linklater’s well-reviewed “Hit Man” for $20 million. But other than that and despite an unusually numerous 50 titles for sale, the TIFF market at large was muted.

The lack of activity was in sync with the festival season for 2023 so far, as Sundance and Cannes went off with a smattering of deals compared to years past.

“In this marketplace, the studios and streamers, aside from Netflix, would rather spend big bucks on one or two movies that they are passionate about versus spending a boatload of money to fill a slate or clog up the pipeline with regular content,” a high-level distribution executive told TheWrap who declined to be named.

According to multiple executives who spoke to TheWrap, shifting priorities for the streamers, ongoing challenges for theatrically-minded legacy studios and concerns about strike-related variables kept Hollywood purses closed. With one big exception.

Netflix stands alone

In addition to eight-figure deals for “Woman of the Hour” and “Hit Man” — which complement their $20 million acquisition of Chloe Domont’s erotic thriller “Fair Play” at Sundance — streaming giant Netflix also grabbed the documentary “Mountain Queen: The Summits of Lhakpa Sherpa” by director Lucy Walker and then purchased rights to Matthew Heineman’s Jon Batiste documentary “American Symphony.”

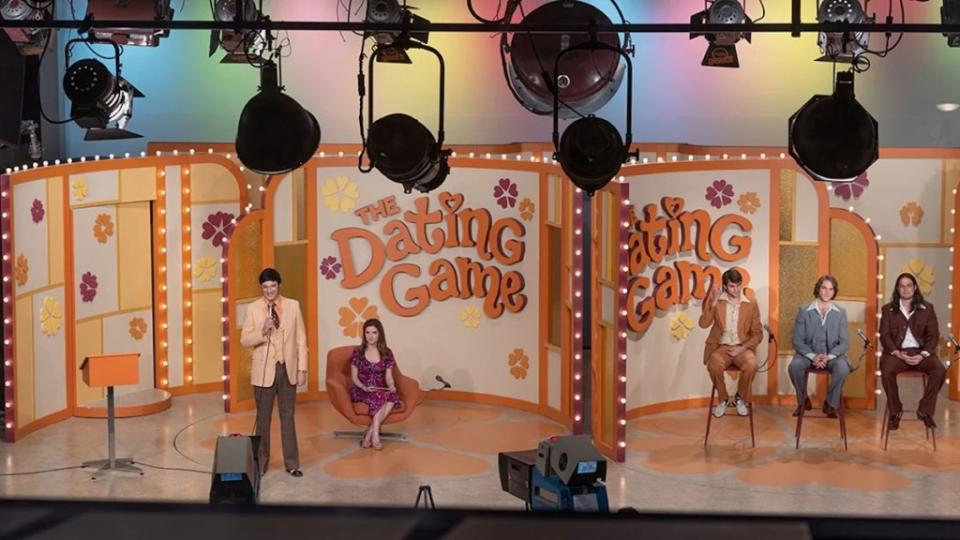

Kendrick’s “Woman of the Hour” is a thriller about a serial killer who appeared on “The Dating Game,” based on a true story. Linklater’s “Hit Man,” which he co-wrote with star Glen Powell, tells the story of Gary Johnson, a staff investigator who plays the role of a hit man to catch individuals ordering a hit, also based on a true story.

Netflix is paying up for select titles that they believe will perform with their subscribers and attract new ones. This year marked their busiest TIFF since 2020 when they picked up “Bruised,” “Pieces of a Woman,” “I Care a Lot” and Sam Levinson’s “Malcolm & Marie.”

As independent film producer Ted Hope told TheWrap, platforms like Netflix and Amazon have “deep data to super specify what they want. For the most part, they are creating it themselves.”

All the Netflix acquistions are commercial in the conventional sense, two uplifting, seemingly inoffensive documentaries about an unlikely accomplishment and professional triumph over adversity alongside three star-driven, adult-skewing, crowd-pleasers.

Considering $20 million pays for nearly an episode or two of shows like “The Crown” and “Stranger Things,” the streamer must feel confident that “Woman of the Hour” and “Hit Man” will both play to Netflix viewers who like watching true crime melodramas and movies about serial killers.

A Netflix representative declined TheWrap’s request for comment.

A natural evolution

Deal-making is likely to extend into well after the conclusion of the festival. However, thus far the TIFF marketplace has been full of promising films and comparatively barren of willing buyers. This continues a trend for the entirety of 2023.

“[The soft TIFF market] confirms, especially post-Sundance and South by Southwest this year, that the indie cinema market is still operating but at a more lukewarm pace,” Redefine Entertainment co-founder Jairo Alvarado told TheWrap. “You can feel the hesitancy from buyers to be less risky.”

The streamers have been pledging to cut costs and release fewer films and TV shows for nearly two years since Wall Street changed its mind in early 2022 and started prioritizing profits and revenue over content spending and subscription figures. It’s no longer enough for a streamer or a studio operating a streamer to make headlines with a provocative buy or pricey original production.

The same can be said for a legacy studio buying a well-liked or buzzy title in the hopes of theatrical glory safe in the knowledge that they’ll have assuredly viable post-theatrical revenue streams like DVD to make up for a shortfall.

If nobody watches the film in theaters or on streaming, or if that quarter’s revenue doesn’t impress the investors, they don’t get extra credit for buying, let alone overpaying for, a film like Ian McKellen’s “The Critic” that inspires online discourse or a movie like “His Three Daughters” which earns critical huzzahs.

Conversely, one sales industry insider argued that the slowing sales marketplace was a natural evolution and less a reaction to the current marketplace.

“Newer studios often emphasize, for practical reasons, acquisition and grabbing high-profile festival flicks,” the sales insider said. “However, as the studios grow, they tend to tilt toward in-house production, whereby the hustle-and-bustle of the festival scene becomes an unnecessary variable.”

No more truth to power

Moreover, with all the streamers trying to expand into as many overseas territories as possible, there is a hesitancy to purchase a film that might inspire controversy in a potentially lucrative marketplace like China or (eventually) Russia. This is especially prevalent in the documentary sandbox.

“Look at how Netflix won a lot of prestige with ‘Winter on Fire‘ and ‘Icarus,'” noted Hope. Those two films nabbed Oscar nominations. And in both cases, the filmmakers made sequels or follow-ups.

“Netflix did not acquire these films, even when they had the IP from the previous films,” Hope continued. “Nobody has bought these films, because they are afraid of being able to sell them on a large basis that can justify the costs.”

Hope believes that streaming companies are fearful of releasing a film globally that might impact the relationship with a given territory.

Considering the very real impact in terms of subscriber loss from even an arguably politically-motivated campaign waged over a film like “Cuties,” it’s hard to fault streaming giants for avoiding risk. Controversy may increase awareness, but as streamers prioritize international growth, there are deeper pitfalls to consider.

Alvarado stated that streamers and studios are stressing the importance of commerciality. “Even if someone pays $5 to $10 million, even if it has known cast members, you will hear a lot of buyers talking about whether it’s ‘adjacent to commercial’ or ‘some version of commercial.'”

Streamers once sold themselves as a safe space for films that were less-than-surefire smash hits. Now, with changing market pressures, territory-specific challenges and every studio needing their streaming service to stand out from the crowd, there’s less incentive to merely offer approximations of what Hollywood stereotypically won’t.

Netflix strikes back

The dual labor stoppages are also having repercussions on the marketplace. For films, the screenwriters and actors are currently forbidden from doing conventional publicity for the duration of the strikes, which most insiders said contributed to the muted environment at this fall’s festivals.

“The combination of [the soft market in] Venice and Toronto showed the need for talent to promote movies,” the distribution executive said. “You can’t just necessarily buy buzz without media-friendly talent.”

However, even here, Netflix has an advantage.

As evidenced time and time again, Netflix can produce or acquire a mainstream, star-driven high-concept film, conduct comparatively minimal publicity, and then drop the movie on the service comfortable in the notion that the thumbnail on the front page will do most of the work for them.

As such, if you’re Anna Kendrick or Glen Powell, going with Netflix means a big paycheck in an uncertain marketplace and less pressure placed on whether you’ll be able to perform pre-release marketing when the film finally does arrive for mass consumption. Netflix gets to create the impression that it’s the global streaming superpower without spending buckets of billions of dollars on countless films, and the filmmakers are safe in the knowledge that, if the strike presses on, they won’t suffer financially due to being unable to promote.

The spending spree suggests that Netflix will still seek out worthwhile films that aren’t produced under their roof.

It’s a win-win, unless you’re a filmmaker whose film wasn’t among the lucky few. For you, 2023 is turning into the year of orphaned indies.

The post TIFF Market: Why Netflix Is Shelling Out Big Bucks for Festival Flicks | Analysis appeared first on TheWrap.